Chinese tech's next battleground

Tech titans are pouring more resources into South-east Asia, driven by both the push of global trade tensions and the pull of 655 million rapidly-digitalising consumers.

Chu hai or "going to sea" is the ethos that China's tech giants have embraced with overseas expansion in the past decade. But the waters are getting rougher in India and the United States. These tech titans may now steer more resources towards South-east Asia, intensifying their battle to succeed in this 655 million-strong market. In late June, India banned 59 popular Chinese apps, including TikTok and WeChat, following border skirmishes. And now, market watchers speculate that Washington may implement similar measures, capping on-and-off trade tensions between the two superpowers.

Amid such volatility, observers expect that the likes of the BAT troika - Baidu, Alibaba and Tencent - may step up their expansion and investments in South-east Asia, even as the Covid-19 pandemic stalls business activity.

These firms' South-east Asian strategy drew attention when Alibaba made its first billion-dollar bet on Lazada in 2016, notes Wang Xiaofeng, a senior analyst at research firm Forrester. Since then, other Chinese tech behemoths have poured capital into billion-dollar fundraises for the region's unicorns.

Some of these deals mirror their rivalries in China; for instance, Lazada's fierce rival Shopee is owned by Sea Group, which is in turn backed by Tencent.

South-east Asia is challenging as a fragmented market, but there are compelling reasons for Chinese firms to invest here. "Now, with the geopolitical environment becoming tougher in the West, South-east Asia has become an even more important ally for these Chinese companies," Ms Wang says.

There are pull factors too. "It is easier for Chinese companies to expand here than in India or other English-language markets - it's a lot closer, and the markets are mobile-centric. Chinese companies can replicate their business model here as the maturity of digital technologies is relatively lower, especially in e-commerce and mobile payments," she adds.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Li Jianggan, chief executive of venture builder Momentum Works, echoes this: "Chinese tech giants, most of whom are listed, are naturally looking for the next growth engine. And because of geographical, historical and cultural similarities, as well as similarities in the path of social and economic development, South-east Asia becomes a natural extension."

Players that have set up offices in South-east Asia include the BAT firms; alongside up-and-coming names such as AI firm Sensetime, e-commerce player JD.com and TikTok's owner ByteDance.

They have been hiring aggressively. For instance, ByteDance was recruiting for over 70 positions in Singapore alone in April, looking to fill roles including software development and operations. Meanwhile, as of July 30, Alibaba had some 80 job postings on LinkedIn within Singapore, mainly for Lazada.

An Alibaba spokesperson tells The Business Times: "South-east Asia is a very important part of our globalisation plans. By 2036, our ambition is to serve two billion global consumers, enable 10 million businesses to be profitable and create 100 million jobs worldwide... The maturity of our operations in the various South-east Asian markets means we are ready to contribute even more to consumers and businesses here."

But with Covid-19 roiling markets this year, what will become of China tech's business wars in South-east Asia? Market watchers who spoke to BT think that while expansion and deal-making may slow down, the onward march of Chinese titans into this region will continue into the long term.

And as this happens, the Chinese companies will find themselves in an increasingly cut-throat race to win over the South-east Asian market. We look at three sectors where the battle lines are being drawn - Over-The-Top (OTT) streaming, fintech and e-commerce - and size up how the tech wars are set to play out.

Tugging heart (and purse) strings with streaming

The death knell had been ringing for South-east Asian streaming service iflix since early this year, given its crippling debt. But in late-June, the distressed firm found a high-profile buyer: China's gaming and entertainment powerhouse Tencent.

iflix reportedly sold for just tens of millions of dollars, compared to the over US$300 million it is said to have raised from investors. But even if the deal was a bargain, it suggests that Tencent is serious about its push into the difficult OTT streaming market in South-east Asia, competing with other Chinese entrants.

China's OTT streaming market is dominated by Tencent Video, Baidu's iQiyi and Alibaba's Youku. The "congested domestic market" means that the Chinese players are likely to further expand in South-east Asia, both organically and via M&A, says Oliver Wilkinson, a partner at PwC Singapore specialised in technology, media and telecommunications.

"Once you have incurred the fixed cost of developing content, you need to monetise it across as broad a distribution platform as possible - and South-east Asia provides a good market for this.

"In large parts of the Western world or North Asia, there is already a dominant OTT platform, such as Netflix, whereas South-east Asia is a melting pot with a wide variety of tastes and a proliferation of content options," he explains.

Tencent has already made significant inroads through marketing WeTV content aggressively in Indonesia and Thailand. With the iflix purchase, it is now equipped with more user data.

But iQiyi is catching up fast. Last year, it launched the international version of its app with regional languages including Thai and Vietnamese, and also inked a strategic partnership with Malaysia's Astro.

To fuel its expansion, iQiyi hired a former vice-president at Netflix, Singaporean Kuek Yu-Chuang, in June. On July 20, it hired three new country managers to oversee Singapore, Malaysia, the Philippines, Indonesia and Brunei.

While Youku is still China-focused, a spokesperson tells BT that it "won't rule out any expansion opportunities in South-east Asia when appropriate".

