Fed's hawkish bent gives Asia a fright

US president-elect Trump's actual fiscal policies will determine future mood

Singapore

AN unexpectedly aggressive outlook from the US Federal Reserve sent Asian markets tumbling on Thursday.

"The rate hike was in line with expectations," CMC Markets market analyst Margaret Yang said. "What was not expected was the hawkish tone."

The Fed met consensus expectations before the markets opened in Asia on Thursday with its decision to raise its target short-term interest rate by 25 basis points to between 0.5 per cent and 0.75 per cent.

But some members of the Fed's policymaking body also foresaw a hastier pace of rate hikes in the next two years, with the median expectation now for three increases in 2017 instead of the previous guidance of two hikes. Fuelling rate-increase fears further, Fed chairwoman Janet Yellen said at a press briefing that the outlook did not fully take into account US president-elect Donald Trump's potential fiscal policy, which is expected to contain significant infrastructure spending.

UOB Kay Hian head of research Andrew Chow said: "Twenty-five basis points is no issue. The tilt toward three rather than two hikes is slightly negative, but again not a basis for super-panic mode. What people worry about is even the three next year hasn't really factored in President Trump's reflationary policy. If his push toward reflation happens quickly, that might indicate more than three hikes next year."

Equities

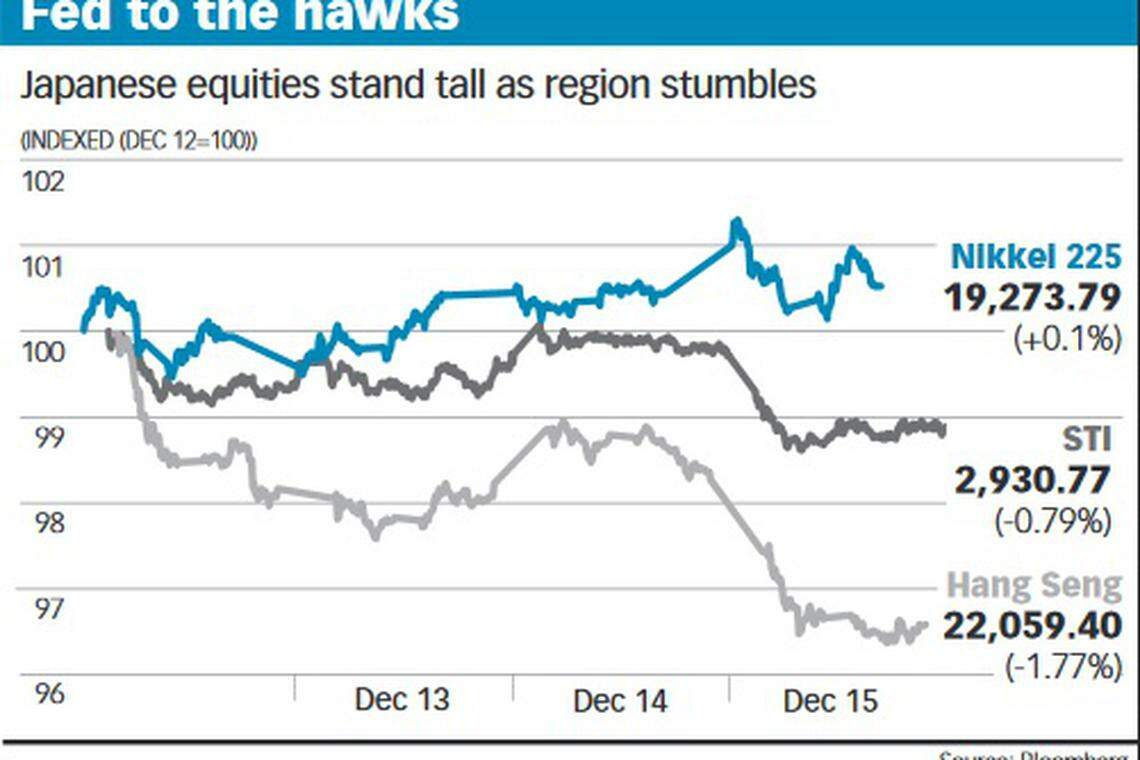

Most Asian equities took a hit amid concerns that quick rate increases would raise the cost of financing and spur an outflow of capital.

