Issue 177: Investing in the blue economy

This week in ESG: Mark Dalio lays out a viable pathway to investing in oceans

Ocean financing

Opportunities in oceantech

For something that covers nearly two-thirds of the planet, the oceans get surprisingly little funding.

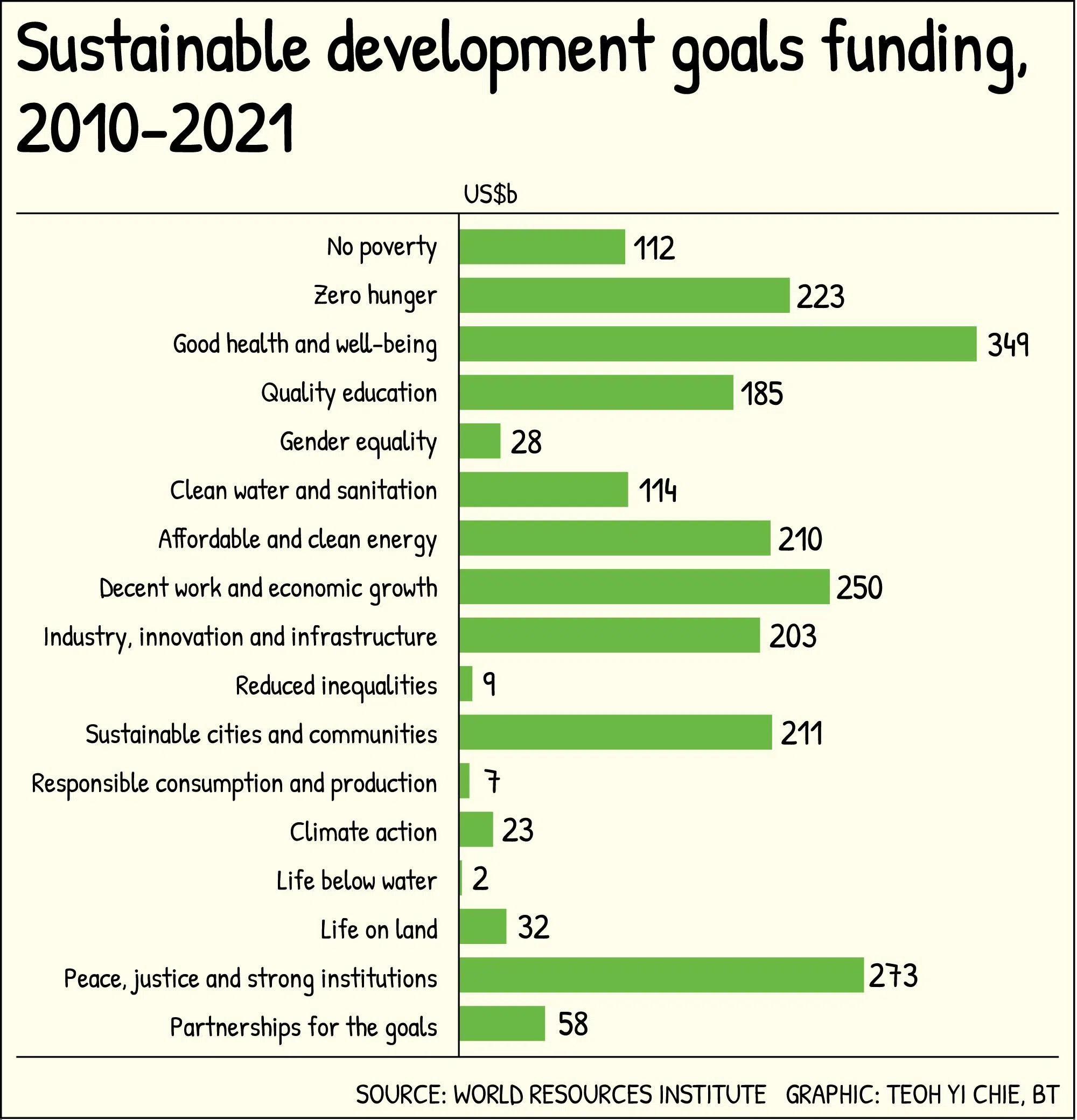

Of the 17 United Nations Sustainable Development Goals (SDG), oceans receive the least development aid — just US$2 billion over the decade from 2010 to 2021. That is less than 1 per cent of total SDG financing, according to data compiled by the World Resources Institute.

