MAS to deploy US$1.8 billion to five asset managers for climate-related investments

MAS will deploy US$1.8 billion of the official foreign reserves (OFR) to five asset managers for climate-related investments, said Ravi Menon, managing director, MAS, at the launch of its first sustainability report on Wednesday.

The deployment is part of the US$2 billion Green Investment Programme (GIP) that was set up in 2019.

MAS manages the OFR with the mandate of preserving purchasing power and long-term value of the OFR. As of May 2021, the OFR stands at US$398 billion.

The names of these asset managers will not be disclosed. The selected fund managers will establish their Asia-Pacific sustainability hubs in Singapore, and launch new ESG thematic funds for the region.

They are expected to start operations within the next few months.

"The GIP will help to enhance the climate resilience of the official foreign reserves, attract sustainability-focused asset managers to Singapore and catalyse funding towards environmentally sustainable projects in Asia and beyond," said Mr Menon.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

"As the guardian of Singapore's official foreign reserves, MAS is integrating climate risks and opportunities into its investment framework."

It comes as climate change is expected to drive more sovereign wealth funds and institutions managing reserves to embed environmental, social and governance (ESG) criteria into their operations and investment decisions over the next few years, said a recent report published by financial data provider Preqin, in partnership with multinational law firm Baker McKenzie.

To build a climate-resilient reserves portfolio, MAS will also exclude from its reserves portfolio those companies most at risk from the economy's transition towards lower carbon intensity.

As an example, companies that derive a substantial part of their revenues from thermal coal mining and have no credible transition plan, will be excluded.

MAS is also expecting its external managers to integrate ESG considerations into their investment process over time to mitigate climate risks in their portfolio.

"By exercising their shareholder rights through voting, engagement, and escalation, our external managers can influence their investee companies to address climate risks and shift towards more sustainable practices," said Mr Menon.

MAS is the second central bank in the world to release a standalone sustainability report after the Bank of England.

The report found that climate change can negatively impact the portfolio of MAS, with equities more impacted compared to bonds and cash.

However, the negative effects are mitigated by the "well-diversified nature of the portfolio", as fixed income instruments accounted for the largest allocation, said MAS.

As part of the report, MAS partnered GIC and external consultants to conduct an analysis on MAS's portfolio based on various climate change scenarios in order to find out possible investment implications.

The report said that equity returns are more sensitive to changes in macroeconomic factors such as gross domestic product due to climate change, as well as changes in companies' earnings caused by climate-related variables such as carbon prices, oil and demand and clean technology deployment.

Sovereign bonds, on the other hand, are less impacted by climate change, said the report. Even so, physical and transition risks from climate change are still present, potentially lowering portfolio returns.

Physical risks refer to damage to physical infrastructure, halted production of goods and services, or disruptions to supply chains of companies, as a result of climate change.

Transition risks arise from the process of adjustment towards an environmentally sustainable economy.

The study found that physical risk contributes more to portfolio impact compared to transition risk, but the most damaging effects of physical risk come much later while transition risk would be a more immediate risk to manage from an investment standpoint.

But even within the same scenario, it was found that the transition risk impact can vary significantly, and as such, a nimbler set of portfolio actions is required to maximise portfolio returns, said MAS in the report.

Given that equities investments are relatively more impacted by climate change, MAS is implementing portfolio actions to address the more immediate transition risk on this asset class, including through its external managers, who directly manage the bulk of its equities portfolio.

The financial regulator plans to commence a climate risk mitigation overlay within the equity asset class.

In his speech, Mr Menon said that such an overlay programme will reduce exposures to carbon intensive sectors, such as energy, materials and utilities.

However, it will maintain some exposure to companies within these sectors that are likely to make a successful transition.

"Excluding entire sectors could mean missing out on opportunities to facilitate transition," he said.

To remain nimble, MAS is looking to allocate more investments to actively managed strategies that seek out climate change-related opportunities, or tilt investments towards more climate-resilient companies.

