Good Class Bungalows - major value uplift in the works?

Given the unique nature of this type of housing, the trend of 'outlier' transactions may expand in scale as Singapore continues to attract talent and businesses in the new economy.

THE Good Class Bungalow (GCB) market has heated up with record-breaking prices since early April. But even though average prices have been rising, they are not climbing at an astounding rate.

In our view, there are hints of a new trend emerging - one that occurs only once every generation.

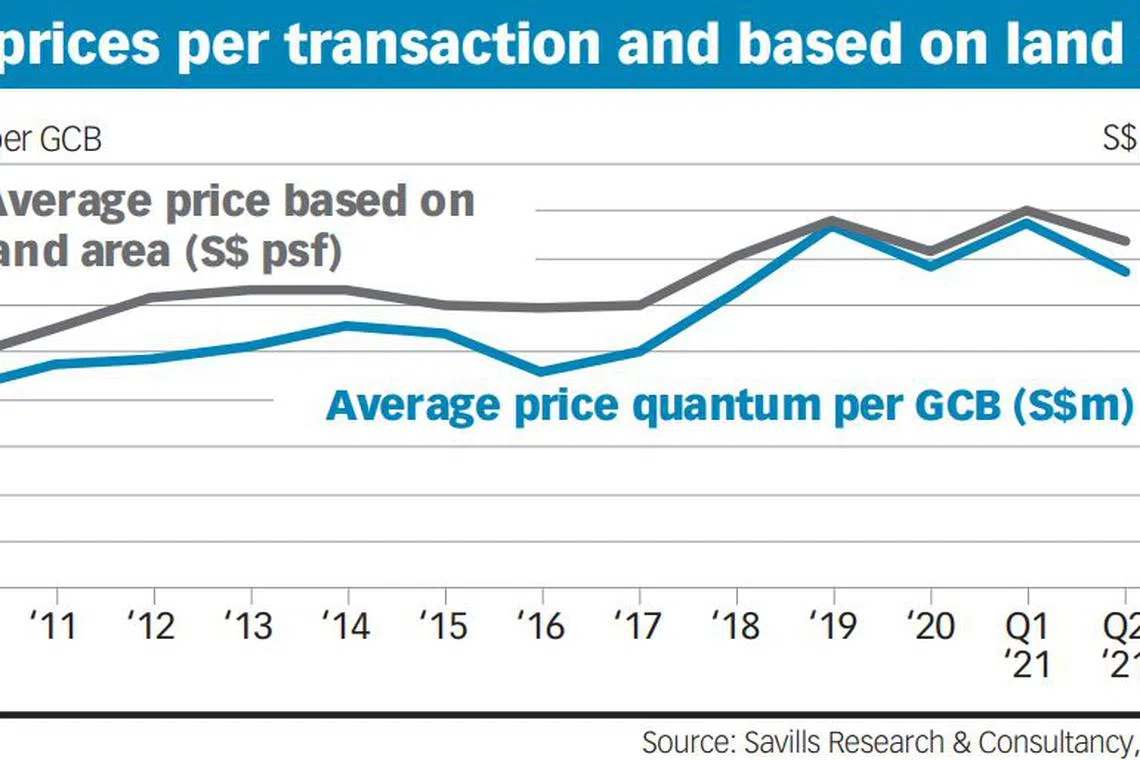

Over the last 10.5 years, the average price of GCB transactions each year has been rising almost in tandem with the average per-square-foot (psf) price based on land area.

