Several Singaporeans hold key roles at Cambodian firm in global scam ring; Temasek denies links

As the US probes an alleged scam network, the spotlight falls on tycoon Chen Zhi and his Prince Holding Group’s Singapore links

[SINGAPORE] Prince Holding Group – accused by the US authorities of running scam compounds in Cambodia – counts several Singaporeans among its top executives, and had previously engaged Temasek-owned consultancy Surbana Jurong (SJ Group) for a US$16 billion coastal development project in the kingdom.

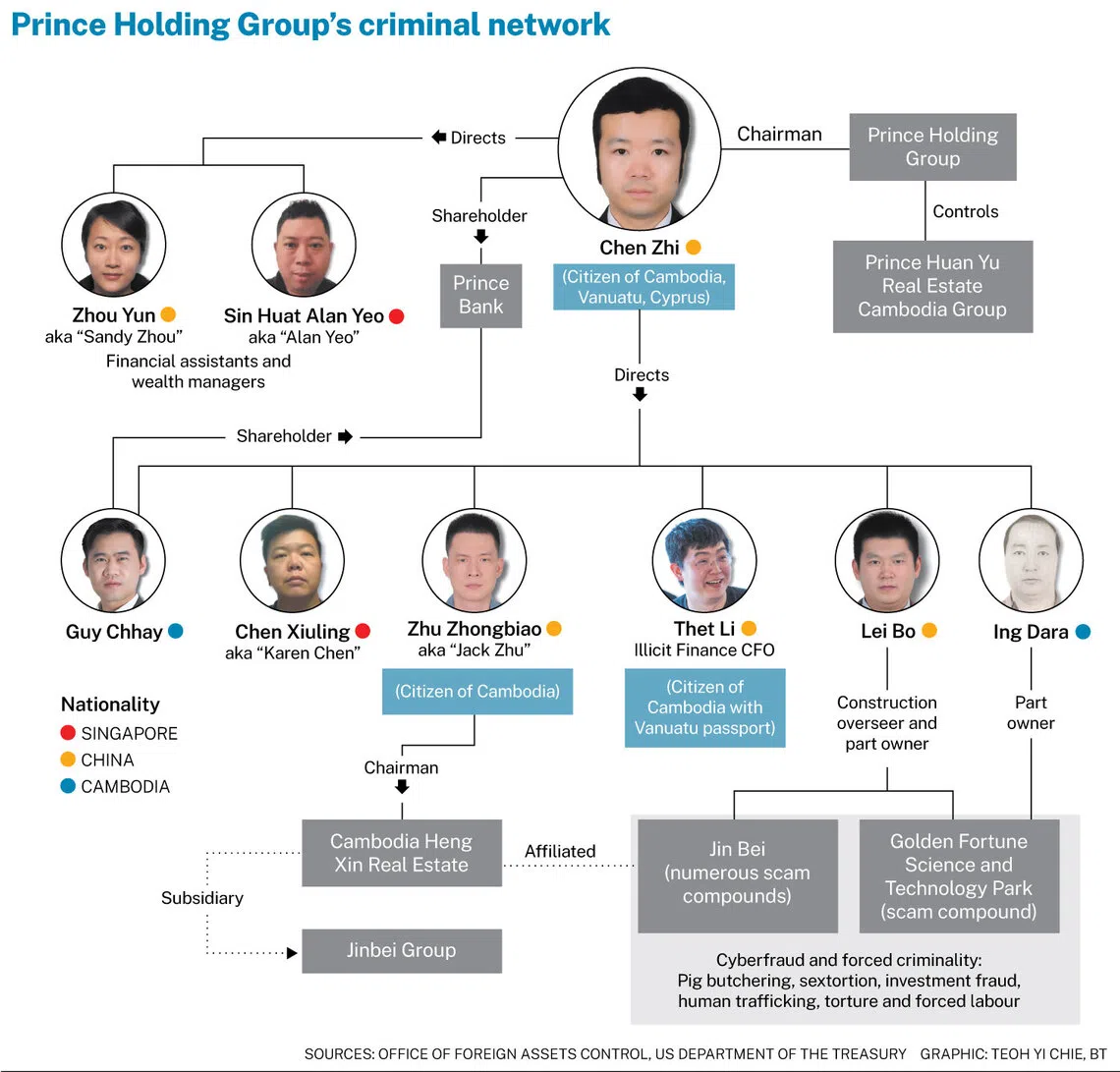

Prince Holding’s founder, Cambodian citizen Chen Zhi, was charged in New York on Tuesday (Oct 14) with wire fraud and money laundering conspiracies. The US authorities allege that he led the conglomerate’s operation of forced-labour scam compounds in Cambodia as part of a vast transnational criminal network.

Fujian-born Chen Zhi was described as the mastermind of “one of Asia’s largest transnational criminal organisations”, with three accused Singaporean co-conspirators and a web of sanctioned companies registered to the same Bukit Merah address.

The Business Times reported in 2017 that Chen Zhi is believed to have bought a S$17 million penthouse at Gramercy Park condo in Grange Road.

The Singapore connection to the multinational conglomerate appears to run deeper.

