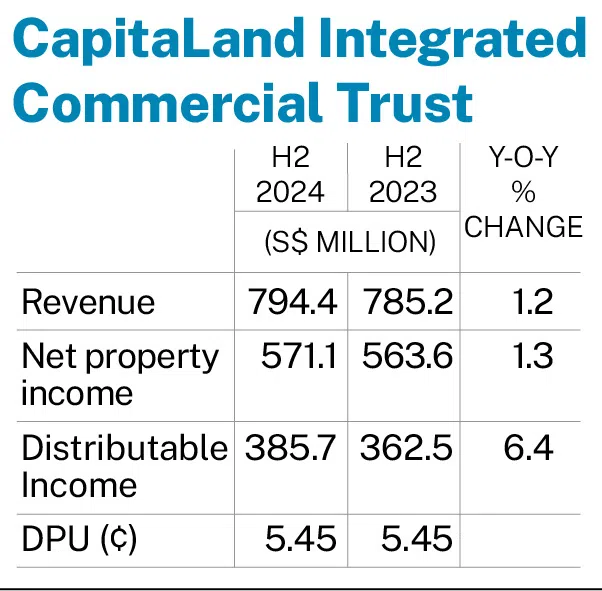

CapitaLand Integrated Commercial Trust’s H2 DPU remains at S$0.0545

Distributable income rises 6.4% to S$385.7 million for the period

THE manager of CapitaLand Integrated Commercial Trust (CICT) posted a distribution per unit (DPU) of S$0.0545 for the second half ended December, unchanged from the previous corresponding period.

This brings total DPU for FY2024 to S$0.1088, up 1.2 per cent year on year. Based on the closing price of S$1.93 per unit on Dec 31, 2024, CICT’s distribution yield for the full year is 5.6 per cent.

On Wednesday (Feb 5), CICT’s manager said the stable H2 DPU came amid an enlarged unit base due to the distribution reinvestment plan in March last year and an equity fundraising in September.

The H2 DPU consists of an advanced distribution of S$0.0216 for Jul 1 to Sep 11, which was paid on Oct 17. The remaining DPU will be paid out on Mar 21, 2025, after the record date on Feb 13.

Speaking at the trust’s earnings briefing on Wednesday morning, Tony Tan, the chief executive of CICT’s manager, said that it had ended the year in “a strong position”.

Tan noted that CICT’s overall portfolio had improved by 0.3 percentage point quarter on quarter to 96.7 per cent, with improvements seen across its retail, office and integrated development portfolios.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Rental reversion for its office and retail portfolios had also gone up by 11.1 per cent and 8.8 per cent respectively, based on the average rent of signed leases in FY2024. (*see amendment note)

Distributable income rose 6.4 per cent to S$385.7 million for H2, from S$362.5 million in the same period the year before.

CICT’s manager said the increase in distributable income was driven mainly by contributions from Ion Orchard in which it acquired a 50 per cent stake last year, as well as better performance of its existing operating properties and “prudent management of operating and interest costs”.

SEE ALSO

The increase was, however, partly offset by the divestment of its office building asset 21 Collyer Quay for S$688 million, noted the manager.

Revenue was up 1.2 per cent on the year at S$794.4 million for the half-year period, from S$785.2 million.

Net property income (NPI) grew 1.3 per cent to S$571.1 million for H2, from S$563.6 million.

Improvements in revenue and NPI were driven mainly by “enhanced performance” of existing portfolios and higher gross rental income, said the manager.

For the full year, CICT’s revenue was 1.7 per cent higher at S$1.6 billion, and NPI grew 3.4 per cent to S$1.2 billion.

The real estate investment trust’s (Reit) portfolio property value rose 6.2 per cent on the year to S$26 billion as at end-December 2024, driven by the Ion Orchard deal and better performance of CICT’s Singapore portfolio.

But the gains were partially offset by the sale of 21 Collyer Quay and lower valuation of the trust’s Australia portfolio. The lower valuation of the Australia portfolio was due to the expansion of its capitalisation rate, which grew by 100 basis points, over the year.

CICT’s adjusted net asset value per unit was S$2.09 as at end-December, up 1 per cent from a year earlier.

Positive rental reversions

In FY2024, the Reit recorded positive rent reversion of 8.8 per cent for its Singapore retail portfolio and 11.1 per cent for its local office assets.

Leases that were executed in suburban malls in FY2024 saw their rental reversion grow by 9 per cent. These leases make up 7.3 per cent of the Reit’s retail portfolio. Leases signed at downtown malls such as Bugis Junction over the same period saw their rental reversion rise by 8.6 per cent. These leases make up 10.1 per cent of CICT’s retail portfolio.

Specific to Ion Orchard’s performance, Tan said that the retail mall, which was acquired by CICT last October, had performed better than earlier projections, with its occupancy close to 98 per cent.

While luxury retail has softened globally, including Singapore, Tan said that he believed that Ion Orchard’s curation of retail stores, which caters across different income streams, will be able to help it ride through different economic cycles.

Asset enhancement works from last year could also contribute to the improvement of Ion Orchard’s performance in the later part of 2025, he added.

CICT’s portfolio occupancy stood at 96.7 per cent as at end-December, up from 96.4 per cent as at Sep 30, 2024. Its weighted average lease expiry was 3.3 years.

Drop in aggregate leverage

The Reit’s aggregate leverage as at Dec 31 stood at 38.5 per cent, down 0.9 percentage point from Sep 30, 2024. This gives the manager “a lot more (debt) headroom” and financial flexibility to consider more asset enhancement initiatives, said Tan.

Meanwhile, the trust’s average cost of debt is 3.6 per cent. Some 81 per cent of the Reit’s total borrowings are on fixed interest rates.

Tan said that he expects the interest rate of the trust’s euro loan, which was fixed several years ago, to “creep up” in the coming year, contributing to a slight increase in overall cost. To this end, the manager will minimise the drawdown of its funds to manage the trust’s interest expenses, said Tan.

As at Dec 31, CICT had an interest coverage ratio of 3.1 times.

‘Anchoring’ Singapore portfolio

Looking ahead, Tan said the Reit will “continue to prioritise leasing initiatives to retain tenants and attract new ones”.

“We are strengthening the market positioning of our assets in Singapore, Australia and Germany through asset enhancement initiatives,” he said.

The manager will also look for new avenues to strengthen the portfolio, “further anchoring ourselves even stronger in Singapore”, said Tan.

The upgrading works at IMM Building in Singapore are scheduled for completion in H2 2025 with “high committed occupancies”, he noted.

Units of CICT ended 0.5 per cent or S$0.01 higher on Wednesday at S$1.94.

*Amendment note: The article has been clarified to indicate that the rise in rental reversion is based on the average rent of signed leases in FY2024.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.