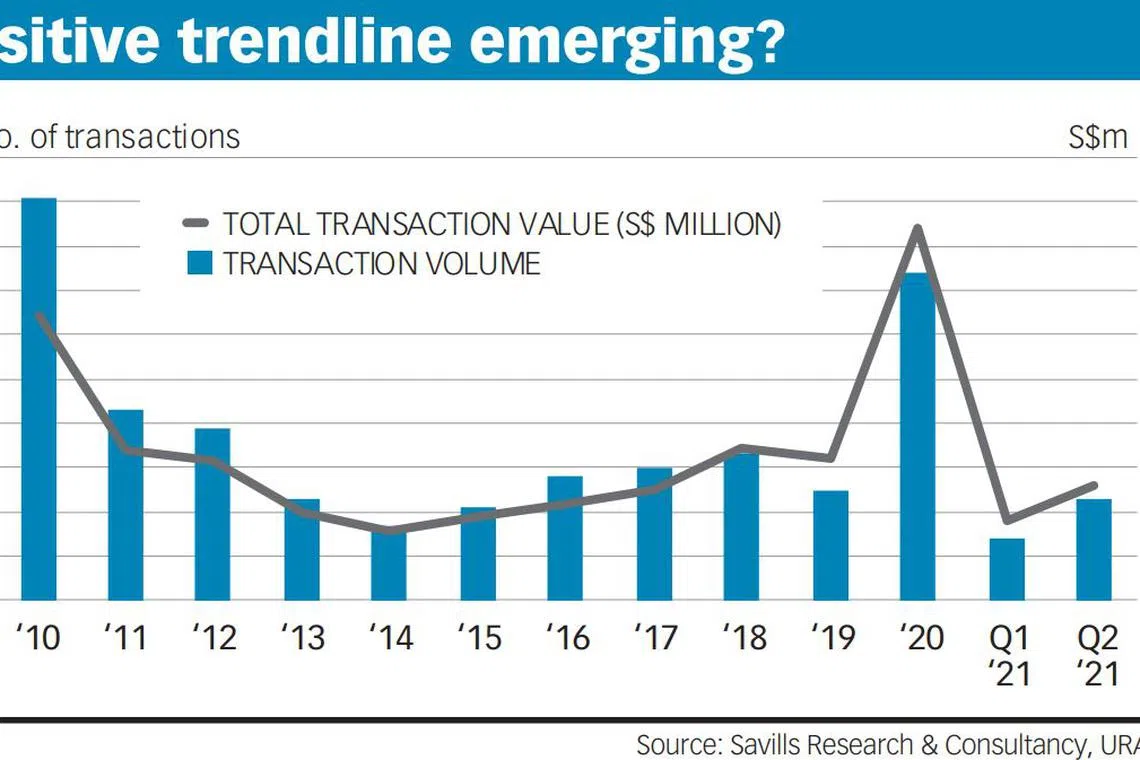

Meanwhile, the number of GCB transactions has yet to rebound to 2010 levels. The deal volume has been languishing at fewer than half those numbers for the most of the past decade.

It was only in 2020 that we saw a positive trendline potentially emerging. With 2021's full-year numbers, the upward momentum may possibly continue, or at least match last year's levels.

For the first half of 2021, there were 37 transactions captured in the URA Realis database. If we simply doubled this to extrapolate to a full-year number of 74, that would be the same as 2020's total.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The sudden reawakening of the GCB market (as well as the entire private residential market) in a pandemic and the accompanying economic slowdown point to a nascent trend that is developing.