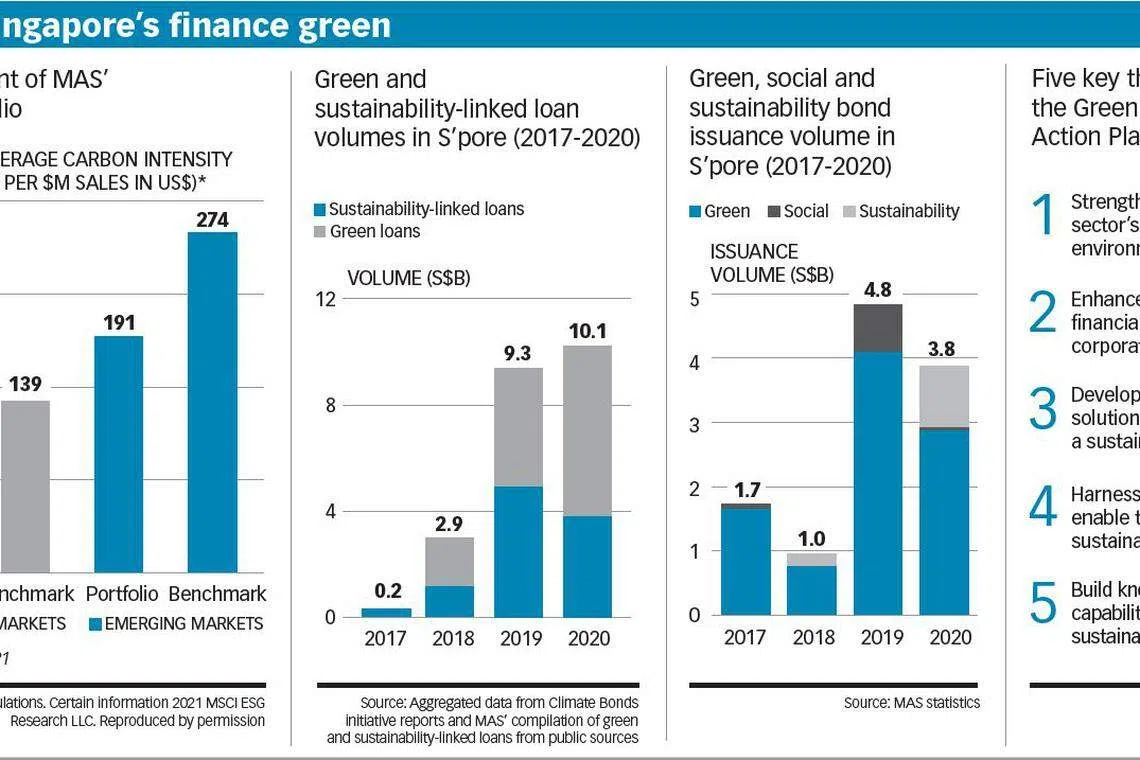

The report also diclosed the carbon footprint of MAS's equities portfolio, reported using weighted average carbon intensity (WACI), the preferred metric recommended by the Taskforce for Climate-related Financial Disclosures.

The WACI of a portfolio is derived by taking the carbon intensity for each of the companies in the portfolio, weighted by the relative size of the investments in the portfolio.

As at end-March 2021, the WACI for MAS's emerging market equities portfolio was 30 per cent lower than its benchmark, while the WACI for its developed markets equities portfolio was 3 per cent lower than its benchmark.

MAS will report its progress in strengthening the climate resilience of the OFR each year.

MAS also disclosed that its carbon footprint has declined over the last two years but the magnitude was amplified by the Covid-19 pandemic.

Its carbon emissions declined 47 per cent from FY2019/20 to FY2020/21, mainly due to a near collapse in air travel due to the pandemic. While emissions from air travel for official business has been rising due to MAS' active and growing participation in international and regional fora, the central bank will "look for opportunities to reduce air travel in line with new norms of international engagement in a post-pandemic world", said Mr Menon.

"We will, by next year's sustainability report, set targets for emissions reduction in 2025 and 2030 and consider the earliest possible timeframe to achieve net-zero emissions," he said.

"We will develop strategies to reduce the major contributors to our carbon footprint, namely electricity consumption, air travel, and currency operations."

Mr Menon noted that the "biggest challenge" is to reduce the environmental footprint of currency issuance. While MAS is still collating emissions data on the excluded outsourced currency operations, it estimates they will eventually account for 40-60 per cent of its carbon footprint. MAS is engaging its currency vendors to reduce their emissions upstream, with some doing so through sourcing of renewable energy and printing carbon-neutral notes through carbon offsets.

"Ultimately, progress on emissions reduction in currency operations hinges on a reduction in public demand for notes and coins," said Mr Menon.

"MAS will continue to promote electronic payments, the use of good-as-new $2 notes for Lunar New Year, and e-gifting during festive seasons. If Singaporeans can reduce their use of cash, it will help to reduce the environmental impact of currency operations, and ultimately the carbon footprint of Singapore."

READ MORE: Climate-linked financial disclosures to be legally binding, align to one global standard: MAS chief

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.