Vietnam puts 1,200-hectare, two-city International Financial Centre into operation

Hanoi introduces sweeping frameworks that include Common Law elements, 10-year residency for foreign experts, and 30-year tax incentives

[HO CHI MINH CITY] Vietnam has formally launched its two-city International Financial Centre, marking one of the most ambitious initiatives in its four-decade reform era as it seeks to attract global capital and challenge established Asian financial hubs.

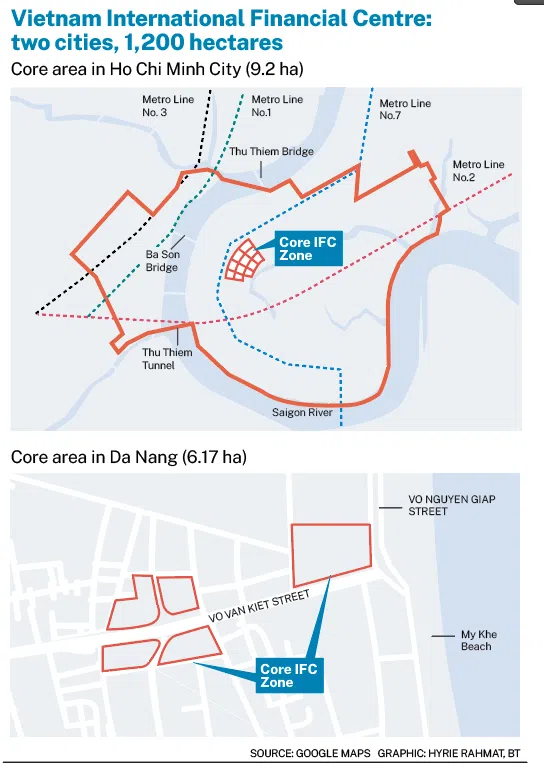

The Vietnam International Financial Centre, or VIFC, spans about 1,200 hectares (ha) across Ho Chi Minh City – the country’s economic engine – and Da Nang, a coastal city roughly 925 km away.

In December alone, Hanoi approved eight guiding decrees and a dedicated law governing the centre, covering everything from tax incentives, land use and residence policies to the potential application of Common Law principles and the deployment of foreign judges in a specialised court.

The government has also established the VIFC’s governing council, chaired by Permanent Deputy Prime Minister Nguyen Hoa Binh, alongside separate executive bodies in Ho Chi Minh City and Da Nang.

“This move signals a bold shift in the country’s 40-year reform journey, aiming to transition the government’s role towards a ‘creation and service’ mindset designed to attract global capital,” said Do Cong Nguyen, Vietnam country manager at Altios, an international business consultancy headquartered in France.

Two cities, two strategies

Under the dual-city model, the VIFC is designed to balance scale and innovation.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

In Ho Chi Minh City, the financial centre is concentrated in a single zone spanning nearly 900 ha, reinforcing its role as Vietnam’s traditional financial hub for capital markets, corporate finance and asset management.

Truong Minh Huy Vu, director of the Ho Chi Minh City Institute for Development Studies, will serve as chairman of the city’s VIFC executive authority.

Da Nang’s centre, in contrast, sprawls across multiple sites totalling 300 ha; it is positioned as an experimental sandbox for new financial models, including fintech, digital assets, trade finance, innovative lending solutions and specialised exchanges.

SEE ALSO

Its executive authority will be chaired by Ho Ky Minh, permanent vice-chairman of the city’s People’s Committee.

Ho Chi Minh City has also shortlisted potential investors for the initial development phase of its VIFC, including Nasdaq, VinaCapital, MB Bank, Vietcombank, Binance, Tiktok and Viettel.

Meanwhile, Da Nang has announced the first 10 members of its financial hub, including Makara Capital Vietnam Holdings, Bybit Technology Vietnam, and Verichains Solutions.

“Trust” signal to investors

At the core of the initiative is a new law on a specialised court within the VIFC, passed by the National Assembly on Dec 11 and set to take effect on Jan 1, 2026.

The law allows foreign judges to hear cases at the centre, with criteria including English proficiency and at least 10 years’ experience in investment and commercial disputes.

Courts may apply Vietnamese law, foreign law or international commercial customs where transactions involve at least one foreign party, as long as rulings do not violate Vietnam’s public order.

“For the first time, we are seeing the introduction of Common Law elements, English-language trials and foreign judges in a specialised court system,” Nguyen of Altios said. “This sends a powerful ‘trust’ signal to global investors.”

Tran Dinh Minh Long, a lawyer at Hanoi-based law firm Vi Dan, noted the changes also implicitly raise the bar for legal professionals in Vietnam.

“Without English proficiency and an understanding of Common Law, lawyers will not be able to practise comprehensively in the country,” he said.

Generous incentives

The decrees governing the VIFC, which all became effective from Dec 18, provide detailed guidance on how to apply the financial and administrative incentives previously approved in the parliament’s June resolution.

A 24/7 online registration system will be introduced, and the VIFC authority is required to issue IFC membership certificates within five working days.

New projects in prioritised sectors are eligible for a preferential corporate income tax rate of 10 per cent for up to 30 years, tax exemptions of as much as four years, followed by a 50 per cent reduction for up to nine additional years.

Personal income tax will be waived until the end of 2030 for managers, experts and highly skilled professionals working at the centre.

Individuals earning income from transfers of shares or capital contributions in VIFC member entities will be exempt from personal income tax on those gains until the end of 2030.

To attract foreign talent, Vietnam is also offering long-term residency incentives, including visas of up to 10 years for foreign professionals and their family members, as well as expedited processing for labour permits within three days.

These decrees set entry and operating requirements for foreign financial institutions and establish rules on land use, commodity exchanges, arbitration centres and fundraising for VIFC-certified startups through crowdfunding or private placements.

Missing links

Despite the sweeping legal overhaul at the VIFC, Vietnam’s broader financial ecosystem remains relatively shallow, with limited financial instruments and capital markets that lack depth and liquidity.

The country is still rated below investment grade by major credit agencies, capping the borrowing capacity of domestic firms, while its stock market remains classified as a frontier market by global index provider MSCI.

Vietnam lacks investment banking capacity and long-term institutional capital, said Eric Truong, chairman of the Vietnam Investment Council and founder of Robinhood Capital in Ho Chi Minh City.

“Without institutions credible enough to underwrite deals for large foreign investors, international capital would struggle to flow in,” he added.

He also noted that Vietnam’s investor base is still dominated by banks providing short-term funding and retail investors, with few large pension, insurance and private equity funds able to anchor markets with long-duration capital.

The roll-out of new VIFC incentives are expected to draw fresh players into Vietnam’s financial markets, but execution will determine whether the country can truly establish itself as an international hub.

“Ambition only gets Vietnam on the map – flawless execution is what will keep it there,” Nguyen of Altios said. “The eyes of the global financial community are now on how Vietnam will bridge the gap between policy and reality.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.