ZenRock interim JMs flag doubtful trades, invoices, cash transactions

They also noted US$1.6b in receivables shrinking to US$136m over just one day

Singapore

THE interim judicial managers (IJMs) of troubled ZenRock Commodities Trading have unearthed hundreds of "questionable" transactions involving duplicate sales invoices as well as multiple back-to-back "side transactions" and "unusually large cash transactions" following a scrutiny into the trader's affairs.

Over the past two years, the Singapore company has conducted over 200 transactions in which the same sales invoice with identical sales contracts were provided to obtain two sets of letter of credit (LC) financing for essentially the same transaction, according to KPMG's Martin Wong, Bob Yap and Toh Ai Ling, the court-appointed IJMs for ZenRock.

The IJM report was submitted in the Singapore High Court on Monday in a hearing that lasted under one hour before Judge Pang Khang Chau. Sarjit Singh Gill SC and Daniel Tan from Shook Lin & Bok are lead counsel for HSBC.

The report's findings are not at odds with the allegations by HSBC Holdings of the trader's "highly dishonest" and "extremely suspicious" trade practices in its application filed two months ago to place the firm under judicial management (JM). The court granted the application and appointed the IJMs on May 8.

The IJMs' review had looked into HSBC's allegations as well as others that had come to its attention. HSBC is the commodities firm's largest lender with an exposure of US$50 million. Five other banks are also exposed to ZenRock with just under US$100 million owing to them. They are Natixis Bank, Crédit Agricole Corporate & Investment Bank, ING Bank, Bank of China and Banque de Commerce et de Placements SA.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

According to the report, the liabilities to the bank creditors under the LC facilities in these doubtful transactions amount to some US$175.3 million as of June 30 2020.

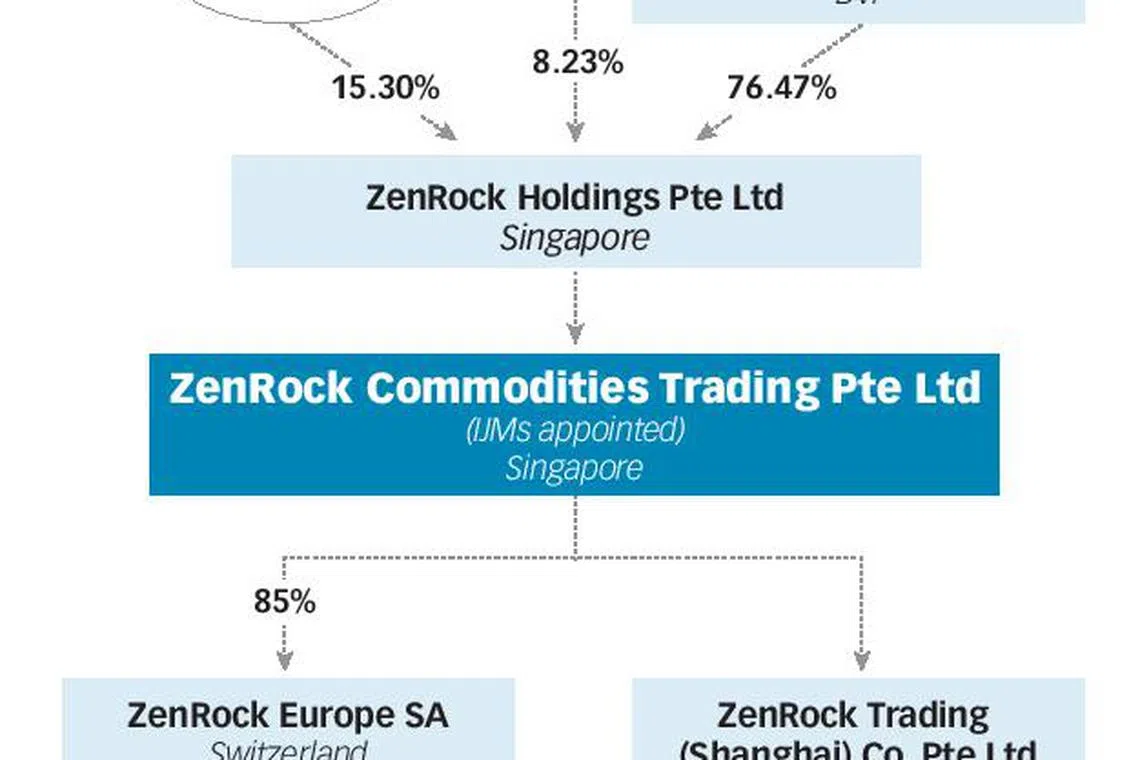

ZenRock directors are veteran traders Xie Chun, who previously worked at China's state-controlled Unipec - the trading arm of China's largest refiner by capacity Sinopec - and Tony Lin HaiTian, an ex-Vitol executive. Both men are also the beneficial owners of ZenRock.

While Mr Lin has been "responsive" to the IJMs, the court-appointed managers said they faced challenges engaging Xie Chun, the man with the most comprehensive understanding of the firm's affairs, due to his meetings with Singapore's Commercial Affairs Department (CAD) and medical leave.

According to the report, a significant part of the IJM's work has been dedicated to assisting the city state's white-collar crimebuster with their ongoing probe into the trader following a police report filed by HSBC.

There were other areas that the IJMs raised grave concerns over, including ZenRock's dealings and the authenticity of its trades with two entities - HuiTongRong, an entity whose sole shareholder is Jing Weijiang, a cousin of Mr Xie Chun and hence, begs more scrutiny, and Shenzhen Qianhai.

As at Dec 30, 2019, both entities were recorded to owe ZenRock a total of US$1.6 billion but these account receivables drastically shrank over a single day to US$136 million by way of setting off against account payables owed to the same companies. The IJMs noted that such drastic set-offs and transfers, without explanations, seemed to be a pattern for the commodities firm at the end of each financial year.

Also, while the underlying trades between ZenRock and these entities did not involve physical trades, the impression was given that there was physical movement of cargo. The report also flagged suspicious cash payments from 2016-2019 of just over US$100 million by ZenRock to HuiTongRong. The IJMs said they intend to continue investigating these matters in the event they are appointed as JMs.

The court-appointed managers are also of the view that ZenRock is unlikely to continue in the long term in its core businesses of oil trading, gasoil blending and storage and commodities derivatives trading and "...any restructuring would, at best, preserve a fraction of ZenRock's original business".

"...ZenRock's business is now at a minimal level and many cost-saving measures, including reductions in the workforce, have been taken and are in the midst of being implemented. For a variety of reasons, there has been a significant reduction of ZenRock's business under circumstances outside of the IJMs' control," said the report.

They said there is value in placing ZenRock under JM, albeit for a relatively short period of time, during which they could also complete an inventory sale and review contract feasibility. They may also consider a proposed management buyout of a newly set-up unit ZenRock Europe by Mark Papallo, who owns 15 per cent of the Geneva-based entity.

However, once the managers are appointed as JMs, the report said they plan to file for the JM order to be discharged and for ZenRock to be liquidated if and when it becomes evident that ZenRock will be unable to meet the purposes set out under the JM order.

READ MORE: The digital revolution against trade fraud

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.