BT Explains: How Singapore is warming to crypto and digital assets

A STREAM of crypto offerings and digital assets is coming on board for Singapore investors.

Here and around the world, the surge in crypto assets has also prompted incumbent banks to move into this space.

Meanwhile, platforms are popping up to offer tokens - or digital fractions - of hard assets, with these tokens registered on a blockchain.

Why is this trend playing out in Singapore, and how is it shaping up today? The Business Times explains:

But first, what is cryptocurrency?

Cryptocurrency is a form of a digital asset - and there are more than 6,000 of them in the world - that supposedly stores value, or "currency". They can be traded on platforms.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The word comes from cryptography - the science of secret writing. They are created using blockchain technology, which generally removes the need for a central authority.

Blockchain, in turn, is a type of database. Each "block" contains information of transactions and is "chained" with other blocks in chronological order. Each time you change the information on a block, it's not written over like in a normal database. Instead, the change is added in a new block to the chain.

Fiat money, as we know it, is backed by central banks that are there to guarantee that our currencies hold their promised value. That assurance allows us to complete commercial transactions - from buying a cup of coffee, to investing in a new home. Cryptocurrencies such as bitcoin have no such backer.

Old meets new

Sygnum Bank, which bills itself as the world's first digital asset bank that operates in Switzerland and Singapore, ran a simple poll on LinkedIn in April. It asked voters to decide what was the most significant bitcoin adoption signal for its future market dominance.

Some 90 votes in, and 55 per cent said the biggest factor is of bitcoins coming to US banks.

Last month, Morgan Stanley became the first US bank to offer wealthy clients access to bitcoin funds. Goldman Sachs, too, has announced plans to offer bitcoin and other digital assets this quarter.

Another factor that ranks closely behind is the S&P's new bitcoin index, with 43 per cent of the votes picking that as the top factor fuelling this quest for market dominance by bitcoin. The world's largest cryptocurrency quadrupled in value in 2020.

These suggest that the rise of institutional interest in cryptocurrency is pushing fresh demands unseen in previous cycles of cryptomania.

