OCBC betting on China's wealth market as Q2 net profit rises 59%

OCBC is looking to strengthen its presence in the Greater Bay Area, and is betting especially on the wealth market in China, its chief executive officer Helen Wong said on Wednesday, as her bank reported a 59 per cent increase in net profit for its second quarter as credit allowances dropped amid an improved economic outlook.

"We have a good presence in Hong Kong and China, and we do want to actually strengthen that. That is very much because we do want to see the synergies between Greater China and Asean. We want to capture a lot of the flow," she said.

OCBC declared a dividend of S$0.25 per share for the first half of the year, translating to a payout ratio of 42 per cent. While lower than peer bank UOB's 50 per cent payout, also announced on Wednesday, and OCBC's own pre-pandemic payout of 47 per cent in FY2019, Singapore's second-largest lender said it looks first at the quantum in calibrating dividends.

"Essentially, we thought that the optimal level to revert to will be the level (we undertook) in terms of our dividend back in 2019, pertaining to the interim, which is 25 cents," said OCBC's chief financial officer Darren Tan, when asked why the payout ratio was not on a par with its peers.

"The reference to the payout ratio, where we have guided in the past, is 40 to 50 per cent, and would be the secondary consideration."

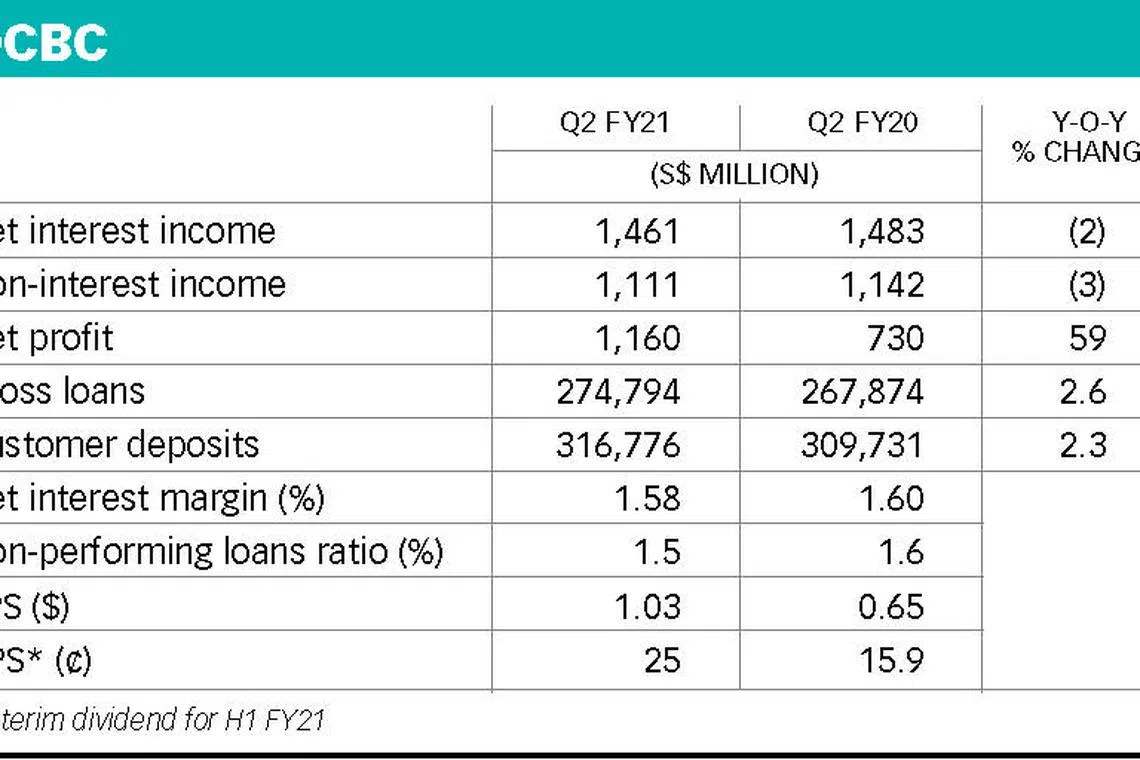

Net profit for the three months ended June 30, 2021 stood at S$1.16 billion, compared with S$730 million from the year-ago period.

