Dwindling options for EC buyers in H2 2021, 2022

Demand for this housing segment has been robust; moving forward, just one EC launch may take place every six months.

EXECUTIVE condominiums (ECs) are a hybrid private-public housing segment created for Singaporeans since 1996. They are generally found in the Outside Central Region (OCR).

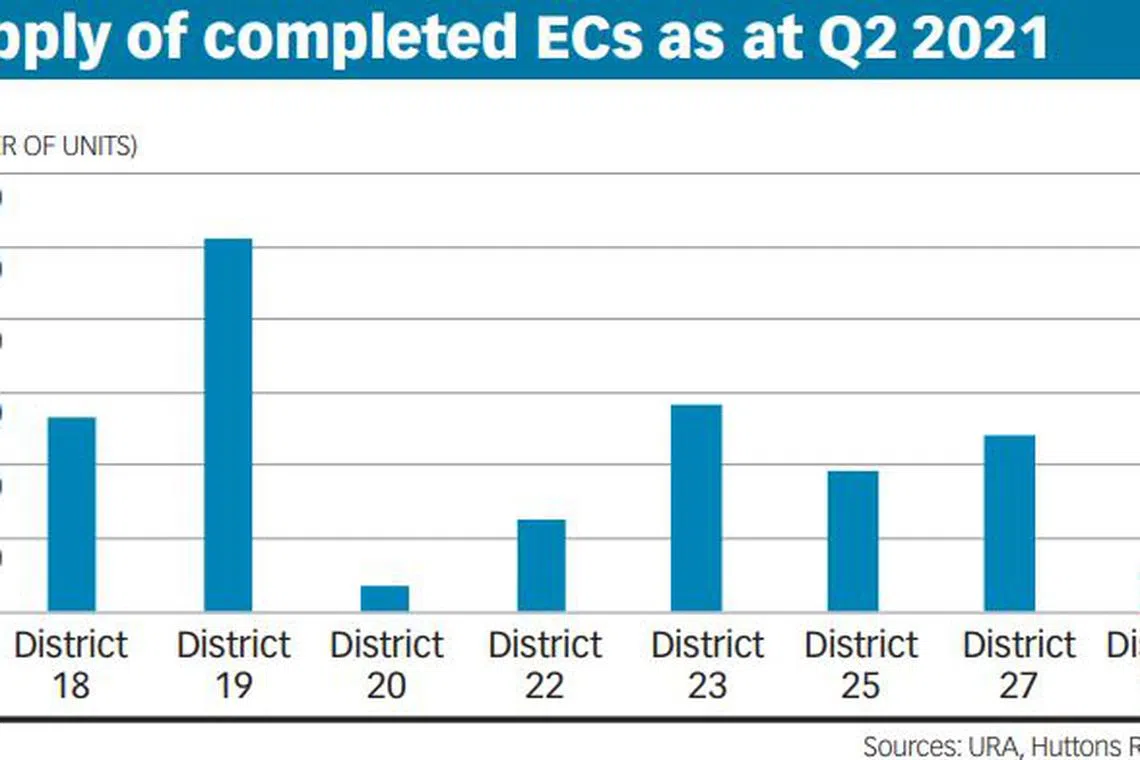

About 30 per cent of completed EC units are in District 19 (Serangoon Garden, Hougang, Punggol).

This is followed by District 23 (Hillview, Dairy Farm, Bukit Panjang, Choa Chu Kang) with 16.5 per cent, and District 18 (Tampines, Pasir Ris) at 15.6 per cent.

The smallest number of such residential properties is in District 20 (Bishan, Ang Mo Kio), followed by District 28 (Seletar, Yio Chu Kang) and District 22 (Boon Lay, Jurong, Tuas).

Across Singapore, there are 66 completed EC projects as at the second quarter this year. Of these, 23 are fully privatised, having passed the 10-year mark, and can be sold freely in the open market.

Units at another 26 completed projects can now be resold to Singaporeans and permanent residents as they have fulfilled the five-year minimum occupation period (MOP).

Since the property market's recovery in the third quarter of 2017, developers have launched seven EC projects, or about two per year, with a total of 4,136 units. That works out to an average of 1,034 units put on the market each year.

The seven projects are Hundred Palms Residences, Rivercove Residences, Piermont Grand, Parc Canberra, Ola, Parc Central Residences and Provence Residence.

SUPPLY BELOW HISTORICAL AVERAGE

At first glance, it may appear that many EC units have been launched in the last four years. However, from the first quarter of 2010 to Q2 2017, there were 22,495 units launched for sale, or an annual average of 2,999 units.

That is nearly triple the current annual EC supply of 1,034 units.