The Singapore Straits Times Index fell 0.79 per cent to 2,930.77, while the Hang Seng in Hong Kong shed 1.77 per cent to close at 22,059.40. In manufacturing-dominated Japan, the Nikkei 225 rose 0.1 per cent to 19.273.79.

In Singapore, bank stocks fell in unison amid concerns about asset quality if interest rates rise too quickly.

"Everything is down except for Japan, and that's because the weakening of the Japanese yen is helping exports," Ms Yang said.

Mr Chow said that despite some overselling on Thursday, stock markets were also correcting from earlier rallies to approach fair value.

"I really think a lot of markets were feeling a little toppy and were ready for a bit of a pullback," he said. "In Singapore the rally had been quite sharp, especially in banks."

Mr Chow maintained his 2017 target of 3,000 for the STI and described the current investing environment as favouring a stockpicking strategy.

Kelvin Tay, regional chief investment officer for UBS Wealth Management, said rising interest rates might support banks' earnings and margins in the medium term.

"We have a preference for companies with defensive earnings and sustainable dividends," Mr Tay said. "Higher interest rates will steer a more selective approach to yield. In this regard, we prefer unleveraged yield."

Fixed income

Yields rose on most Asian bonds.

"Expectations of the faster Fed's rate hike pace caused an acceleration of capital outflow from the region, as indicated by falling in Asian equities and bonds," Mizuho Asian FX strategist Ken Cheung said. "However, regional sentiment sounds not so panicked as renminbi sentiment and China fundamentals remain largely stable."

Chinese bonds, in particular, found no respite from recent selloffs amid attempts by the Chinese government to stem the flight of capital.

Bank of Singapore fixed income research managing director Todd Schubert said that the Fed statement "proved to exacerbate a market already suffering from its own unique blend of problems - government efforts and policies to reduce leverage in the system, the potential for accelerating inflation and a depreciating yuan.

"We expect that bond markets globally will continue to exhibit volatility until president-elect Trump takes office and his actual fiscal policies take shape."

Currencies

The Singapore dollar slipped one per cent to S$1.4369 for every US$1, moving in sympathy with other Asian currencies.

Whether the US dollar can maintain its strength will hinge on details about Mr Trump's policies after he assumes office and on whether the Fed made the right call, said Credit Suisse investment strategist Jack Siu.

"The US dollar is likely to strengthen, driven by prospects of higher yield support going forward," he said. "However, the currency reaction will crucially depend on the Fed's rationale for its hawkish projections (growth or inflation driven, or both) and the reaction of risky assets. If risky assets perform poorly, then we would expect the US dollar to strengthen broadly, but the surplus currencies, especially the Japanese yen, to perform better."

Commodities

Gold underperformed other precious metals and slipped about 1.6 per cent on the day to US$1,139 per ounce, said CMC's Ms Yang.

"I do see a strong support level at S$1,136 per ounce," she said.

Oil also sputtered on bad news after bad news.

"Oil has been caught in a pincer move overnight, between Federal Reserve rate hikes and mixed US Energy Information Administration crude inventory data, with both Brent and WTI falling over 3.5 per cent on the session," Oanda senior market analyst Jeffrey Halley said.

UOB Kay Hian's Mr Chow said visibility on Mr Trump's policies was critical: "Once you get more clarity, the market will stabilise a bit."

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Capital Markets & Currencies

Europe: Stoxx 600 logs best day in three months as banks shine

US: Stocks rally after strong tech results

Mixed trading in Asia as investors watch for further macro data; STI down 0.2%

Vietnam delays launch of new stock trading system

Hong Kong bourse regains favour on hopes of a market revival

Asia: Markets rise as strong US tech earnings offset poor data