Is the double-digit growth of HDB resale flat prices sustainable?

It's not, in the long run; a sustainable growth rate for resale prices of public housing should be at most 2 to 3 per cent above inflation, in line with the economy and income growth.

THE HDB resale market defied odds and embarked on a remarkable recovery in spite of the pandemic and economic downturn. Based on the second quarter of 2021 statistics from the Housing and Development Board, resale flat prices rose nearly 11 per cent from the year-ago period.

The double-digit year-on-year growth has not been witnessed since the 2010-2011 period, when prices increased annually by 10 to 13 per cent. Resale flat prices are now about 2 per cent below the peak in Q2 2013.

We believe the momentum was driven largely by the housing market's demand-supply dynamics and boosted by the economic recovery starting from end-2020. Overall housing demand was supported by ample liquidity and low interest rates.

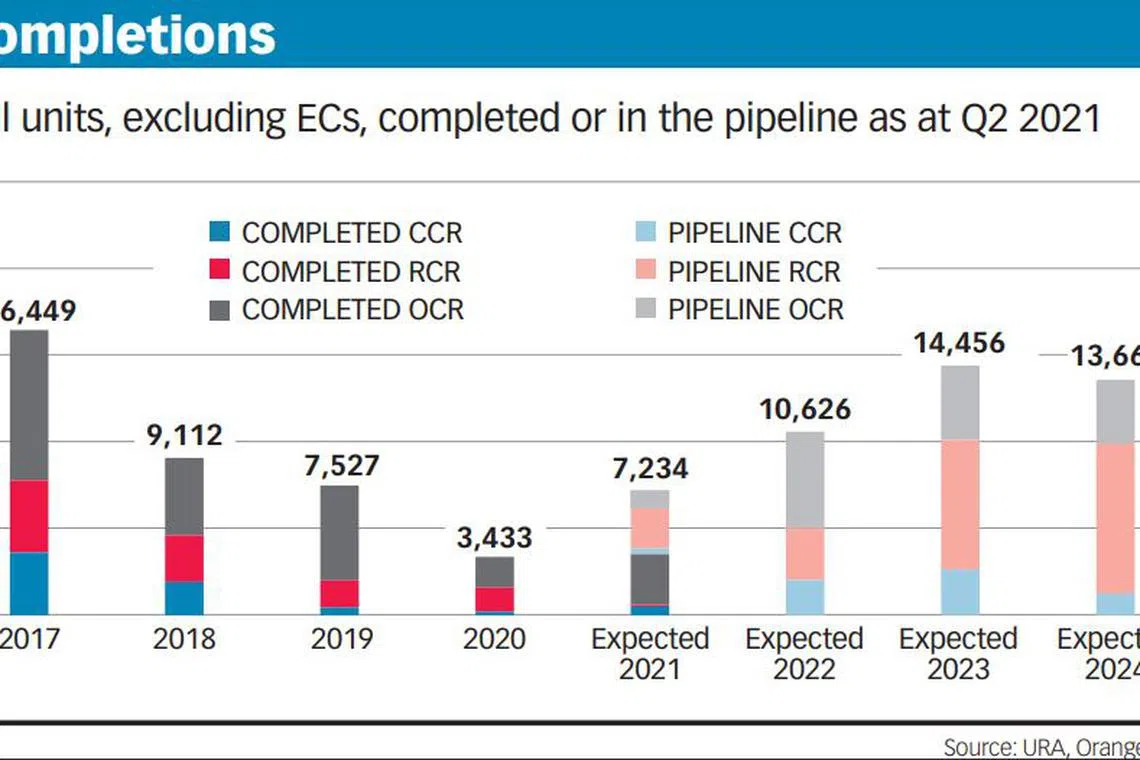

On top of these, demand for HDB resale flats in particular has been buoyed by first-time homebuyers facing long waiting times for Build-To-Order (BTO) projects, exacerbated by construction delays. Demand from these buyers was further fuelled by generous resale grants of up to S$160,000.

There were also a number of buyers purchasing resale flats due to other pandemic-fuelled motivations. More HDB occupiers have been upsizing to homes with bigger floor areas, to facilitate work-from-home arrangements. While these larger HDB flats have higher price quantums, they are more affordable than upgrading to a private apartment of the same size.

Some buyers downsized their homes due to financial hardships as a result of the economic downturn. However, this group of "downgraders" has been thinning out, given the improving economy.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Current supply conditions also played a significant part in driving resale flats' price growth. Higher demand coupled with the limited pool of flats available for sale led to demand outstripping supply, as seen from the increasing number of cash-over-valuation (COV) transactions this year.

