Taking offices beyond the CBD: what drives decentralisation

A massive site coming up in Jurong Lake District is an exciting proposition for developers and occupiers. Still, a decentralisation strategy should be supplemented by an injection of supply in the CBD to sustain Singapore’s competitiveness.

THE concept of office “decentralisation” was launched in the 1990s, as part of a broader urban planning strategy to balance economic growth, redistribute some economic activity to the suburbs and create a diverse work environment.

Since then, regional centres such as Woodlands, Tampines and Jurong East have been conceptualised. Other commercial nodes, such as Novena Fringe Centre and Paya Lebar Central have been developed into vibrant office clusters.

As a result, the proportion of office stock in decentralised areas has grown significantly over the years. By end-2023, decentralised stock had almost trebled to 14.7 million square feet (sq ft) from 25 years ago, accounting for about 24 per cent of total office stock today.

More recently, the focus has shifted to Jurong Lake District (JLD), which is envisioned to become Singapore’s largest commercial district outside the Central Business District (CBD).

In June 2023, the government launched a 6.5 hectare site adjacent to Jurong East MRT station, designated for a master developer. Upon completion, the integrated development will feature over 1,700 residential units, 146,000 square metres of office space, and diverse complementary uses such as retail, hotel or community spaces.

It is situated near more than 3,000 multinational corporations (MNCs) clustered in the International Business Park, Jurong and Tuas Industrial Estates, as well as Tuas Port. Companies in JLD can also tap the large talent pool from the many tertiary institutions and research hubs in the vicinity.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

This master developer site brings exciting opportunities and options for developers and occupiers. While the site is huge and there are some minimum fixed requirements, there is flexibility via an option scheme where the developer can spread out the development across 15 years, which should minimise some development risks.

The projects will likely appeal to end-users who require cost-effective locations and prefer the convenience and lifestyle offered in suburban areas. Potential occupiers include those in construction and engineering, energy and commodities, consumer or industrial products, transport and storage sectors, synonymous with the current tenant profile of buildings in the western suburbs.

Two case studies: Paya Lebar Quarter and Hong Kong

To study what drives the success of large-scale decentralisation, we delved into two case studies – the experience of Paya Lebar Quarter, as well as Hong Kong’s decentralised market.

SEE ALSO

Paya Lebar Quarter

The Paya Lebar precinct in Singapore has undergone significant growth and emerged as a prominent decentralised office location since 2018, following the completion of Paya Lebar Quarter (PLQ). PLQ is a mixed-use project that comprises over 900,000 sq ft of net lettable area of Grade A office across three towers, a mall and a 429-unit residential development.

PLQ’s strength lies in its prime location and accessibility to public transport links – it is directly connected to Paya Lebar MRT Interchange and is a 15- to 20-minute drive to the CBD and Changi International Airport.

Commitment levels for PLQ were at an average of 60 per cent across the three towers when it achieved Temporary Occupation Permit, and it took about two years for the development to reach stabilised occupancy.

Today, PLQ has near full occupancy with a diverse set of tenants in the government, pharmaceutical, transport and insurance sectors. Achievable average rents within PLQ have risen by about 20 per cent from S$7 per square foot per month in 2018.

