Temasek posts negative 1-year return; ups exposure to China, private markets

One-year TSR is -2.28% for fiscal year ended March 31; exposure to China, at 29%, surpasses that in Singapore, at 24%, for the first time

Claudia Tan HS

Singapore

TEMASEK Holdings on Tuesday reported that its one-year total shareholder return (TSR) had fallen into negative territory amid the Covid-19 pandemic, and that it will remain cautious as it braces for more uncertainty against a cloudy outlook for recovery.

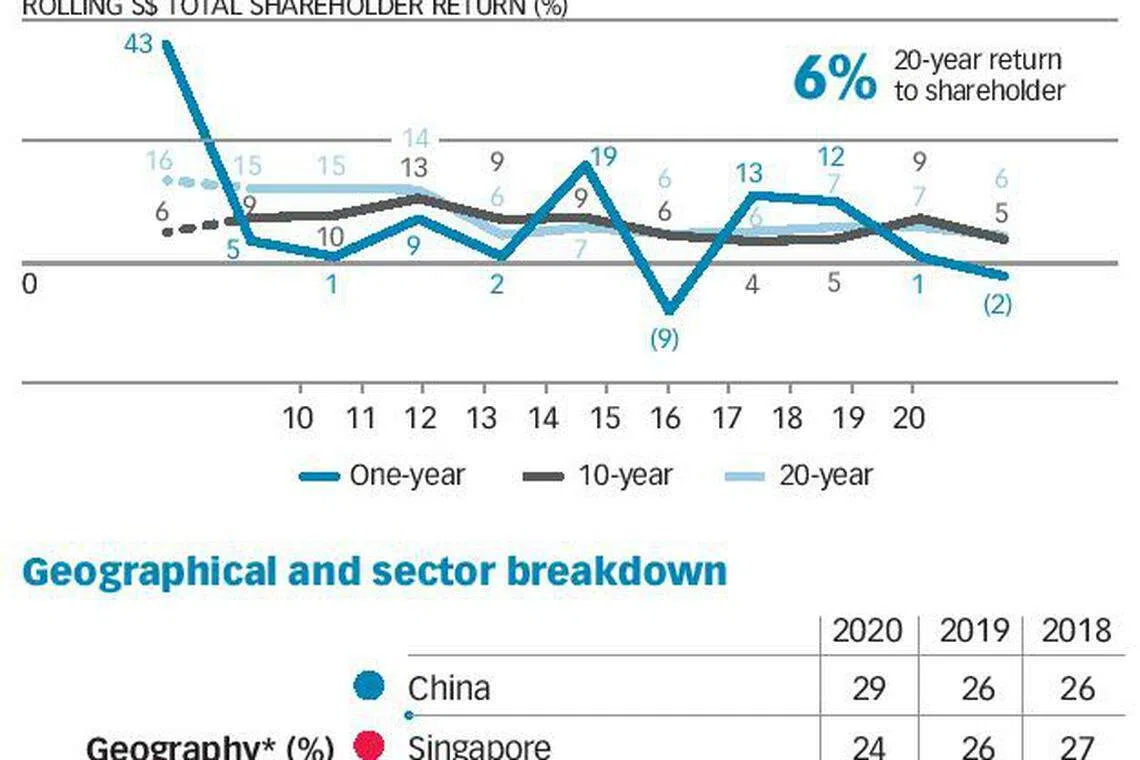

The one-year TSR came in at -2.28 per cent for the 12 months ended March 31, 2020. This is a further drop from the previous fiscal year's one-year TSR, which had tumbled to 1.49 per cent.

TSR takes into account all dividends distributed to its shareholder, less any capital injections. The lower TSR was in part due to the sharp market correction in the quarter up to March 31 in response to the onset of Covid-19, that was also seen across regional indices over that period.

Compounded over 46 years since its inception in 1974, annualised returns stood at 14 per cent.

Among key risks cited by Temasek is growing concerns arising from geopolitical and trade tensions between the United States and China and the impending US presidential election.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Still, the US and China will continue to be the "top two destinations for capital", Dilhan Pillay Sandrasegara, chief executive of Temasek International told the media. But mounting geopolitical tensions mean they have to "think more broadly" about investments and look beyond the robustness of business models, he added.

The state investment firm had continued to increase exposure to China despite the country coming under greater pressure from geopolitical tensions. For the first time, Temasek's exposure to China surpassed Singapore, rising to 29 per cent versus 26 per cent last year.

Exposure to the city-state fell to 24 per cent from 26 per cent a year ago. Meanwhile, its exposure to the North American market stood at 17 per cent and that in Europe at 10 per cent.

Png Chin Yee, deputy chief financial officer and head of financial services at Temasek International, told the media that this is due to the relative valuations of the two markets. Looking at the market as a whole, MSCI China has outperformed Singapore by about 15 percentage points, she said.

She added that it is "quite natural" that Temasek will see much more exposure outside of Singapore given the smaller economy here compared with economies like the US and China, but noted that Temasek will continue to invest in the local ecosystem.

New investments in China include Kuaishou Technology, a short video social platform; Beijing-Shanghai High Speed Railway; and Ocumension Therapeutics, an ophthalmic pharmaceutical platform company.

Temasek is positive on China with the expectation that overall policy will stay accommodative to support the economic and job recovery.

Wu Yibing joint head of Enterprise Development Group and head of China Temasek International also pointed out that investment in China is geared towards domestic consumption and innovation - trends that have been accelerated by the pandemic.

In Singapore, the economy has experienced a severe contraction, said Temasek.

"Nonetheless, parts of the economy have shown resilience, and the ongoing fiscal support has helped to support employment and alleviate pressures on businesses."

Investments in Singapore growth companies include ShopBack and Growthwell Group, which makes plant-based meat alternatives.

Two-thirds of Temasek's exposure is in Asia, led by China and Singapore by concentration.

On Temasek's new investments, the US again accounted for the largest share during the year, followed by China and Singapore.

In the US, Temasek backed a management-led recapitalisation in Eastdil Secured, a commercial real estate brokerage company and invested in JAB Consumer Fund to increase exposure to the consumer sector.

Investments outpaced divestments during the year. Temasek invested about S$32 billion in assets and divested about S$26 billion in the same period.

It ended the year with a "resilient balance sheet", said Temasek.

The investment firm's net portfolio value dropped to S$306 billion, about 2.2 per cent below the year-ago S$313 billion on a Singapore-dollar conversion basis.

The impact from the pandemic on its portfolio was partially mitigated by a "resilient private book" and large cash balance entering the crisis, said Ms Png.

Temasek has increased its exposure to unlisted assets, with investments in the private markets now making up 48 per cent of its portfolio, up from 42 per cent in 2019.

"Private assets have in the past delivered stronger returns than our listed portfolio.

"They have outperformed and given us the illiquidity premium that we expect to derive from being invested in the private space," said Ms Png.

Its exposure to financial services remained the largest, and stood at 23 per cent.

Trends in the payments space, which are tied to e-commerce and digital payments are here to stay even in a post-pandemic world, said Ms Png.

Temasek increased exposure to the payments sector and other non-bank financial services companies such as PayPal, Mastercard and Visa, to benefit from the acceleration in digitisation of financial services.

Technology, media and telecommunications remain areas of focus as well.

Asked about the firm's forecasts for the coming year, Ms Png said: "I will just say that we've actually seen recovery in global markets since the end of March, and so that should give you an indication as to where market valuations might be and where our portfolio valuations might be today."

READ MORE: Sustainability at the core of everything we do, including investments: Temasek

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.