But other Chinese players are already up against Tencent and iQiyi, such as Viu, the streaming service by Hong Kong's PCCW Media. Alongside the Middle East and Africa, South-east Asia is a core market for the firm, says its chief content officer Virginia Lim.

"The growth potential also lies in the diverse local content offerings portraying various cultures which are very unique and vibrant. Given the right treatment, format and storytelling, these shows can definitely travel and appeal to a broader group of audience in Asia," she says.

The OTT streaming market is notoriously tough to succeed in. As evidenced by the woes of iflix and Hooq, Singtel's failed streaming play, content acquisition costs are steep, while monetisation is challenging.

Even so, Mr Li of Momentum Works thinks that the Chinese players may enjoy a late-mover advantage. "My sense is that players like Hooq and iflix have spent hundreds of millions educating the market - and other players might feel it is time to come in and start reaping the benefits left untouched by the martyrs," he says.

Proxy battles emerge in race to dominate payments

Like the OTT streaming wars, another battle is brewing across South-east Asia in a niche but promising segment: e-wallets.

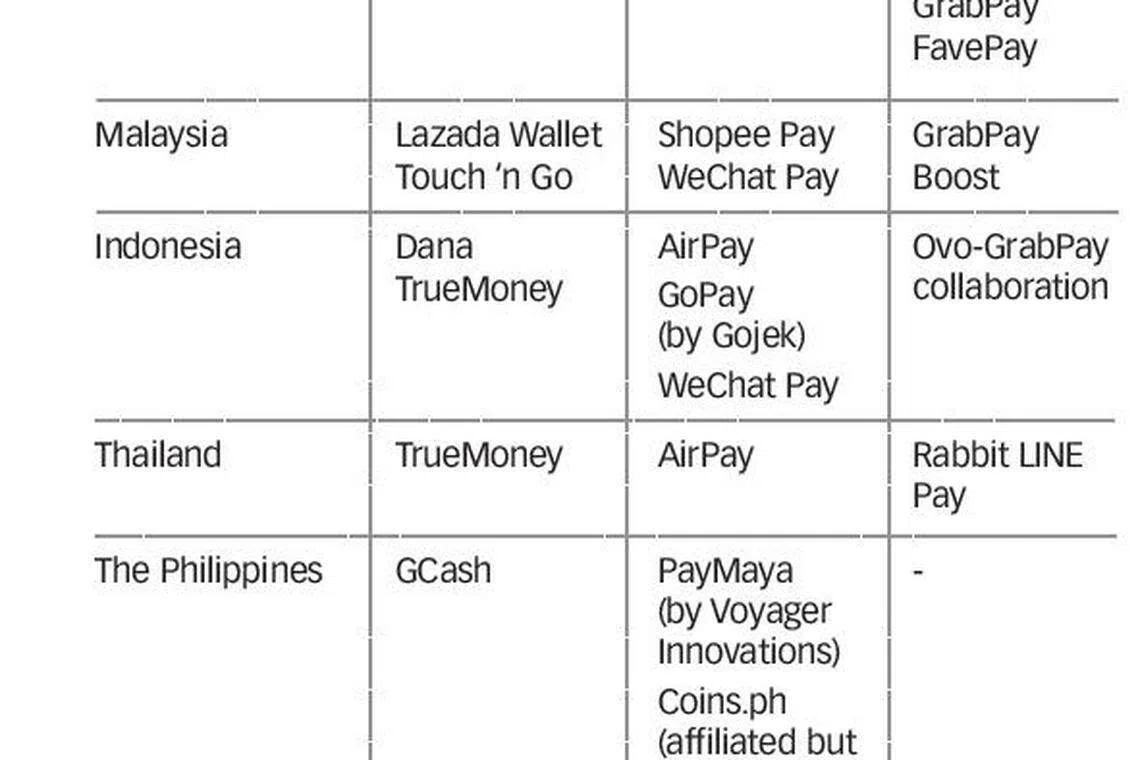

Both Tencent and Alibaba have unleashed a strategy of backing rival e-wallet operators across South-east Asia, setting up proxy wars that could spur consolidation, a recent DealStreetAsia report pointed out.

For instance, in Indonesia, Alipay operator Ant Group has backed e-wallet operators Dana. Speculation is now rampant that Dana and Ovo may soon merge, giving Ant Group an even firmer foothold in key battleground Indonesia. A Dana-Ovo combination will strongly rival GoPay, the e-wallet operated by Gojek, which is in turn backed by Tencent.

Tencent appears to be up for the fight, having put its money into numerous other e-wallets operators across South-east Asia, including Sea, which has Shopee Pay, and Voyager Innovations, whose e-wallet PayMaya is popular in The Philippines.

The e-wallet battle is all about who can build the largest and most pervasive ecosystem, and is driven by saturation in the mainland Chinese markets, as well as South-east Asia's rapid adoption of e-payments, says Liew Nam Soon, EY's Asean regional managing partner.

"Thus, there has been much emphasis on alliances, merchant acquisitions, partnerships and ultimately scale, with a goal toward building an ecosystem that can lock in the consumer and be the platform of choice for their life needs," he says.

