The enduring charm of landed homes

The perennial interest in these coveted assets and their limited future supply ensure they will maintain a lasting appeal among those who can afford them.

THERE were 73,263 completed landed homes - including detached, semi-detached and terrace houses - in Singapore as at the second quarter of 2021, making up 19.3 per cent of the private housing stock and just 5.1 per cent of total housing stock. The limited availability and enduring charm of landed homes has made them a coveted asset among residential property types.

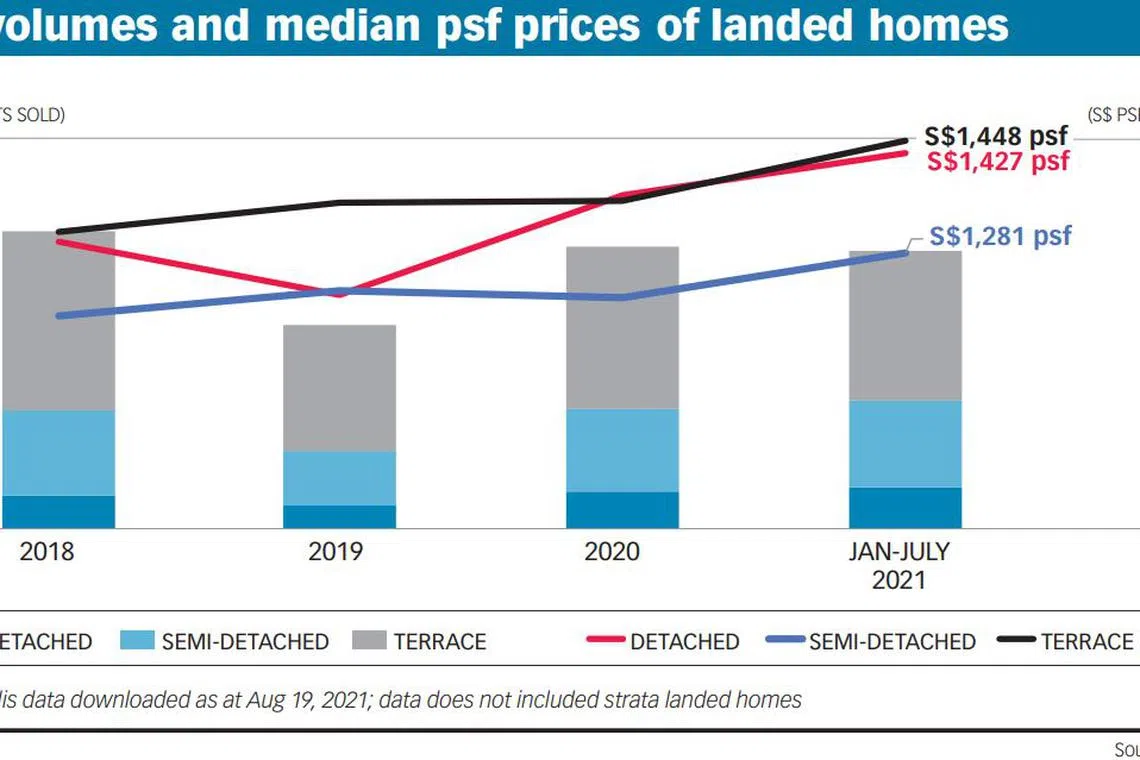

Similar to the broader housing market, the landed segment was affected by cooling measures introduced in July 2018. Sales were also hampered by sellers' high price expectations, which potential buyers could not match. The landed segment further weakened in 2019 as Singapore's economy was hit by the US-China trade war.

With their larger living spaces, landed homes became more appealing to buyers last year as people spent more time at home for work, study and family recreation, due to the pandemic. This contributed to the 38 per cent surge in sales volume to 1,805 in 2020, from 1,304 in 2019.

The strong sales momentum continued this year, with 1,779 landed homes changing hands in the first seven months. In particular, the number of detached and semi-detached houses sold in January-July 2021 has already exceeded 2020's total. At this rate, we can expect more than 2,000 landed homes to be transacted by year-end, the highest since 2012, signalling a renaissance for the segment.

Based on prices per square foot (psf) of land area, the three types of landed properties have charted a general uptrend from 2018 to July 2021. Semi-detached houses clocked the biggest gain of 10.5 per cent in that period to reach S$1,281 psf. Prices grew 9.7 per cent to S$1,448 psf for terrace houses, and 9.6 per cent to S$1,427 psf for detached houses.