In the pipeline are three more EC projects amounting to an estimated 1,850 units. Located at Yishun Close, Tengah Garden Walk and Tampines Street 62, these three projects can be launched for sale after they pass their 15-month waiting periods in, respectively, February 2022, September 2022 and November 2022.

Parc Greenwich, along Fernvale Lane, was launched on Sept 11, 2021. It was the first EC launch in District 28 in eight years and the only EC launch in the second half of 2021.

RISING AFFLUENCE, HDB UPGRADERS DRIVING DEMAND

Demand for ECs has been robust, with projects typically selling at least 30 per cent of their units at the launch. The sale volume could have been higher if not for the fact that the number of units set aside for second timers in the first month of launch is capped at 30 per cent. There is always a spike in sales after the first month.

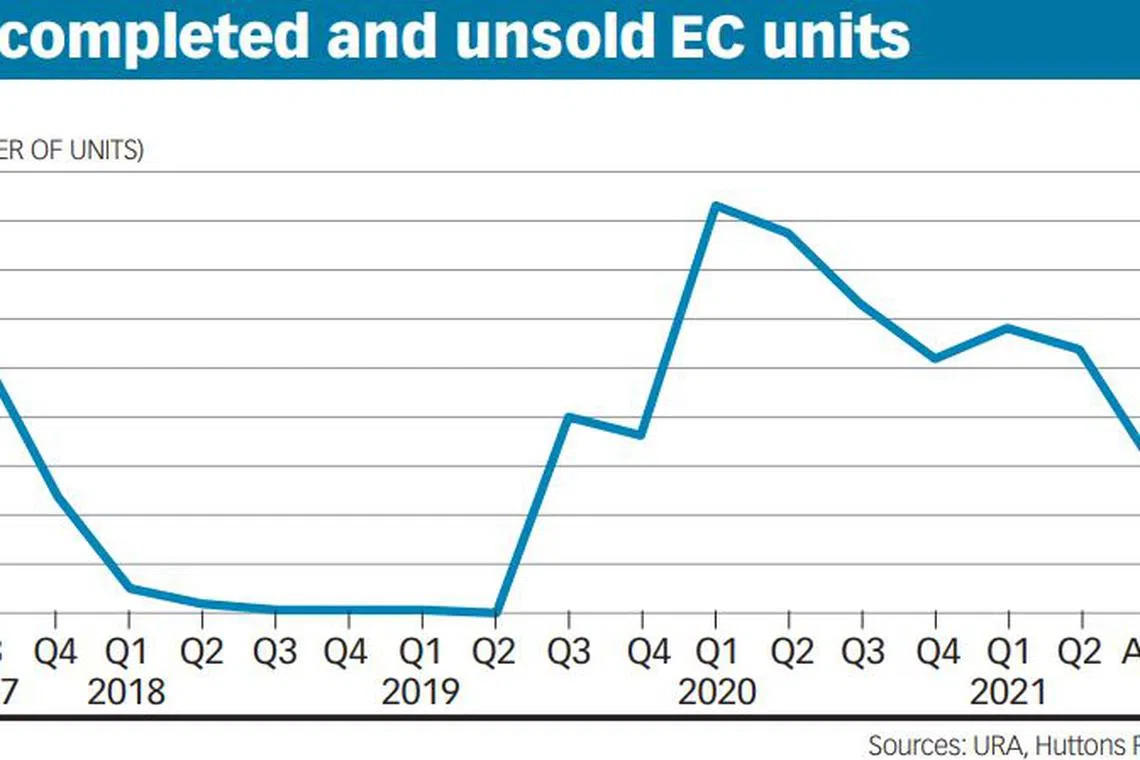

As at Aug 23, 2021, developers had sold more than 90 per cent of the total 4,136 units launched since Q3 2017, leaving an estimated 300 uncompleted EC units unsold. The number of unsold EC units has been trending downwards since Q1 2020.

Reasons for the robust demand for ECs in recent years include the availability of deferred payment schemes, a favourable transition policy, rising affluence among Singaporeans, a larger pool of HDB upgraders, a buoyant HDB resale market, limited choices in the immediate estate, and price gains for resale EC units.

Over the past decade, the number of households earning S$9,000 to S$13,999 per month is estimated to have increased by 50 per cent or 80,000. Rising affluence has partly fuelled the desire to upgrade to an EC environment and lifestyle.

There have also been more flats meeting their five-year MOP recently. About 102,000 three-room and larger flats would reach their MOP in 2021. Many flat owners thus put their newly MOP-ed flats up for sale and joined the growing pool of upgraders.

