Struggling natural diamond industry seeks to rediscover sparkle

Lab-grown diamonds account for nearly half of all engagement ring purchases worldwide in 2024

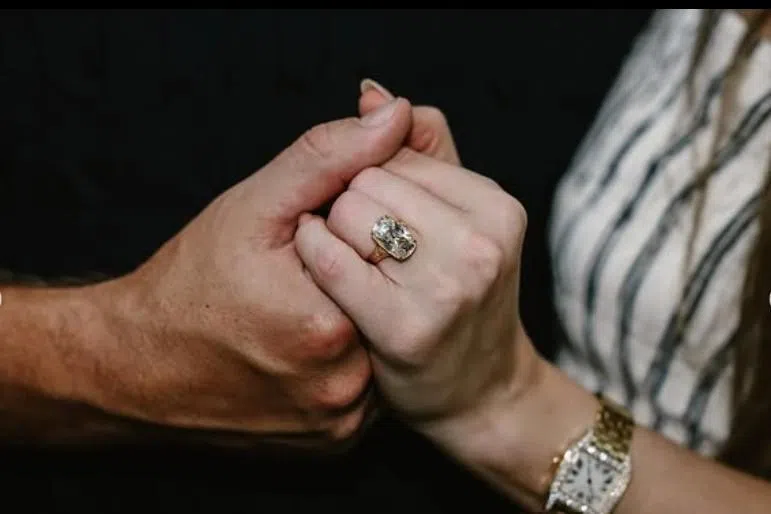

[LONDON] The recent news of American pop star Taylor Swift’s engagement to American professional football player Travis Kelce broke the Internet; also, her diamond engagement ring – valued by some experts to be in the region of US$1 million – could well be the big boost that the struggling global diamond industry needed.

Not long after Swift posted a photo of that stunning ring on her social media platforms, fans quickly noticed the size and uniqueness of the diamond – an antique stone that is somewhere between eight and 10 carats, set on a yellow-gold band.

Al Cook, the chief executive officer of De Beers, a leading diamond miner and producer, weighed in on the diamond on Swift’s ring: “It’s an old-mine cut that’s rarely seen these days.”

De Beers and other major players in the global gems industry are about to launch a marketing blitz in an attempt to boost the sales of natural diamonds.

It is part of a concerted effort to counter the growing popularity of lab-grown diamonds, which have flooded the market in recent years and under-cut the prices of natural diamonds.

Lab-grown diamonds can be produced quickly – within a matter of months or even weeks, in some cases – and are almost identical to natural diamonds in cut, colour, clarity and weight.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Back in 2018, they accounted for just 2 per cent of the US$40 billion diamond jewellery market in the US. That proportion is now as high as 16 per cent, said Edahn Golan, a veteran independent diamond analyst based in Israel.

And, according to jewellery insurer BriteCo, lab-grown diamonds accounted for nearly half of all engagement ring purchases worldwide in 2024, compared to roughly 5 per cent in 2019.

According to analyst Golan, the average prices of lab-grown diamonds have plunged by 74 per cent to around US$850 a carat since their peak five years ago.

In contrast, the average retail prices of natural, mined diamonds have tumbled by 30 per cent but are still priced much higher at US$4,700 a carat.

The price of natural D-flawless diamonds, the highest quality natural gem, have fallen from US$56,500 a carat in 2018 to US$43,750 today. In contrast, lab-grown D-flawless diamonds cost only US$2,500 for the same size and clarity, added Golan.

Big change on the cards

The coming months will likely see a big change for De Beers in terms of its ownership. British mining giant Anglo American wants to divest its 85 per cent stake in De Beers.

The government of Botswana owns the remaining 15 per cent and reportedly wants to raise this by reportedly buying some or even all of De Beers’ stake.

Experts and analysts in the global diamond trade hope that when De Beers is eventually independent, it will be free to embark on more innovative advertising and branding campaigns.

“We will recreate the magic of natural diamonds for modern consumers,” said Cook of De Beers.

His company’s senior executives have already said that promotions are underway ahead of India’s Diwali festival in October, followed by the busy Christmas period and the Chinese New Year celebrations in early-2026.

“The outlook for natural diamonds is compelling,” noted Cook. “Global supply is declining with no new mines discovered in the past decade. Consumers in key regions are becoming more affluent and are increasingly differentiating between natural diamonds and lab-grown ones.”

To counter the slide in demand for natural, mined gems, De Beers was recently part of a consortium of diamond-producing countries and leading players in the diamond industry that signed an accord to spend 1 per cent of their annual diamond revenue on marketing.

In De Beers’ case, it projects sales revenue of around US$3.5 billion this year, so its allocation will be US$35 million. If the other signatories fulfil their promises, the total should exceed US$80 million, analysts said.

Besides helping retailers with diamond advertisements, De Beers will also introduce gem-detection technology that retailers can use to show their customers if a diamond is natural or artificial.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.