Among those in senior management is Singaporean Edward Lee, chief executive of its property arm Prince Real Estate Group, according to Prince Holding’s website.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

When BT checked Lee’s LinkedIn profile on Friday morning, it listed him as being chief executive of Kingsmen Real Estate (Cambodia) Group since December 2021. This detail has since been removed from his profile.

Lee also identifies himself as secretary of the Singapore Business Investment Forum, an organisation that says it provides support for Singaporean businesses and investors in Cambodia.

The other Singaporean on Prince Holding’s management team is chief communications officer Gabriel Tan, who joined the group in 2021. He also heads its philanthropic arm, Prince Foundation, according to his LinkedIn profile and an interview he gave to media intelligence platform Telum Media.

SEE ALSO

Tan’s profile shows the communications veteran held roles in local investor relations firm Financial PR; advertising, marketing and public relations agency Ogilvy; as well as Cambodia’s NagaCorp, a Hong Kong-listed hotel, gambling and leisure operator.

Both Lee and Tan, along with Chen Zhi, Prince Bank chairman Honn Sorachna, and Prince Holding chief financial officer Michael Chiam, were named in a Bill proposed in the US Congress on Sep 18, according to the US Congress website.

The draft legislation seeks to establish an interagency task force to combat foreign scam syndicates, and includes a list of foreign individuals who could potentially face sanctions. The Bill, the recommendations of which have not been debated, has not yet been passed.

Cambodian mega project

Temasek clarified that SJ Group had undertaken a master planning assignment for Canopy Sands, a subsidiary of Prince Holding, which ended in 2022.

“(SJ Group) had no ownership or operational role, and has no ongoing projects with Prince Holding Group or its entities,” said Temasek in a statement on Friday.

Canopy Sands is now also a target of the latest US sanctions.

It was previously reported that SJ Group was engaged by Canopy Sands in 2021 to provide master planning, urban design and coastal engineering services for a coastal development in Sihanoukville, Cambodia.

The 934-hectare project, known as Bay of Lights (previously Ream City), is nearly three times the size of Singapore’s Marina Bay; amenities such as business and financial centres, malls, hotels, a beach club with cabin resorts, a go-kart circuit, a golf course and a national sailing centre have been planned for it.

The project, which sits on reclaimed land, has drawn controversy over environmental concerns, alleged displacement of local communities and its ties to Prince Holding.

When BT contacted Canopy Sands and Prince Holding in March 2024 for updates on the project, Adrian Chen, business development director of Belt Road Capital Management (BRCM), said the initial land and infrastructure activation phase was scheduled for completion by 2025, with subsequent phases extending to 2045.

BRCM is another Prince Holding subsidiary under US sanctions.

Adrian Chen said Surbana Jurong’s involvement “was crucial in the initial stages”, and added that its “foundational contributions remain embedded in the DNA of our project”.

He also noted that the project adopted a majority of Surbana Jurong’s master planning concepts, which were later refreshed to “better adapt to local needs and integrate global best practices tailored for Cambodia”.

Canopy Sands last year also appointed The Ascott, the wholly owned lodging business unit of Temasek-backed CapitaLand Investment, to provide hospitality management services for two of its hotels.

Temasek clarified that Ascott holds no ownership stake in the properties and described as “misleading” a Bloomberg report suggesting that Chen Zhi was building relationships with firms backed by the Singapore investment company.

“We would like to iterate that Temasek has no relationship with Prince Holding Group or any of its subsidiaries,” it said.

In response to queries from BT, Surbana Jurong said the master planning assignment ended in 2022, without any ownership or operational role. It added that it has no ongoing projects with Prince Holding or its entities.

Who is Singapore’s Karen Chen?

The US’ recent financial fraud crackdown is being described as one of the largest in history, after the authorities moved to sanction individuals and entities linked to Chen Zhi, his associates and Prince Holding.

Also named on the list is Chen Xiuling – a Singaporean known as Karen Chen – who was on Tuesday sanctioned by the US for her alleged ties to Prince Holding.

The US authorities allege that the 43-year-old oversees the group’s companies in Mauritius, Taiwan and Singapore; she is listed in corporate filings as the ultimate owner of several entities controlled by the group.

A check by BT on Handshakes revealed that more than 20 companies – which name her as a director, secretary or both – share the same registered address on the eighth floor of a building in Jalan Kilang Barat in Bukit Merah.

Also registered in the same building, on the seventh floor, is Capital Zone Warehousing, a storage solutions provider for luxury collectibles, whose head of operations is Nigel Tang Wan Bao Nabil – the second Singaporean sanctioned by the US authorities.

When BT visited the premises on Thursday, there was no response at either the front or back entrance of Capital Zone Warehousing. Macallan whisky bottles and Cohiba Behike cigar boxes were displayed outside the doorway.

The eighth floor was occupied by 8 at Barat, described on Capital Zone Warehousing’s social media as its luxury co-working brand.

At least two women were seen inside. When BT knocked on the door, the occupants moved out of sight behind a kitchen island in the pantry.

Two personnel who identified themselves as building maintenance staff later told BT that the seventh and eighth floors belong to the same company.

A Monetary Authority of Singapore spokesperson said: “We are looking into whether there have been any breaches of MAS’ requirements in relation to this case.”

BT has reached out to Chen Xiuling, Edward Lee, Gabriel Tan, Michael Chiam, Capital Zone Warehousing and others for comment.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.