On top of that, the bulk of the supply were flats which attained their five-year minimum occupation period (MOP) this year. These younger flats come with longer remaining leases and are typically in newer condition, thus fetching higher prices and contributing to the rising resale price trend. A bumper crop of flats will reach their MOP soon, estimated to be over 25,500 units in 2021 and 31,300 units in 2022.

PRICE TRENDS IN THE LAST DECADE

Based on resale transactions over the last 10 years, prices of HDB flats in both mature and non-mature estates have increased by at least 15 per cent since 2011.

However, much of this growth was due to the strong price recovery that began in the second half of 2020. Prior to that, HDB resale prices were in the doldrums, with the lull period starting in 2013.

Resale transaction data as at Aug 27, 2021 showed resale flat prices averaging S$528 per square foot (psf) in mature estates, up 15.4 per cent from 2011's levels. In non-mature estates, the average price was S$439 psf, up 15.6 per cent from a decade ago.

This year, a handful of non-mature estates have achieved resale flat prices similar to those in mature estates. For instance, Punggol's average hit S$488 psf, close to the S$484 psf in Serangoon, a mature estate.

The narrowing gap in price premiums between mature and non-mature estates can be attributed to the latter's improved connectivity and better-quality infrastructure.

Another reason is the decaying leases of older flats in mature towns, which contributed to downward pressure on their resale prices.

Ranking the 26 HDB towns by their 10-year price growth rates, we found that flats in the Central Area took the top spot, with resale prices climbing 32.4 per cent since 2011. Among the non-mature estates, Choa Chu Kang posted the fastest growth in resale prices, rising 18.9 per cent.

In terms of price appreciation from 2020 to 2021 year-to-date, the same two estates experienced the biggest increases. Resale flats in the Central Area became 12.4 per cent more expensive, while those in Choa Chu Kang saw prices surging by 18.4 per cent from last year.

MILLION-DOLLAR TRANSACTIONS

Besides the escalating resale prices, other key trends have gained traction in the HDB resale market over the past year, with one of them being the rise in million-dollar deals.

There have been 147 million-dollar HDB resale transactions this year, as at Aug 27, exceeding previous years' records. In 2020, there were 82 such deals, which likewise surpassed the 64 in 2019.

Several of these transactions involved rarer flat types. For instance, a handful of Design, Build and Sell Scheme (DBSS) flats in Bishan were sold at record-setting prices, with the highest reportedly reaching S$1.295 million. Most of these million-dollar properties also tend to be bigger HDB flat types in mature estates - attributes that are highly valued by buyers.

Although the growing occurrence of such deals may signal rising flat prices and their price appreciation potential, buyers should not be alarmed, as these represent less than one per cent of total transactions.

CASH-OVER-VALUATION

More buyers have paid COV over the past year. COV occurs when a resale flat is sold above its actual HDB valuation, and the difference must be paid for in cash. COV transactions tend to occur in a seller's market, when demand exceeds supply.

One in three resale flat buyers paid COV this year, a bigger proportion than last year's one in five, the Ministry of National Development (MND) said in early July 2021. Still, the current proportion of buyers who paid COV remains lower than during the 2010-2013 peak period, MND noted.

Prospective buyers looking to purchase a resale flat are advised to exercise prudence and avoid overbidding for a flat beyond their budget.

IS THIS SUSTAINABLE?

While a thriving property market points to healthy macroeconomic fundamentals and housing demand, a double-digit growth rate in prices is not sustainable in the long run.

This is because the intended purpose of HDB flats is to provide homes for the masses, rather than serve as an investment product. HDB flats ought to remain the most affordable form of housing, to cater to the younger generation and the middle-lower income groups.

Based on a simulation of a double-digit growth for resale prices over the next decade, price tags of four-room and five-room flats are likely to run above S$1 million by 2030. This will mean most of these flats will exceed many homebuyers' budgets.

In our view, a sustainable growth rate for resale prices of public housing should be at most 2 to 3 per cent above inflation, in line with the economy and income growth.

If the current uptrend persists, it will neither be sustainable in the long term nor beneficial to society.

- The writer is CEO of PropNex Realty.

READ MORE:

- Dwindling options for EC buyers in H2 2021, 2022

- HDB resale prices rise in August to just 0.1% below peak; record high of 26 million-dollar flats sold: SRX

- Price premium of HDB resale flats in mature estates may shrink further

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.