New disclosure standards for Singapore retail ESG funds due early 2022: MAS

THE Monetary Authority of Singapore (MAS) will set out early next year its regulatory expectations on the disclosure standards that retail funds in Singapore with an ESG (environmental, social, and governance) investment objective must meet, said its managing director Ravi Menon.

In a speech on Wednesday, Mr Menon said that with the enhanced disclosure in place, investors will be able to better understand the criteria that an ESG fund uses to select its investments.

Investors will also obtain from a single offering document more information on the fund's investment process, as well as the risks and limitations associated with the fund's ESG strategy.

They will receive periodic updates on whether the investment objective of an ESG fund has been met too.

The attention comes amid rising attention on whether ESG funds have been correctly labelled, raising risks of greenwashing.

There are varying ESG scoring methods in the market. A 2020 Milken Institute report looked at a sample of 943 firms' performance in 2018, the latest year for which all ESG scores from three major rating agencies - RobecoSAM, Sustainalytics, and Thomson Reuters - were available.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The analysis showed that the three rating agencies give very different ESG scores, with a correlation below 0.5, to more than 60 per cent of the firms.

The exception is for the worst-performing ones. There, the rating agencies were in agreement - so shown by the correlation of 0.95 or more - for only 10 per cent of the firms that made the bottom of the list when it came to ESG standards.

Mr Menon said in his speech: "We need to make sure that as green investments become more mainstream, there are strong disclosure requirements in place."

He likewise pointed out that there are more than 200 frameworks, standards, and other forms of guidance on sustainability reporting and climate related disclosures. "This has resulted in selective reporting and inconsistent disclosures that are not comparable."

For example, some companies report absolute reduction in greenhouse gas emissions, while others report carbon intensity reduction metrics. Some companies report reductions year-over-year, while others report reductions over multiple years.

Having green finance as a "key enabler" for the transition to a sustainable future, as Mr Menon noted, comes as climate change is happening at a "rapid, widespread, and intensifying" pace, as pointed out in the recent report from the United Nations Intergovernmental Panel on Climate Change.

Global warming has already reached 1.1 degrees Celsius above pre-industrial levels, the warmest in 125,000 years.

"With each year's delay in reducing global emissions, the task will get more difficult and costly," said Mr Menon.

