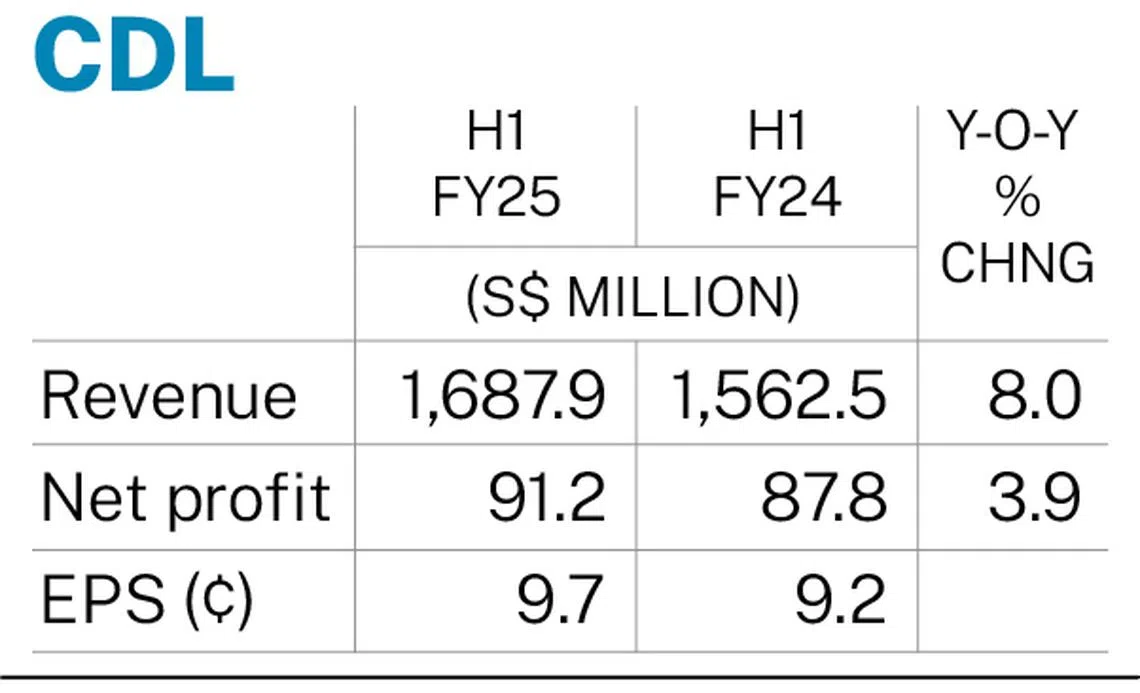

CDL H1 profit up 3.9% at S$91.2 million on robust condo sales; declares higher special dividend of S$0.03 per share

Group hit by forex loss of S$63.1 million, reversing from previous gain of S$51.3 million

[SINGAPORE] Property developer City Developments Ltd (CDL) saw net profit rise 3.9 per cent on the year to S$91.2 million for the first half ended Jun 30, driven by stronger contributions from its property development segment.

Earnings per share rose to S$0.097, from S$0.092 a year earlier.

A special interim dividend of S$0.03 per share was declared for H1, a slight increase from the S$0.02 per share a year prior. It will be paid out on Sep 5, after the record date on Aug 20.

Speaking at an earnings briefing on Wednesday (Aug 13), CDL chief executive Sherman Kwek noted that the group’s performance “could have been a lot better”, but it was hampered by unrealised net foreign exchange losses amounting to S$63.1 million. In comparison, CDL recorded a net foreign exchange gain of S$51.3 million in H1 FY2024.

This was mainly due to a depreciation in the greenback following the implementation of US trade policies in April, added group chief financial officer Yiong Yim Ming. The group was hit hard due to US dollar-denominated loans for past US hotel acquisitions and working capital requirements.

Excluding such losses or gains, Kwek said profit would have surged by 323 per cent.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The profit growth followed an 8 per cent increase in CDL’s top line to S$1.7 billion.

Revenue from property development jumped 24.3 per cent to S$583.2 million, boosted by residential projects in Singapore – namely The Myst condominium in Upper Bukit Timah, Norwood Grand in Woodlands and Union Square Residences in Havelock Road.

Some 903 private homes worth S$2.2 billion were sold by CDL in H1 – a rise of 54 per cent in volume and 90 per cent in value year on year.