The earnings were in line with the S$1.14 billion consensus forecast in a Bloomberg survey of five analysts.

As part of its "China Plus One" strategy, the bank will beef up its China business offices in Asean so as to improve support for inbound business. It will also strengthen its coverage within China - not just in commercial banking, but in investment and transaction banking, Ms Wong stressed - as well as partnering Chinese banks to look at cross-border wealth flows.

Like other global lenders, OCBC is eyeing China's upcoming Wealth Management Connect initiative, Ms Wong said. She was referring to the cross-border investment scheme in the Greater Bay Area that is expected to facilitate a total fund flow of 300 billion yuan (S$63.5 billion) in terms of sales in investment products.

Although there has been a spike in Covid-19 infections in China with the spread of the Delta variant, Ms Wong expressed confidence in the authorities bringing the situation under control. "The domestic economy is actually recovering very well. If you call it a setback, I'll actually call it more of a normalisation. It is a very big economy, and it continues to manage to grow in the mid to high single-digit average GDP. It is very admirable."

OCBC's net interest income for the quarter fell 2 per cent to S$1.46 billion, mainly from a two-point decline in net interest margin (NIM) to 1.58 per cent.

Non-interest income dipped 3 per cent to S$1.11 billion, in line with lower trading, investment and insurance income, partly offset by a 28 per cent increase in fee income.

Total allowances were 69 per cent lower from a year-ago period, standing at S$232 million. However, this represented a 44 per cent increase from the previous quarter, where allowances stood at S$161 million. The non-performing loan (NPL) ratio of 1.5 per cent was unchanged from the previous quarter, and below the 1.6 per cent NPL that was posted a year ago.

Mr Tan said the bank has set aside allowances in the second quarter as a "buffer against potential credit deterioration" in the region, in view of the pandemic's resurgence in South-east Asia. Allowances for impaired assets stood at S$283 million for the first half of the year and were "mainly for various corporate accounts for Malaysia and Indonesia", in the second quarter. The bank expects to see an increase in relief loans from the two countries in the coming quarter, he said.

In the year-ago period, OCBC had paid an interim dividend of 15.9 Singapore cents, capping its payout in line with guidance from the Singapore regulator.

In July and August last year, the Monetary Authority of Singapore (MAS) had called on local banks and finance companies to respectively cap their total dividends per share (DPS) for FY2020 at 60 per cent of FY2019's DPS, and offer shareholders the option of receiving the remaining dividends to be paid for FY2020 in shares in lieu of cash.

Late last month, MAS lifted its dividend cap on locally-incorporated banks and finance companies based in Singapore. It joins other central banks that have recently eased dividend restrictions imposed on banks last year, as the global economy rebounds amid gradual re-openings and rapid vaccine roll-outs.

In the long run, Ms Wong said she expects NIM to remain within current levels and loan growth to fall within the "mid single digits" towards the end of the year. "Long-term trends remain stable and this will continue to drive our loan growth, China flows, wealth flows, etc," she said, citing also "good momentum" on the bank's mortgage book fuelled by growing home sales in Singapore.

OCBC shares closed at S$12.46 on Wednesday, up 1.8 per cent or 22 Singapore cents. READ MORE:

- Singapore banks restore dividends as allowances fall, see improved outlook

- UOB Q2 net profit up 43%; declares S$0.60 dividend

- OCBC appoints its head of group operations and technology as new COO

- Lion Global, OCBC Securities to list China-focused ETF on SGX in August

- OCBC geared for 'very strong' Greater Bay Area competition; Q1 profit more than doubles to record

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.