Keppel Reit H2 DPU down 10.4% at S$0.0251 amid enlarged unit base

Meanwhile, net property income is up 2.4% at S$107.7 million in the latest half year

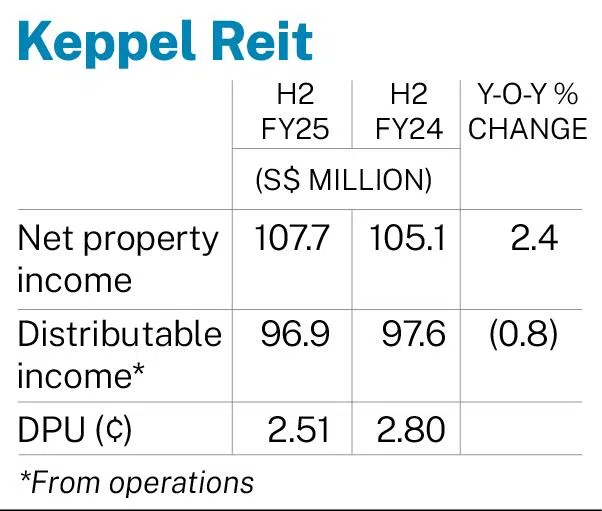

[SINGAPORE] The manager of Keppel Reit posted a distribution per unit (DPU) of S$0.0251 for the second half ended Dec 31, 2025, down 10.4 per cent from S$0.028 in the year-ago period.

Speaking at an earnings briefing on Wednesday morning (Feb 4), chief executive of the manager Chua Hsien Yang attributed the lower DPU for the latest distribution period, from Oct 17 to Dec 31, to an enlarged unit base, following a private placement and preferential offering.

He also cited the lack of income contribution from two acquisitions completed in December 2025. These comprise a 75 per cent interest in a freehold retail mall in Sydney acquired for A$393.8 million (S$351.6 million), and an additional one-third stake in Marina Bay Financial Centre (MBFC) Tower 3 for S$937.5 million.

Distributable income from the Reit’s operations consequently fell 0.8 per cent to S$96.9 million in the half year, from S$97.6 million in the prior year. From FY2025, the manager will receive 25 per cent of its management fee in cash. Assuming management fees were paid entirely in units, distributable income from its operations would have risen 6.7 per cent year on year to S$104.2 million.

A distribution of S$0.0088 a unit will be paid on Mar 25, after the record date of Feb 12. An advanced DPU of S$0.0163 was already paid out on Nov 25, for the period from Jul 1 to Oct 16, pursuant to the private placement launched in October 2025.

Net property income (NPI) rose 2.4 per cent to S$107.7 million in the latest half year, from S$105.1 million in the previous year – primarily due to stronger occupancy at the trust’s Sydney office building and higher contributions from its Singapore assets.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Borrowing costs fell 6.7 per cent to S$44.1 million in H2 FY2025, from S$47.3 million in H2 FY2024.

On a full-year basis, NPI grew 6.9 per cent to S$215.9 million in FY2025, from FY2024’s S$201.9 million. This brought distributable income from the trust’s operations to S$192.4 million for the year, down 1.1 per cent from S$194.5 million in the previous year. Assuming management fees were fully paid in units, distributable income for FY2025 would have grown 6.3 per cent to S$206.8 million.

For the year, DPU was S$0.0523. This translates to a distribution yield of 5.4 per cent, based on the Reit’s closing price of S$0.975 per unit as at end-2025.

Strong occupancy

Keppel Reit’s portfolio occupancy stood at 96.7 per cent as at end-2025, driven primarily by new leases secured for properties in Singapore and Australia. Rental reversion for the year was 11.5 per cent, with over 1.7 million sq ft of leases committed and a weighted average lease expiry of 4.4 years.

In Australia, an anchor tenant occupying eight floors at 8 Exhibition Street, a 35-storey Grade A office building in Melbourne, is expected to vacate at the end of this year. The Reit has, however, secured a tenant in January for five full floors, with the lease expected to commence next year. Incoming rent will be double that of the outgoing tenant, Chua said.

Another tenant occupying three floors at 8 Exhibition Street has also been secured, at rents more than double those of the exiting tenant, he added. The lease is expected to commence in the first half of 2028.

On the homefront, ANZ Group is reportedly relocating to the Marina One complex from Ocean Financial Centre (OFC). Asked about the potential vacancy, Chua said the manager was unfazed by tenant departures, especially for full-floor units.

“We have shared in the last two quarters that we have a lot of demand for full floors, especially in OFC. If there is a tenant who leaves, there will definitely be more demand, (or we could) lease this space at much higher rates,” he said.

He added that the lease is due to expire in October, but discussions with the tenant – whom he declined to name – are ongoing over a possible term extension, depending on the timing of a new tenant.

As at Dec 31, 2025, Keppel Reit’s portfolio value stood at S$11.7 billion. Its exposure to Singapore rose to 79.8 per cent, in line with the Reit’s strategy to focus on key markets and “premium” locations for sustainable growth and capital appreciation over time.

Aggregate leverage was 47.9 per cent, largely due to loans drawn to fund the MBFC Tower 3 acquisition. If proceeds from the trust’s preferential offering had been received before the end of the year and used to fund the deal, leverage would have been lower at 40.4 per cent.

For FY2025, its weighted average cost of debt was 3.4 per cent per annum, with an interest coverage ratio of 2.6 times. The manager noted that its debt maturity profile remained “staggered”, with a weighted average term to maturity of 2.4 years. In 2026, the manager’s chief financial officer Sebastian Song said the manager aims to achieve a cost of debt in the low 3 to 3.3 per cent range.

Bringing down borrowing costs is among the manager’s top priorities in the coming year, Chua added. Beyond that, he said the manager will continue driving organic growth within the enlarged portfolio through rental growth and proactive cost management. This is especially in light of the “very low supply and high demand” in the Singapore office market and the trust’s Australian assets, he said.

He added that the manager was not rushing into further acquisitions or equity fundraising, having already completed a fair amount of deals in FY2025.

“In the first half, we really want to dedicate (ourselves) towards asset management,” said Chua. “If the time is right, if we do find attractive offers for some of our assets… we could look at strategic divestments.”

In the second half of the year, Chua said the manager could look at potential acquisitions, but this would likely be preceded by divestments. Its share buyback programme could also return now that leverage was lower, and especially if divestments are made, he said.

Units of Keppel Reit closed at S$0.975 on Wednesday, down S$0.005 or 0.5 per cent.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.