Climate-linked financial disclosures to be legally binding, align to one global standard: MAS chief

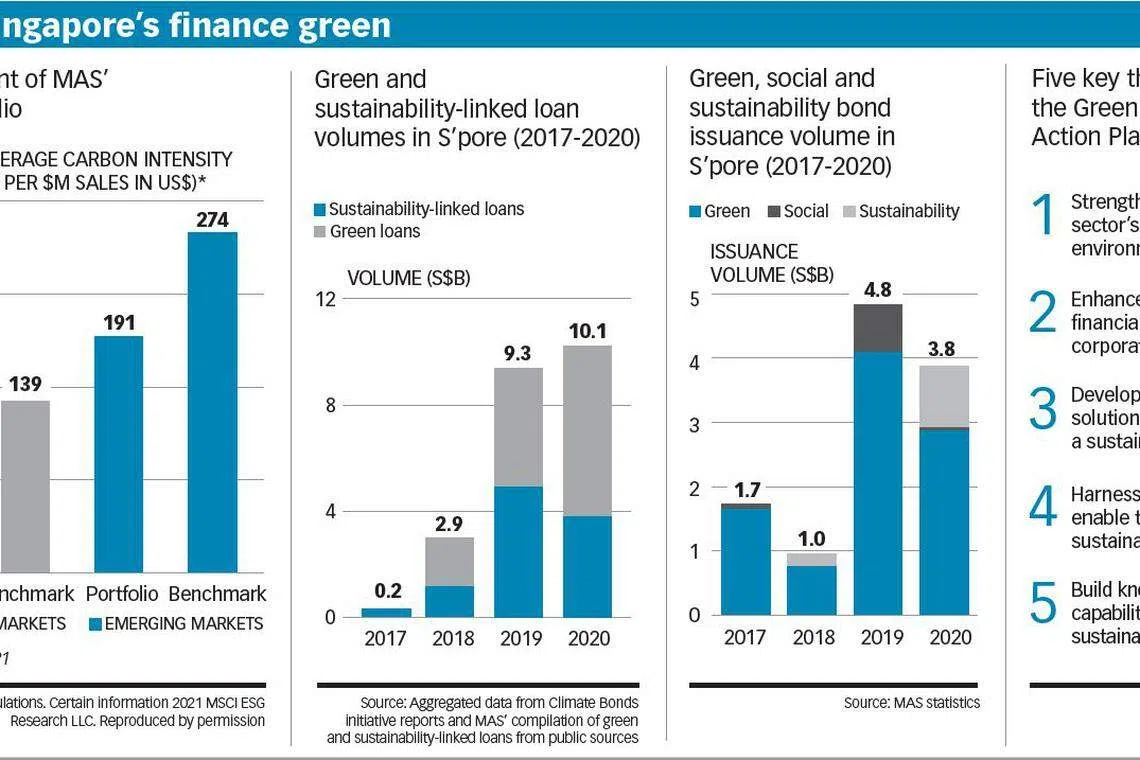

MANDATORY climate-related financial disclosures for financial institutions and listed entities in Singapore are in the works to align them to a single international standard, said the head of the Monetary Authority of Singapore (MAS).

Ravi Menon, MAS' managing director who was speaking at the launch of its inaugural Sustainability Report on Wednesday, said: "We need to urgently enhance the quality and consistency of climate-related disclosures."

He noted that reliable and comparable climate-related disclosures are critical for better pricing of climate-related risks, more effective risk-management and market discipline, and effective allocation of capital towards financing green and transition activities.

"The lack of consistent climate-disclosure standards has resulted in selective reporting against different frameworks, impeding the growth of sustainable finance globally."

Roadmaps for these disclosures to be set out by MAS and the Singapore Exchange (SGX) will take a phased approach, with a more ambitious timeline considered for entities that are larger or more exposed to climate risks.

MAS already expects financial institutions to make climate-related disclosures from June 2022, in accordance with "well-regarded international reporting frameworks", said Mr Menon.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

It will consult the industry later in the year to focus on how to transition these expectations into legally binding requirements against a single internationally-aligned standard, he said.

As for SGX, it already subjects listed entities to annual sustainability reporting on a comply-or-explain basis, but without specifying any particular framework for them to follow, Mr Menon added.

It will soon consult the industry on making climate-related reporting in line with the recommendations of the Task Force on Climate Related Financial Disclosures (TCFD), which is a framework broadly accepted internationally.

This move by SGX comes behind others in the region, like Hong Kong and Japan, which have moved towards mandating climate-related reporting in line with the recommendations of the TCFD.

In his speech, Mr Menon said that there has been a renewed sense of urgency and commitment to the climate agenda.

"Despite the pandemic, 2020 witnessed numerous commitments to carbon neutrality and net-zero emissions - by governments, corporations and financial institutions."

The United States has rejoined the Paris Agreement, and the stage is set to translate long-term ambitions into tangible policies and early actions, said Mr Menon.

MAS is also actively involved in international forums that are developing green taxonomies. It is a member of the International Platform for Sustainable Finance (IPSF), which is developing a common reference point for definitions of green activities across major existing taxonomies. MAS is also working with fellow Asean regulators to develop an Asean taxonomy aligned with international benchmarks while taking account of the regional context.

"Consistent definitions of what constitutes green activities are key to facilitating cross-border capital flows towards sustainable outcomes," said Mr Menon.

He pointed out as well that developing a clear taxonomy for transition activities is especially relevant for Asia.

"Asia needs to sustain economic and social development while shifting to a lower carbon future. A taxonomy that includes both green and transition activities can support a progressive shift to greater sustainability," said Mr Menon.

In Singapore, the green finance industry task force (GFIT) is developing such a taxonomy to guide financial institutions, setting out a "traffic light" system to classify sustainable activities as green, transition activities as yellow, and highly carbon intensive activities as red.

Wong Kee Joo, chief executive of HSBC Singapore, the chair of Singapore's GFIT, told The Business Times: "The inaugural MAS Sustainability Report is a clear, written mandate by a progressive regulator to build a sustainable, future-proofed economy, and paves the way for other Asean markets. In cementing its approach to environmental risk, the MAS is providing financial institutions with the frameworks to build a more resilient financial system in Singapore.

"With this enhanced mandate, financial institutions should now work individually, as well as collectively, to adopt more rigorous climate-related disclosures and environmental risk management practices to support the region's low-carbon transition."

MAS is also supporting initiatives to foster efficient markets to trade carbon credits, with carbon credits helping to channel funds from firms with hard-to-abate emissions to projects that reduce or remove emissions.

"Voluntary carbon credits will be an important complement to decarbonisation efforts, especially in Asia where transition issues need to be tackled."

DBS, SGX, Temasek, and Standard Chartered have announced plans to launch Climate Impact X, an international marketplace for high-quality carbon offsets generated from nature-based solutions in Southeast Asia.

In his concluding remarks, Mr Menon noted that the world is "on the cusp of the greatest economic and societal transformation since the Industrial Revolution".

"The coming Green Revolution, along (with) the digital one, will involve all segments of the economy and society, governments, businesses, and individuals will all need to do their part," he said.

"It is in this spirit of collective action that MAS is publishing a sustainability report, to account for what we are doing together with the financial industry, and in our own right, to help remake a greener world and secure a more sustainable future."

READ MORE:

- Liquidity key to success of Singapore's carbon exchange

- New ESG-linked bonds emerging for Asia to transit its inconvenient truth

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.