To be sure, this figure captures only official development assistance, excluding private-sector and philanthropic capital. But even when those sources are taken into account, funding remains paltry.

According to National University of Singapore marine biologist Dr Toh Tai Chong, about US$1 billion of philanthropic money went into oceans in 2022, representing 1 per cent of global philanthropic funds.

Long viewed as ‘out of sight and out of mind’, the oceans have consistently been relegated to the lowest of priorities among both public and private financiers, who tend to prefer channeling funds towards other important environmental or social causes.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

However, Mark Dalio, the co-founder and co-chief executive officer of the non-profit ocean exploration initiative OceanX, believes that investing in ocean technologies, including those applying artificial intelligence and machine learning, is the most viable pathway in mobilising more capital towards the planet’s largest ecosystem.

And his reasoning is compelling, both from a financial and environmental perspective.

Oceantech - particularly those involving sensing, robotics, AI-enabled analytics - could be replicated, deployed globally and commercially scaled more easily than other domains of ocean financing, such as ocean conservation, which have long struggled to generate revenue.

SEE ALSO

Clearer pathways to commercialisation would be attractive not just to growth-stage investors, but may also bring in other sources of capital, including blended finance, development banks as well as other investors.

And it seems that there is growing awareness around this among venture capitalists, as projections point to the blue economy growing from its current size of about US$1.5 trillion to US$3 trillion by 2030.