Meanwhile, the HDB resale market bottomed out in Q2 2019. If the current trend continues, transaction volumes of HDB resale flats may reach 27,000 to 29,000 units this year, the highest since 2010. HDB resale prices may rise up to 8 per cent in 2021, the strongest growth since 2011, giving owners even more reasons to upgrade.

Besides, the seven EC project launches since Q3 2017 were in estates with hardly any private residential launches. For HDB upgraders who wish to stay in their current estates, and with private residential options almost non-existent, ECs are the apparent choice.

In the resale market, EC units have recorded steady price gains of 52.3 per cent from 2010 to H1 2021, demonstrating their value as an asset that appreciates over time. Esparina Residences, launched in Q4 2010 at an average price of S$749 per square foot (psf), was transacting at S$1,160 psf in H1 2021, up 54.9 per cent.

In fact, all EC projects have seen price appreciations, and unit owners were able to reap gains in as short as five years.

BRIGHT OUTLOOK

The outlook for the EC market is positive for H2 2021 and 2022. Part of the reason is that there will be a huge pool of HDB upgraders due to the sheer volume of flats that have passed the five-year MOP. Flat owners may be keen to tap on the buoyant HDB resale market and upgrade.

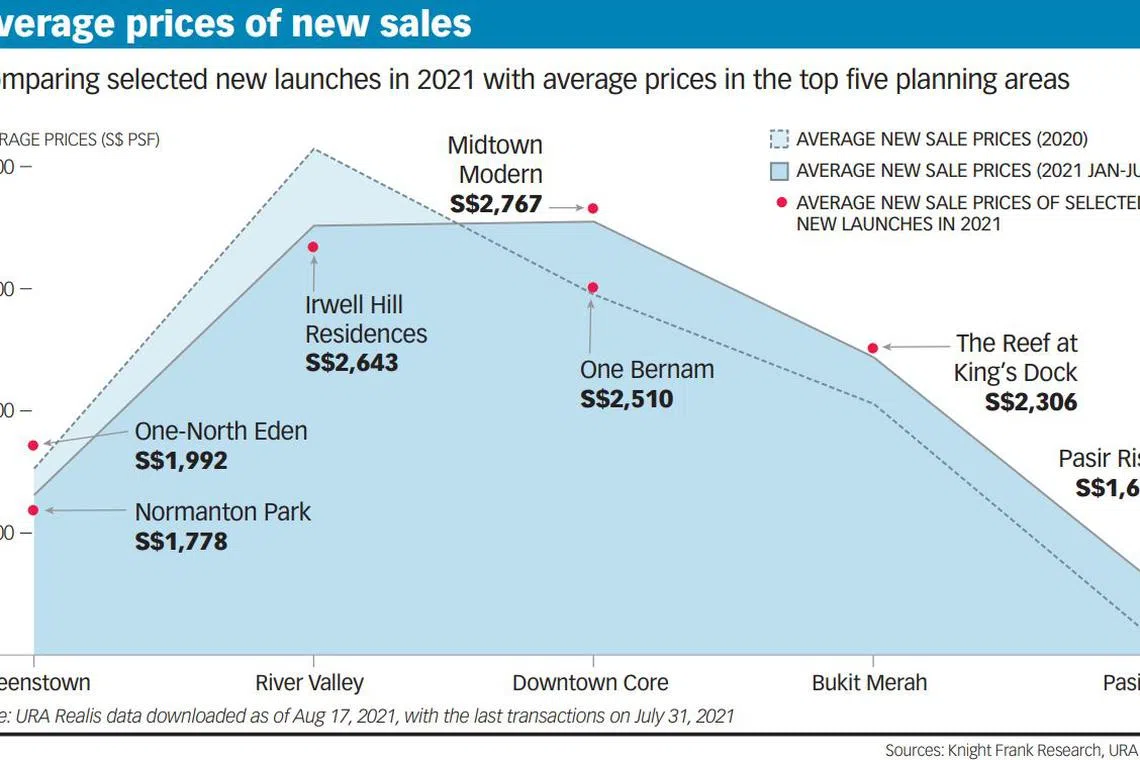

Besides, recent land bids for mass-market condominium projects have been similar to the selling prices of current EC projects in the market. With prices of mass-market condominium units potentially reaching S$2,000 psf in 2022, the value proposition of new EC projects would only get stronger.

The land supply for EC projects under the H2 government land sales programme is below the historical average. Moving forward, just one EC launch may take place every six months, limiting options for buyers.

- The writer is senior director (research) at Huttons Asia.

READ MORE:

- Frasers Property's Parc Greenwich sells 65% of units at launch weekend

- Parc Greenwich EC another test of OCR demand

- Pasir Ris 8's multiple price hikes of up to S$2,000 psf may raise expectations for suburban condo pricing

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.