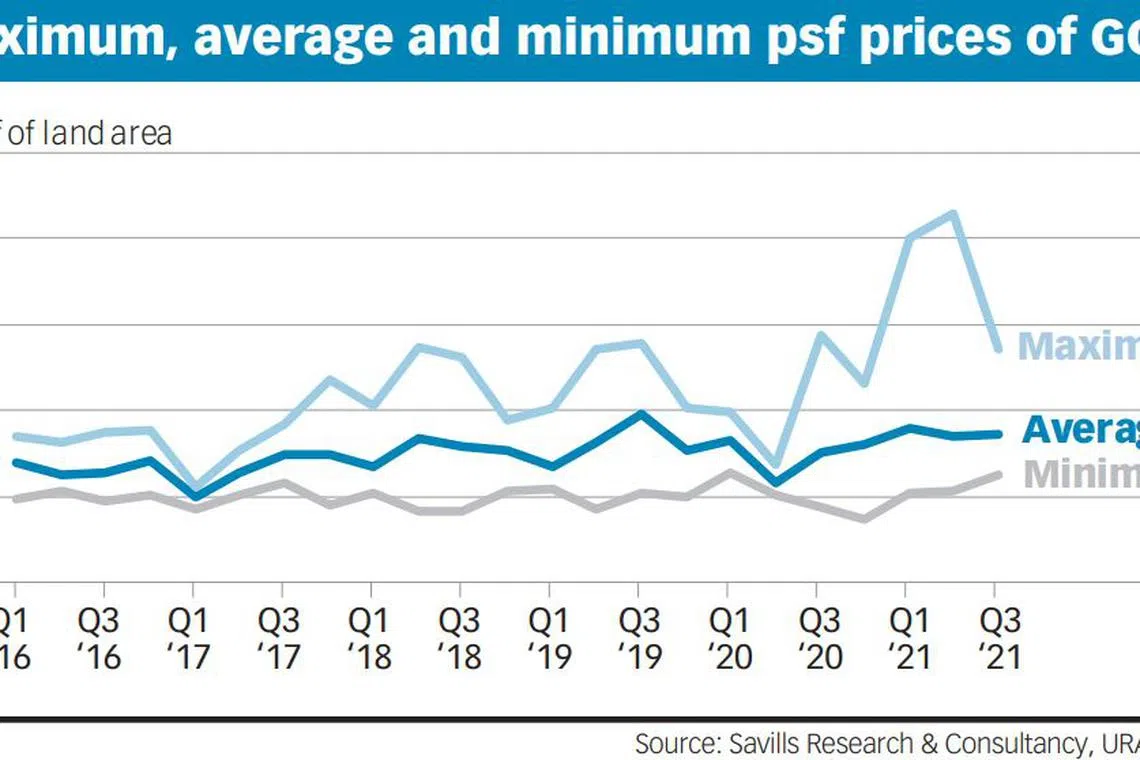

In the last five years and three quarters, although the compound annual growth rate (CAGR) for GCB psf prices based on land area was 7.1 per cent (versus URA's private residential property price index's 3.2 per cent), the rate of increase was not uniform across the spectrum of transactions.

The CAGR was 4.9 per cent for the minimum price and 10.5 per cent for the maximum price, from 2016 to H1 2021. The dispersion of prices has also increased over this period.

Besides, the distribution of transacted prices does not appear normal nor uniform. In H1 2021, the right-tailed "outliers", both in terms of overall quantum and psf price, are far from the general cluster of observed prices.

We believe these "outlier" deals may in fact be indicative of an upcoming step-up in values in this segment of the private residential market, based on anecdotal evidence about the buyers' motivations.

Empirically, we can also get a whiff of this incipient trend. The number of GCB transactions started to reawaken only in 2020, after a 10-year slumber, while the average deal price shifted gears in 2019 due to the record S$230 million price tag in a sale by Wing Tai's chairman.

Recent transactions that made headlines have also increasingly involved buyers who made their fortunes in the new economy (technology and Internet-related industries).

Essentially, the "outlier" GCB transactions in the right tail of the price spectrum may not be mere flashes in the pan.

As the new economy grows in size to rival or even supersede traditional industries, an additional layer of economic structure is created, and with this, comes new wealth.

New wealth creation is quite unlike old wealth. New-economy companies boast astronomical valuations that are several times those of old-economy firms.

Also, successful new-economy entrepreneurs tend to be much younger and therefore more likely to embrace the "you only live once" (YOLO) mentality.

All these may be translated into the GCB market, where fresh records are expected to be set more frequently for transaction prices, be it in absolute quantum terms or on a psf basis.

FUTURE TRENDS

GCBs remain the most coveted type of housing for the highest echelon of society. They are exclusive to Singapore citizens, and every bungalow is unique in terms of site attributes, location or other characteristics.

Given this nature, the trend of "outlier" transactions may expand in scale as Singapore continues to attract talent and businesses in the new economy.

Based on feedback on the ground, there is continued interest from new citizens for the best addresses, with the Singapore Botanic Gardens as the pivotal landmark.

Another group of buyers would be the next-generation scions of the economically active "old rich". To them, purchasing a GCB is seen as a method of wealth preservation.

As GCB values continue to push new benchmarks, there could be a downstream effect on the detached housing market, where the price quantum tends to be lower due to the smaller size of the properties.

Come 2025, the number of millionaires in Singapore could increase 61.9 per cent from 2020 levels, Credit Suisse's Global Wealth Report 2021 estimated.

Using that as a proxy for the number of ultra high-net-worth individuals in Singapore who can afford GCBs, the demand for this residential real estate segment is expected to surge in tandem, amid limited supply.

GCB prices look set to soar to a higher cruising altitude, and as things stand, we could be in the early stages of the engines powering up.

- Alan Cheong is executive director of research and consultancy, and Galven Tan is deputy managing director of investment sales and capital markets at Savills Singapore.

READ MORE:

- The enduring charm of landed homes

- The changing profile of the Good Class Bungalow market

- Entrepreneurs riding digital economy boom snap up bungalows in Singapore

- Good Class Bungalows on a roll - H1 deals soar to S$1.4 billion

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.