What's the fuss over an infrastructure play as simple as an e-wallet?

Mr Liew explains: "The Chinese companies' ability to adapt e-payment and, in particular, payments infrastructure will determine who is more successful. The bigger Chinese tech companies have been clever to get into this space without building from the ground up, by backing rival wallets."

Whoever dominates the payments space naturally has a hold on related verticals, adds Jonathan Zhong, a Chinese entrepreneur-turned-venture capitalist at ATM Capital.

"Payments is one of the most important (pieces of) infrastructure for Chinese tech, because it is the starting point to capture other sectors like e-commerce and streaming," he says.

The victor of the payments war may also be poised to ride on South-east Asia's digital banking wave, which many Chinese players see as a crucial stepping stone for capturing the region's fintech market.

Ms Wang of Forrester thinks that there will be consolidation in the payments landscape eventually, but not before a tough, multi-cornered fight. "Other smaller players cannot participate in this game... Those with deep pockets of Alibaba and Tencent have a better chance of surviving," she says.

E-commerce war still raging on; could evolve

Unlike streaming and payments, e-commerce is a mature vertical in South-east Asia's tech ecosystem. But there is still no let-up in the war between Sea-owned Shopee, Lazada and Indonesia's Tokopedia - all three of whom have strong Chinese backers. The recent spike in e-commerce, driven by the Covid-19 outbreak, has only added fuel to the fire.

In contrast to the e-wallet war, Alibaba isn't playing by proxy this time, but is directly on the battlefield.

Since 2016, it has sunk US$4 billion into Lazada, and now appears more dominant in running the firm's day-to-day operations. The behemoth has also backed Indonesia's Tokopedia, while Ant Group is invested in Bukalapak.

Alibaba has also grown its own footprint in South-east Asia. It first set up its office in Singapore in 2013 with the initial intention of serving local shoppers of its auction site Taobao, a company spokesperson says.

But Alibaba has since expanded its operations here to include Lazada, logistics service Cainiao and online retail site Tmall. It is also helping South-east Asian SMEs access the Chinese market.

"To satisfy Chinese consumers' appetite for imported products, our Tmall Global unit actively works with brands and merchants from this region who haven't yet established their China operations to introduce their branded products to the vast Chinese market directly," the spokesperson says.

Tencent appears to be competing through its investment in Sea, unlike Alibaba's boots-on-the-ground approach. Passive investments has also been Tencent's approach in other verticals such as gaming.

But this does not mean Tencent is disadvantaged in battle. In fact, Shopee has made significant inroads against Lazada; last year, it ranked as the top online shopping platform in South-east Asia, while Lazada came in second, an iPrice study found.

Meanwhile, a third Chinese tech giant, JD.com, has been muscling into the market. Its battle strategy has been to set up joint ventures with incumbents, such as Central Group in Thailand and Provident Capital in Indonesia.

According to January 2019 news reports, Gojek is said to have come on board as an investor in the latter venture, JD.id, at a US$1 billion valuation.

The clash of the e-commerce giants may also open up more room for other ecosystem players from China to thrive, such as cross-border platforms and e-commerce enablers including Baozun, says Ms Wang.

Large-scale Chinese platforms specialising in cross-border e-commerce, such as SheIn, are also expected to enter South-east Asia, although this has not happened yet, says Mr Li.

How the e-commerce war plays out will be interesting to watch. Unlike the payments or streaming space, where several players can co-exist, e-commerce may be more of a winner-takes-all market in South-east Asia - making this even more of a high-stakes fight.

As Mr Li sees it: "Compared to other tech opportunities, e-commerce is a field where at least one regional giant will emerge - and it is also quite hard to replicate, if the leader is apparent."

Will Covid-19 cut the battle hymn short?

The ongoing battles in streaming, fintech and e-commerce may hit an inflection point this year, as the full economic impact of Covid-19 plays out. A key unknown remains: Could the global uncertainty force the Chinese tech giants' retreat to the safety of their home market?

Even in a downturn, there is room for the Chinese tech to make opportunistic bets on South-east Asian companies with weaker balance sheets, notes Mr Liew of EY.

"The money does not just go to the unicorns but also to second-tier and emerging tech companies. These investors would look for opportunities to acquire companies with strong fundamentals, particularly customer value proposition and robust technology stack," he says.

And despite the pain from Covid-19, South-east Asia itself has strong fundamentals. "Singapore is seen as an attractive hub, with the largest number of Chinese tech companies, comparable to the Valley, while Indonesia and Vietnam are attractive for their large population and revenue potential," he adds.

Patrick Yeo, PwC Singapore's venture hub leader, echoes this: "Chinese tech majors will continue to invest in South-east Asian startups. In fact, we believe that if measures continue to tighten in western countries, the pace will accelerate."

Ian Goh, managing partner at Shanghai-based venture firm 01vc, thinks that even in turmoil, the spirit of chu hai will carry on strong.

He says with a laugh: "I think many Chinese entrepreneurs are good at spotting opportunities in new markets; they can't keep still."

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.