Geographically, the landed segment's performance differs by district. Transaction data from 2018 to July 2021 showed the highest sales volumes in Districts 19, 15, 28, 16, 10 and 20. The 4,158 homes sold in these six districts made up 61 per cent of the total 6,797 transactions island-wide. Unsurprisingly, these are also the districts with the highest concentration of landed housing.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Supported by robust sales, the prices of landed homes in the top six districts showed a healthy compound annual growth rate (CAGR) from 2018 to July 2021. District 20 led the pack with a 3.1 per cent CAGR.

District 16's prices grew by a smaller 1 per cent, likely because this location is farthest away from the city, relative to the other districts.

Another reason for the popularity of the top six districts is that they are established housing estates with popular primary schools, malls, and entertainment and lifestyle options. Except for Districts 15 and 28, the other four are served by several MRT lines, enhancing their connectivity.

As these districts are either within or surrounded by HDB estates, there is a constant pool of families upgrading to landed homes in the same neighbourhood. Some demand also came from those who sold their units in the 2017-2018 collective sales.

Districts 8, 12, 9, 4, 25 and 18 each had fewer than 100 transactions of landed homes from 2018 to July 2021. This stemmed from the low stock of just 2,623 landed homes in total in these six districts.

In District 8, the negative CAGR of 16.1 per cent in prices was an anomaly, as only two terrace houses were sold in 2018 with a high median of S$2,176 psf, and another two were sold in January-July 2021 at a low median of S$1,158 psf.

District 12's strong CAGR of 4.5 per cent could be attributed to the limited availability of landed homes for sale. The 2.2 per cent CAGR in District 4 was supported mainly by the sale of high-end villas in Sentosa Cove.

Districts 25 and 18 were less appealing to buyers due to the distance from the city centre, although their median prices, being below S$1,000 psf, suggests room for future growth.

Conservation houses at Emerald Hill and Cairnhill made up nearly half of the 40 transactions in District 9. Buyers forked out a premium for these rare and prized assets, supporting the strong CAGR of 8.9 per cent.

POTENTIAL LANDED HOTSPOTS

The Thomson-East Coast Line (TEL) Stage 2 opened on Aug 28, comprising the Springleaf, Lentor, Mayflower, Bright Hill, Upper Thomson and Caldecott stations. TEL will also be connected to two other MRT lines. This improves the connectivity of landed estates at Sembawang, Upper Thomson, Lentor, Ang Mo Kio and Thomson, which will draw buyers.

TEL's next three stages will open between 2022 and 2025, spanning 23 stations from Mount Pleasant to Sungei Bedok, passing through Downtown and Districts 9, 10, 15 and 16. Potential buyers will be keen on the landed homes in these locations.

Meanwhile, developers have been eyeing collective-sale sites. This year, there have been a few en-bloc sales of smaller residential developments, such as Lew Mansion, Surrey Point, Ji Liang Gardens and Woo Mon Chew Court. These deals affected fewer than 50 households in total.

If larger sites in Districts 10, 15, 19 and 20 are sold en bloc, they will release a significant number of households seeking landed homes in the same neighbourhoods. Those districts could then become hotspots for landed housing sales.

New projects may also drive landed home prices higher, amid the current property upcycle. On the cards are Belgravia Ace, with 104 semi-detached and three terrace houses, as well as Pollen Collection, with four semi-detached and 128 terrace houses. Both projects are located in District 28 and could be launched before end-2021.

These properties are likely to be priced higher than recent sales at Luxus Hills, where new terrace houses fetched S$3.2 million to S$3.5 million while semi-detached houses were sold at about S$4.2 million.

Also, the project on the site of Mediacorp's former Broadcast Centre - within the Caldecott Good Class Bungalow Area - will set the price level of new bungalows in that district.

Given the perennial interest in landed homes and as Singapore learns to live with an endemic Covid-19, bigger households and multi-generational families will look to upgrade from apartments to landed homes, while the more affluent will look for larger houses.

As the future supply of landed homes stays limited, such properties will maintain a lasting appeal among those who can afford them.

- Han Huan Mei is research director, and Cheong Choon Ghee is senior associate vice-president at List Sotheby's International Realty.

READ MORE:

- Good Class Bungalows - major value uplift in the works?

- Do landed homes trump condos as investments?

- Demand for Sentosa Cove bungalows mirrors buzz in luxury housing market

- Mediacorp sells Caldecott Hill site for S$280.9m

- Price surge stokes en bloc hopes, but expectations gap a hurdle

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.