Stay strong, HODL

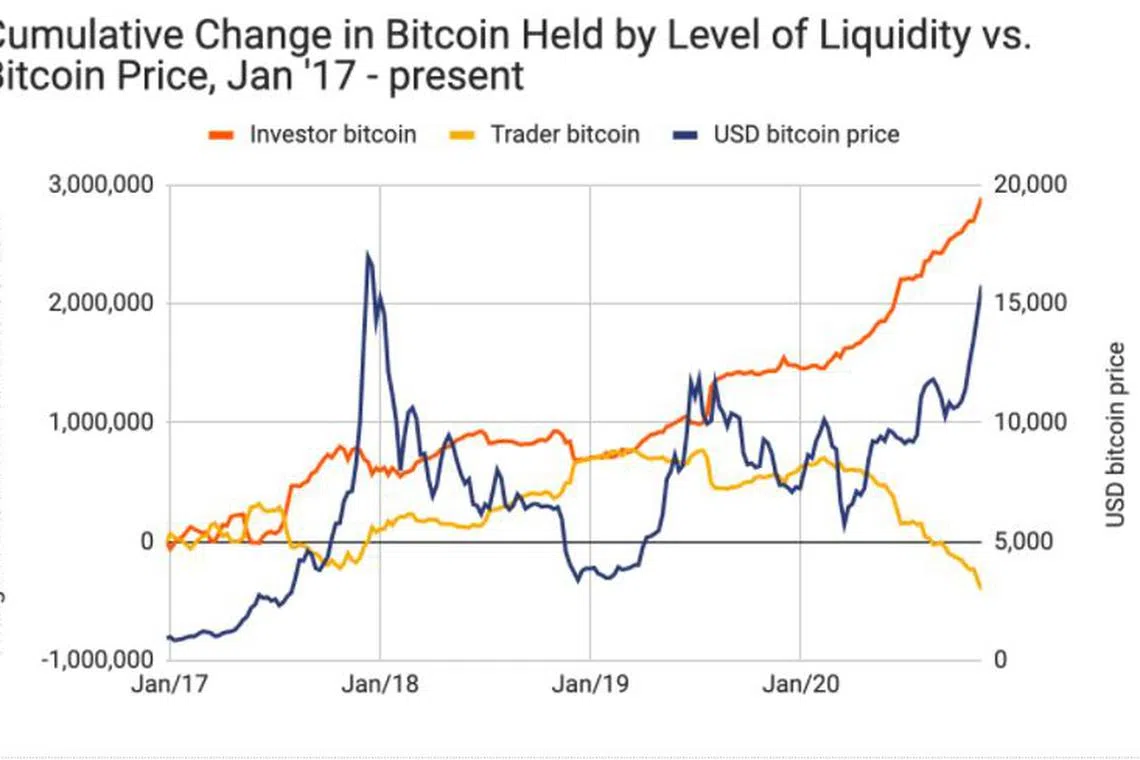

A study by Chainanalysis, a blockchain analysis company, showed that the amount of bitcoin held in illiquid wallets is much higher today, compared with the last bull run in 2017. Such illiquid holdings represent 77 per cent of the 14.8 million of available mined bitcoin (see chart). So demand is up, while supply available for trading has been squeezed.

*HODL is a meme used in the world of bitcoin. It is likely the wrong spelling of "hold" that made rounds in bitcoin forums in the early days amid frenzy trading. So to go long on cryptocurrency is to be a long-term "hodler".

Then there's Elon Musk

Part of the surge comes from one big name in the investment world: Elon Musk. The eccentric entrepreneur added to the bitcoin mania, after he said this year that Tesla had added US$1.5 billion worth of bitcoin to its corporate treasury. The gains from bitcoin pushed Tesla's net profits to a record high in the first quarter.

But his tweets on cryptocurrencies have weighed heavily on bitcoin trades, in themselves already volatile.

Earlier this month, Mr Musk said Tesla had stopped accepting bitcoin as payment for its vehicles, due to worries over its carbon footprint. This was a U-turn from his decision just about two months before.

Singapore's HNWIs take a punt

Singapore-based high net worth individuals are sitting up to these trends.

Signum Capital, a Singapore-based venture firm that backs blockchain-enabled projects, has supported some 70 projects, with funds raised from family offices and high net worth individuals. Each investment ranges between US$100,000 to US$2 million.

Given surging interest, DBS Private Bank, via its wholly owned trust company, now has a trust solution for four cryptocurrencies to allow its private banking clients to invest, custodise and manage digital assets.

Retail investors, come on in

Meanwhile, Saxo has this month launched crypto FX trading for Bitcoin, Ethereum and Litecoin in Singapore. The online trading platform allows investors to trade Bitcoin, Ethereum and Litecoin against the euro, yen and US dollar from a single margin account.

Due to the volatile nature of the instruments, retail investors can trade on 60 per cent margin, while accredited investors can trade on 40 or 50 per cent margin.

Art attack

In March, a Singapore-based "entrepreneur, coder and angel investor" who went by the name Metakovan spent US$69 million worth of cryptocurrencies on a piece of digital art. He latched onto the trend of non-fungible tokens (NFTs), which are non-duplicable digital certificates of ownership for digital assets.

Singapore and regional artists and fashion players are also tapping on this NFT trend. A Singapore-based fashion brand, for example, allows customers to buy an "outfit". The store would then ask customers to upload one of their photos and proceed to "dress" them in the digital garment they just purchased. One end goal? To post that photo on social media.

Buyers beware

The world of cryptocurrency is a rough ride.

China on May 19 banned financial institutions and payment companies from offering services tied to cryptocurrency transactions. Bitcoin tumbled in response to below the US$40,000-mark for the first time in more than three months. That also meant within hours, it fell very sharply from the year's high of US$64,895.22 just reached on April 14.

Regulators are watching keenly how cryptocurrencies are used in money laundering. Cryptocurrencies are also now more commonly used as payment for ransomware attacks.

Vertex-backed Binance Holdings is under investigation by the US Department of Justice and Internal Revenue Service, on issues probing money laundering and tax offences. It is said to be the world's biggest cryptocurrency exchange. Binance is incorporated in the Cayman Islands and has a registered office in Singapore. It has claimed it owns no single corporate headquarters.

Copyright SPH Media. All rights reserved.