WHEN it comes to investing in Asia and emerging markets (EMs), China has been the “be-all and end-all” market of choice across decades for some investors – and for good reason.

Since the country opened up to the world in the 1980s, China’s share of the global economy has risen from under 2 per cent in 1990 to 18.4 per cent in 2021, an unprecedented feat.

China’s weight in the MSCI Emerging Market Index also climbed from 18 per cent in 2008 to 25.7 per cent at end-February. This is thanks to the partial inclusion of A-shares – stocks that trade on domestic exchanges in the mainland – in the EM index since 2018.

As a result, EM fortunes are hitched closely to China’s, where for periods of time, the market can be subject to influences beyond the invisible hand of free-market players, such as regulation, policy and geopolitics.

While China remains a fertile hunting ground for long-term, fundamentally driven investors, the growing influence of geopolitics is politicising investment decisions, and domestic politics is driving higher volatility.

This outsized impact of non-fundamental factors came to the fore in a challenging 2023 for Chinese markets. It contrasts, though, with what we are seeing on the ground and hearing first-hand from our mainland companies. We still expect high single-digit or low-teen earnings growth this year.

Nonetheless, China concerns are playing into how investors are increasingly thinking about how to better manage their China risk, and looking beyond China for opportunities in Asia and EMs.

Outside China lies a plethora of opportunities. The rest of the EM region is diverse and dynamic. The middle class is young and growing, such as in Asean. Some economies, such as Indonesia, are resource-rich. Innovative companies, such as Indian IT solutions providers, are expanding their reach across the globe.

Significantly, EM ex-China is making its presence felt more and more in global capital markets, via greater integration and sophistication supported by policy initiatives and reform.

From where we stand, there are some key long-term structural drivers that lend credence to the investment potential of EM ex-China.

Consumption promise

First, the consumption promise looms large. Most people in EMs outside China are young and have growing incomes. They face less external shocks and benefit from better macro management, domestic reforms, digitalisation and urbanisation, boosting incomes and consumption.

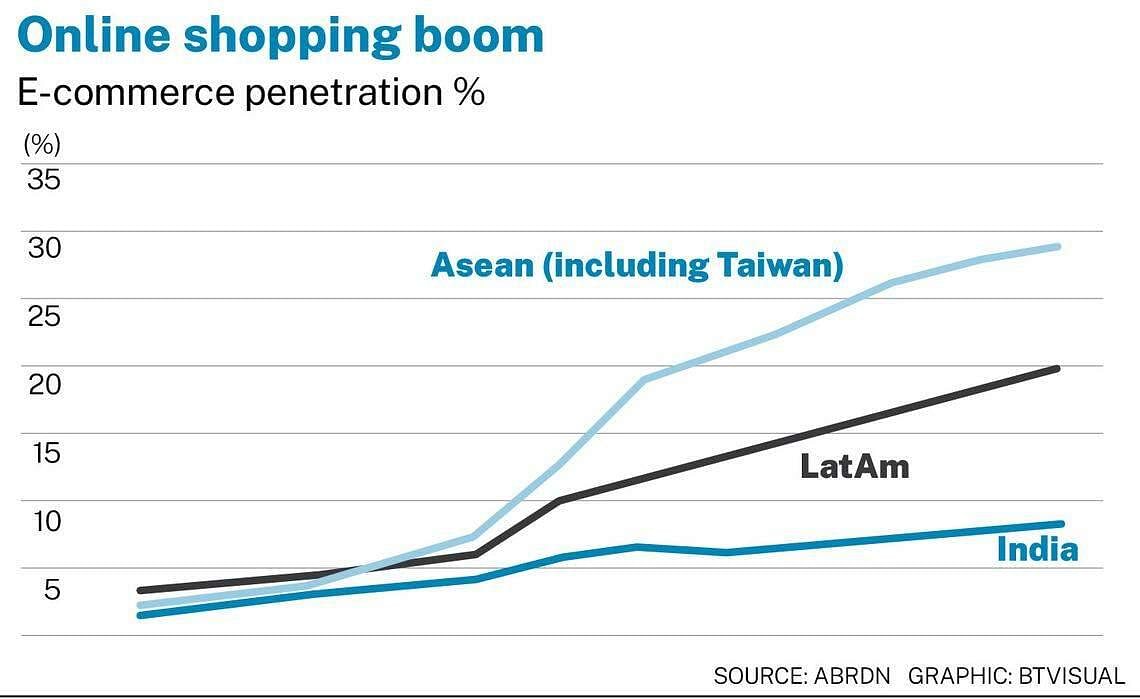

The rapid growth of digital technologies, with mobile phones ubiquitous and Internet access becoming cheaper, has meant a big change in consumption habits and boosted online sectors such as e-commerce.

We are seeing some of the biggest shifts in offline-to-online retail in India, Asean and Taiwan. In Indonesia, for instance, companies are benefiting from the large population, increasing spending power and rising number of smartphone users.

Second, digitalisation is also boosting sectors such as automation, electric vehicles, renewable energy, 5G and artificial intelligence. While China is a leader in fintech and e-commerce, EM ex-China has many tech companies that are vital for the digital revolution.

A good example is Taiwan Semiconductor Manufacturing Co (TSMC), the world’s top pure-play foundry that makes integrated circuits for various products and customers. Semiconductors is a growing and attractive industry, and TSMC is well-positioned to benefit from it. Other companies in related or ancillary industries also gain as chips increase in quality and become more complex.

Third, global supply-chain diversification. Asean has been a prime beneficiary of the China-plus-one strategy, in which multinational corporations are moving their supply chains away from China due to the geopolitical tensions with the US.

Here, Vietnam stands out as a great growth story, due to the investments pouring into higher technology sectors, especially automotive and electronics. Alongside a population that is becoming more educated, productive and mobile, post-independence reforms are driving agriculture and manufacturing, such as incentivising technology transfer in the move up the value chain, with some even dubbing it as China 2.0.

All the above points to a region that will continue to thrive in the decades ahead, albeit with bumps along the growth journey. This is especially pertinent in the current climate, where uncertainty still prevails in the short term.

This year, in particular, is an active year for elections, with polls in Taiwan (remaining status quo with the ruling Democratic Progressive Party back in charge); Indonesia (where the Prabowo-Gibran duo is set to win the presidential election just held); and India (with voters heading to the polls in April). Judging from survey results thus far, it looks like policy continuity across Asia.

Further afield, the US elections in November could increase political polarisation and geopolitical uncertainty.

Policy trajectory

We are also watching closely the US monetary policy trajectory through 2024. The Federal Reserve has indicated that US policy rates have reached their high point and indicated three policy rate cuts in 2024, although the latest data is still showing elevated consumer inflation, which could push any rate easing further out. Lower US rates and a weaker US dollar would boost the appeal of Asian and EM assets and currencies.

China, meanwhile, is still seeing a disconnect between sentiment and fundamentals. For sentiment to turn around, companies need to keep delivering earnings that are in line with or better than expectations, and confidence in the broader economy needs to improve. We are seeing some stabilisation and green shoots of recovery, aided by incremental policy support.

While investors are likely to continue to devote attention to China, we think many high-quality businesses outside China – within the Asia and EM investable universe – tend to get overlooked.

Following a string of reforms and better macro management, conditions have turned exceptionally favourable for the region. The currency dynamics look better; external balances and government debt are better managed; capital markets have deepened and grown more sophisticated, while digitalisation and innovation are creating seismic shifts in consumption patterns and business models.

All this is helping to transform emerging economies, and it is gradually being reflected in their performance. We see this as a good indication of their prospects in the months ahead.

The writer is head of Apac equities, abrdn