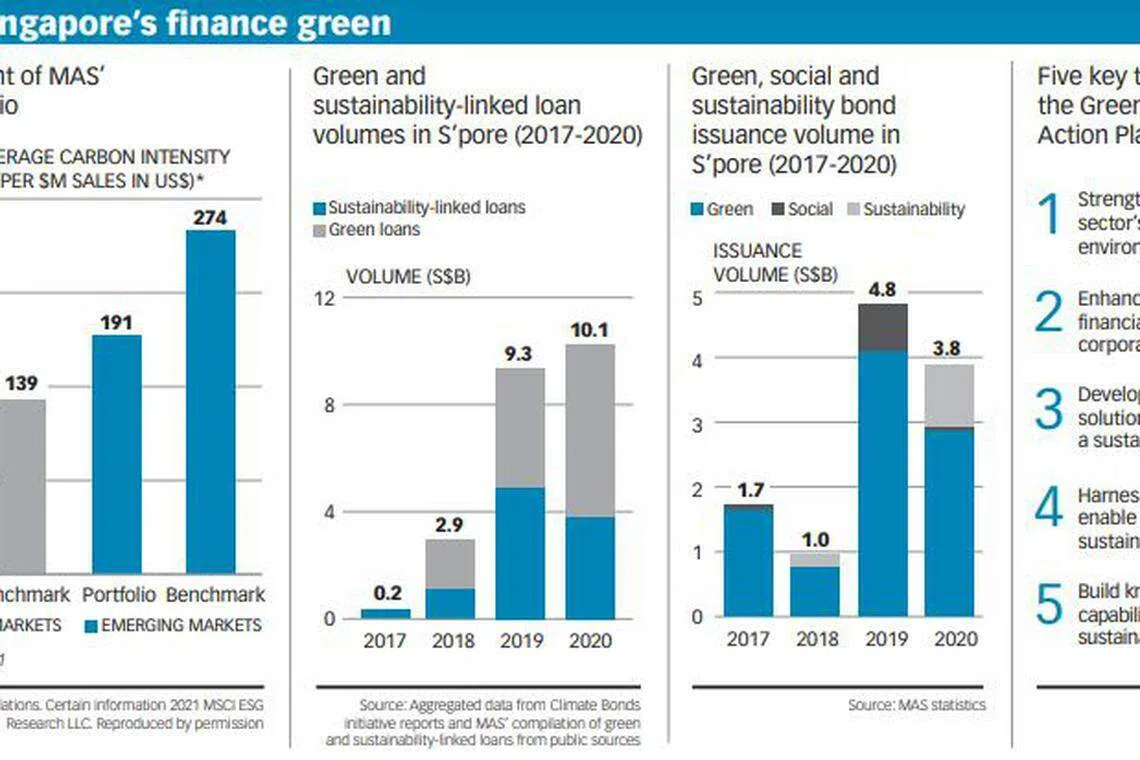

The volume of assets invested in sustainable projects is rising rapidly, with now about one-fifth of all assets worldwide are now in funds that use some form of ESG criteria, data cited from a KPMG report showed.

But green finance has not been able to reach scale, Mr Menon pointed out. According to the International Energy Agency, global investment in energy projects needs to more than double from its current level by 2030 in order to meet net-zero emission goals by 2050.

Given the challenges, steps must be taken to improve the quality, availability, and comparability of data, the definitions for green and transition activities, and to improve disclosures by having a consistent set of global standards, he said.

Bankers told The Business Times that this is a step in the right direction to protect retail investors from "greenwashed" products.

John Ng, head of funds selection and advisory, DBS Private Bank said: "Today's ESG landscape is still fragmented as there isn't a single established disclosure standard or ESG evaluation process for fund managers. Protocols on company analysis and selection based on ESG requirements are pretty much left to individual fund houses to determine, and are based on varying criteria, which can give rise to inconsistencies.

"With MAS taking the lead to ensure that all ESG funds sold in Singapore provide better disclosure on how fund managers determine their ESG processes, this will avail greater transparency to investors and deepen their understanding of ESG funds, which will ultimately enable them to make more informed investment decisions."

Tan Siew Lee, head of wealth management Singapore, OCBC Bank, said: "The ripple effect of a well-structured standard will also stimulate a corrective alignment mechanism across company reporting, fund manufacturers and rating agencies; thereby equipping retail investors with ESG insights to make more informed investment decisions, while ensuring their investments are channelled into ESG funds the right way."

Mr Menon also announced on Wednesday that the National University of Singapore will be establishing by the end of this year the Sustainable and Green Finance Institute, or SGFIN.

The institute will help groom a pipeline of talent and leadership in sustainable and green finance across the career spectrum. In a press statement, NUS said the institute plans to recruit more than a dozen research talents from around the world.

"It will help equip companies with the multi-disciplinary knowledge necessary to integrate sustainability considerations into their business strategies and investment decisions, and quantify their environmental and social performance."

A key research focus of SGFIN is to develop a sustainability and impact measurement and assessment framework. The framework will seek to determine the monetary value of companies' environmental and social performance.

It aims to address the lack of consistent and standardised ESG data in Asia by utilising modern statistical and advanced machine learning tools to capture environmental and social data on Asian firms.

"The three centres of excellence in green finance in Singapore will complement one another," said Mr Menon, referring to the Sustainable Finance Institute Asia, the Singapore Green Finance Centre, and now, SGFIN.

"The growing depth and diversity of research in sustainable finance will provide ballast to Singapore's growing status as a leading green finance hub."

READ MORE:

- Climate-linked financial disclosures to be legally binding, align to one global standard: MAS chief

- The long game of sustainable investing

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.