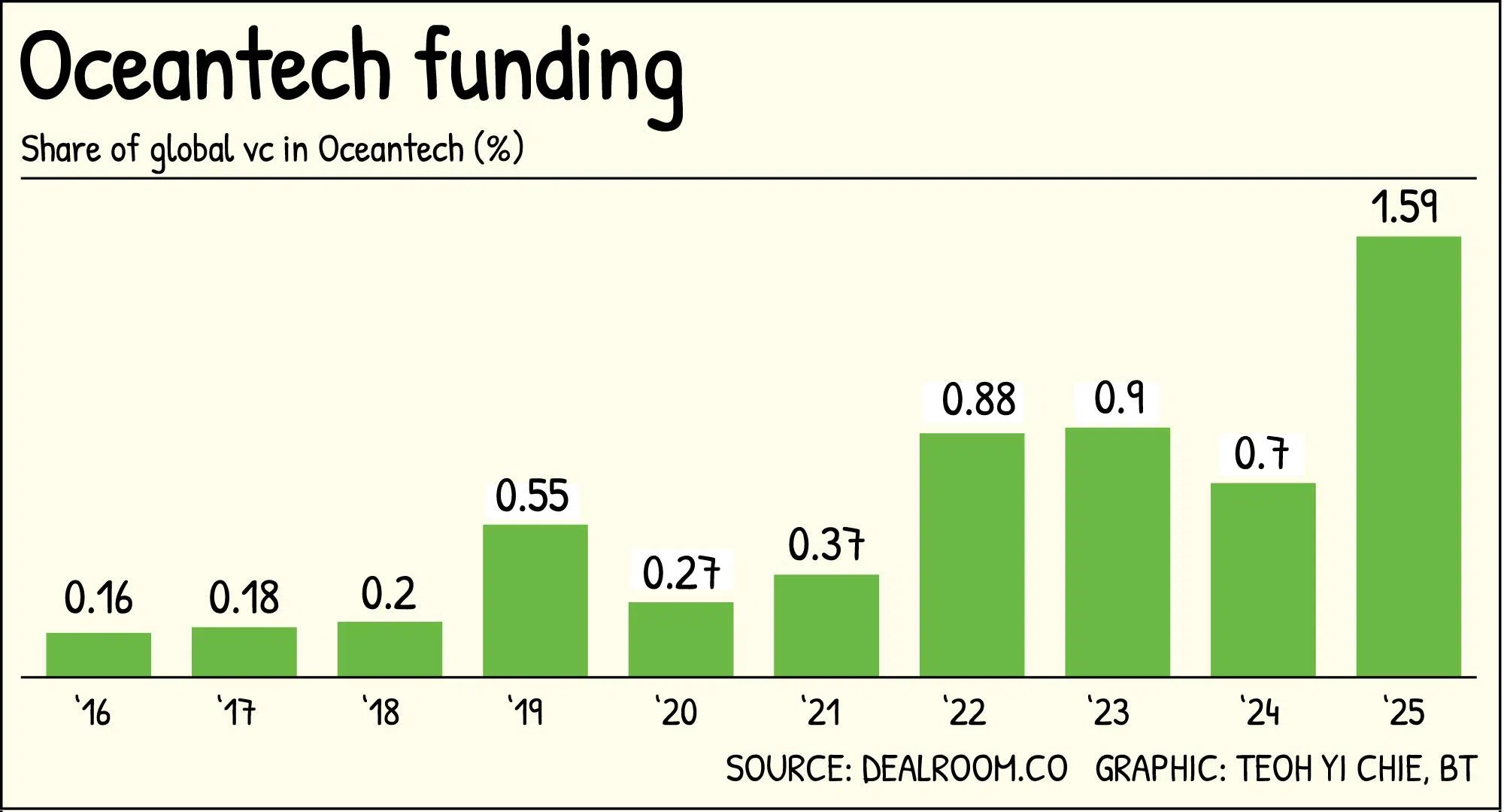

The share of global VC funding going towards oceantech has steadily increased over the years, according to dealroom.co.

Even though it’s still a miniscule proportion at less than 2 per cent of total VC, dealroom.co said that VC funding towards the blue economy has grown seven times in the last eight years.

Beyond the ability to make returns, it’s the “knock-on effects” that Dalio points to - better data collection, processing and synthesising - that underscores why oceantech is a crucial starting point to unlock more ocean finance.

One persistent barrier to ocean financing is the lack of quality data on an ecosystem that operates mostly out of sight.

Being able to obtain better data - whether through tools that enable ocean monitoring and measurement - help reduce uncertainty and perceived risk for investors. Capital has traditionally flowed towards projects that are familiar, tested and proven to investors, and the oceans are anything but.

An oft-quoted adage - that you can only manage what you measure - that has been used to refer to carbon emissions among sustainable finance professionals applies just as well to oceans.

There would be clear positive environmental effects - better data would enable more effective marine protection and earlier detection of ecosystem stress. Stronger climate modelling would also improve understanding of ocean acidification and how it is pushing the Earth’s largest habitat into increasingly risky territory - one of the oceans’ biggest threats, and a consequence of their role in absorbing growing amounts of carbon dioxide from the atmosphere.

But the spillover benefits are not just environmental, but would likely be reflected across various sectors of the blue economy, including fisheries, maritime transport, offshore renewable energy and carbon credits.

That’s because having better data should ideally enable policymakers to design frameworks that support the growth of the blue economy, while safeguarding the natural capital on which these activities ultimately depend on.

And this is particularly crucial for South-east Asia, given that it’s a region which has abundant coastal and marine ecosystems, and whose people are largely dependent on them.

It is estimated that about 625 million people in South-east Asia depend on the ocean for their livelihoods, with the ocean’s economy accounting for about 30 per cent of the region’s gross domestic product - a proportion higher than compared with developed countries.

Better data could help fishing communities in South-east Asia impacted by lower yields - as marine life have been found to swim north due to warmer climates - by coming up with adaptive fisheries management, such as having dynamic fishing zones, for example.

That being said, despite oceantech having the potential to generate financial returns and having spillover environmental impact, it is not the be-all and end-all.

While better ocean technologies might currently be the most viable entry point for the eventual mobilisation of more capital towards oceans, much of the blue economy cannot support pure commercial returns and require more innovative financing approaches, such as blended finance.

Policy and regulatory reform, in particular, is needed to ensure that the data is being used effectively.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.