CDL also fully recognised profits from its joint venture project, Copen Grand executive condominium in Tengah. The development was fully sold a month after its launch in October 2022, with prices ranging from S$1.09 million for a two-bedder to S$2.17 million for a five-bedder.

Pre-tax earnings from property development consequently rose to S$152.5 million in H1, from S$8.8 million in the year-ago period.

Hotel revenue was down 1.5 per cent to S$735.3 million, with pre-tax losses of S$84.4 million. This was largely due to foreign exchange losses, a weaker performance in the US and Singapore, as well as inflationary cost pressures.

Earnings from the group’s investment properties held firm at S$248.5 million in H1, with pre-tax earnings of S$76 million.

Revenue of other segments rose by over 20 per cent to S$120.9 million. But net exchange losses and lower fair value gains resulted in a pre-tax loss of S$4.1 million.

In the year to date, CDL recorded over S$1.5 billion in contracted divestments. Further gains of up to S$465 million are expected with the completion of the sale of its 50.1 per cent stake in South Beach in the third quarter.

This could result in dividend rewards for shareholders, depending on how the full year ends, said Kwek. Typically, the group targets a payout ratio of about one-third.

Succession planning

In a statement on Wednesday released before the results briefing, executive chairman Kwek Leng Beng said that CDL’s executives have “put past issues behind us”, and that the “board and management are aligned and focused on effective execution and value creation”.

The elder Kwek had accused his son, CDL’s chief executive, of an attempted boardroom coup earlier in February. This triggered a series of dramatic claims and counterclaims, with the elder Kwek only dropping his lawsuit two weeks later.

When asked if he was still confident in succession planning, Kwek Leng Beng reiterated what he said in the company’s press statement – that the board was aligned and remains “steadfast in building a resilient and future-ready organisation, anchored in trust, performance and sustainable growth”.

He added: “As far as (the) succession plan is concerned, the past (is) over. We look forward to the future with strength, tenacity. I am always looking forward, and this should be the case.”

Sherman Kwek, concurring with his father’s sentiments, said: “Despite some instability in the earlier part of the year due to internal issues, the ensuing period has been marked by stabilisation, renewed alignment and disciplined execution...

“While the operating environment remains fluid, the potential easing of interest rates offers further upside as we continue to pursue our capital recycling and fund management initiatives.”

The chief executive said development projects will remain a core focus for CDL.

So far, the group has already acquired three state land sites under the government land sales (GLS) programme to replenish its land bank. This includes a Jurong West land parcel for S$608 million in June. Last week, CDL topped offers for two EC sites in Woodlands and Bukit Panjang.

Given the three acquisitions, Sherman Kwek said CDL is likely to slow down in its bidding activity for the rest of this year. “We don’t want to be overburdened with too much land bank in any particular location... It’s about diversification across asset classes and geographies.”

The group may still make further investments in H2, but will focus on optimising its portfolio with complementary assets or those that are undervalued, the chief executive said.

Maintaining a healthy gearing ratio also remains a priority. As at Jun 30, the group’s net gearing stood at 70 per cent, with an average borrowing cost of 4 per cent and interest cover ratio of 2.4 times.

The aim is to bring gearing to the low 60 per cent range over time, with upcoming sales helping to offset short-term increases from recent site acquisitions, said Kwek.

Still, the group maintains a “robust” capital position, with cash reserves of S$1.8 billion, and S$3.5 billion in cash and available undrawn committed bank facilities.

CDL added: “The group will continue to focus on optimising its portfolio and unlocking capital for more productive use, such as selective acquisitions, debt reduction, paying dividends and facilitating share buybacks.”

On the goal of trebling CDL’s hotel numbers to 500, in light of group hotel operations’ poorer performance in H1, Kwek Leng Beng said: “I’ve always believed there’s a lot of future (for hotels).”

He explained that hotels are long-term assets that yield strong capital gains once sold, despite slow initial cash flow, and called the 500-hotel target “not too ambitious”. “I believe this is the right strategy.”

On CDL’s prime downtown project Newport Residences, the younger Kwek said the group had no time pressure to launch it, and is waiting for the “right market conditions” to ensure strong launch momentum.

The project was shelved after the government hiked the additional buyer’s stamp duty in April 2023, a week before its planned launch.

Recent successful launches of other Core Central Region projects have been encouraging, but the decision will be timed carefully, said Sherman Kwek.

Share of CDL rose S$0.45 or 7.1 per cent to close at S$6.80 on Wednesday.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.