The Projector owes S$1.2 million to creditors; Golden Mile cinema put up for rent

Creditors include the cinema’s members, owed close to S$90,000, as well as banks, Cathay Cineplexes and the Composers & Authors Society of Singapore

[SINGAPORE] The company behind embattled cinema chain The Projector owes creditors S$1.2 million, including close to S$90,000 to almost 2,300 of its members, The Business Times has learnt.

In an e-mail to creditors on Tuesday (Aug 19) night, the company, Pocket Cinema, said that a creditor meeting has been set for Aug 29 at 2.30 pm via video conference.

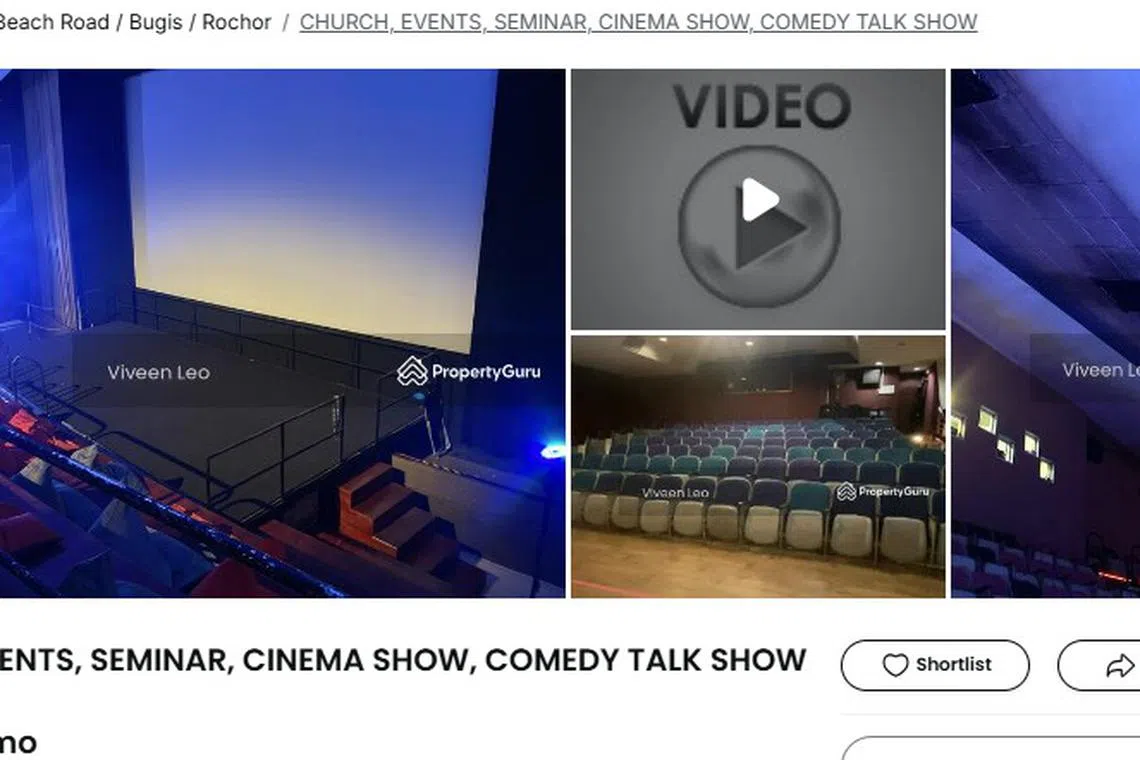

Separately, a listing on property website CommercialGuru shows that The Projector’s former premises at Golden Mile Tower have been put up for rent at S$33,000 a month.

The developments come after The Projector abruptly announced its shuttering earlier on Tuesday, citing costs, changing audience habits, and “the worst consumer market conditions in a decade”.

According to the e-mail, the largest creditor is a company called Overseas Movie, which is owed about S$382,888. OCBC is owed S$200,000, while UOB is owed around S$106,818.

The Projector’s co-founders Karen Tan and Blaise Trigg-Smith are owed more than S$100,000 each. Other creditors include unused ticket holders, who are owed some S$14,300, and the Composers & Authors Society of Singapore, owed about S$17,733.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Fellow cinema operators are also among the creditors. Over S$9,000 is due to Golden Village Pictures, and more than S$1,800 to Cathay Cineplexes.

Other notable creditors include:

- LSI Software (S$97,639.70)

- Gourmetz (S$13,014.60)

- Forte Law (S$9,000)

- The Walt Disney Company (Southeast Asia) (S$8,308.96)

- Cineaste Production House (S$3,283.53)

- First Printers (S$1,378.85)

The debt figures are based on The Projector’s books and records for voting purposes, and are subject to the proof of debt form submitted to the liquidator.

Premises for rent

The CommercialGuru listing indicates that 10,000 square feet of space – including The Projector’s three cinema halls and cafe-bar space – are up for rent. Two of the halls can accommodate more than 200 people, while the third can hold about 100 people.

The S$33,000 monthly rental translates to about S$3.30 per square foot.

The space is described as suitable for purposes including church gatherings, comedy shows and live performances.

The listing also indicates that a “big hall” in Somerset able to accommodate 340 people is up for rent every Sunday, from 9 am to 1 pm. It is not clear if this refers to The Projector’s tie-up with Golden Village at Cineleisure, which the indie cinema exited earlier this month.

Financial status unclear

The current financial status of The Projector’s operator Pocket Cinema is unclear. Regulatory filings of Pocket Cinema’s Singapore entity indicate that it made S$64,122 in net profit in 2017, on the back of S$1.3 million in revenue. Figures for more recent years are not available.

Another Singapore-registered company owned by Pocket Cinema, called Projector X, made a loss of S$323,766 in 2023, regulatory filings show. This was on the back of S$2.2 million in revenue that year.

The 2023 loss was a reversal from the S$308,268 net profit that Projector X made the prior year, with S$2.5 million in revenue.

The entity had over S$856,000 in bank borrowings as at Dec 31, 2023, of which about S$218,000 was secured.

BT has reached out to The Projector for comment.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.