Hong Kong

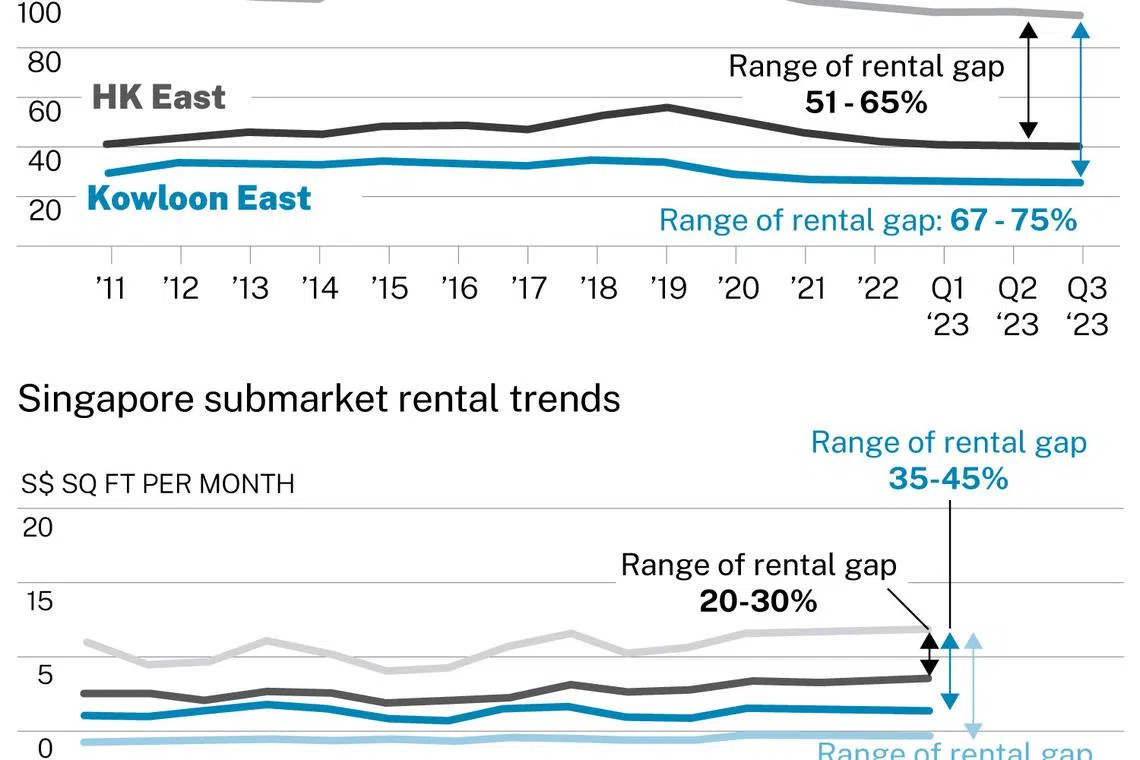

Hong Kong boasts a much larger decentralised office market than Singapore, with at least one-third of the city’s total Grade A office stock in Hong Kong East and Kowloon East. Conversely, Singapore’s Grade A offices are predominantly concentrated in the CBD.

In addition, Hong Kong’s decentralised areas offer rents that are a fraction of Central’s, boasting discounts of up to 75 per cent. Comparatively, the rental gap between Singapore’s CBD and decentralised offices is narrower at 20 to 45 per cent.

As a result of Hong Kong’s cost-efficient decentralised options, among other reasons, many MNCs such as Ernst & Young, Baker McKenzie, and Julius Baer have also moved to Hong Kong’s decentralised areas.

Balanced approach essential

While the government’s focus has been mainly on decentralisation, we believe that a mixed approach is essential. A singular focus on decentralisation could lead to a disconnect from corporates’ preference to be in prime and core locations.

CBRE’s 2022 Singapore Live-Work-Shop survey found that the CBD remains the most sought-after office location as employees are more satisfied with the transport and accessibility that a city-centre location can offer, compared with decentralised and fringe areas. This also aligns with a wider and global trend that a central office location is essential with talent retention and recruitment initiatives.

Furthermore, future supply in CBD will be extremely limited. As at end-2023, the five-year future supply (from 2024 to 2028) in CBD is estimated to be at least 29 per cent below the 10-year past completions.

In addition, the potential take-up of the CBD Incentive Scheme will likely lead to a long-term reduction of office supply, as it grants bonus gross floor area to property owners if the ageing buildings are redeveloped into mixed-use developments with residential or hotel components.

This has been aggravated by the lack of government land sale sites in the CBD.

Over the longer term, the office market could be moving in the direction of a severe supply crunch in the CBD by 2030, if there continues to be a lack of meaningful new supply in the submarket.

A decentralisation strategy should ideally be supplemented by an injection of supply in the CBD to sustain Singapore’s commercial competitiveness and provide diverse choices for future occupiers.

In a nutshell, with Singapore looking to maintain its status as a financial and technology hub, high-quality space in the CBD will continue to stay relevant and highly sought after.

At the same time, decentralisation offers a distinct value proposition that targets a different segment of the demand pool. In the longer term, the injection of quality new developments in new locations seeks to support the resilience and flexibility of the office sector by providing more choices to occupiers, which will be crucial in shaping the future of work.

David McKellar is co-head of office services, Singapore, and Goh Jia Ling is associate director of research, South-east Asia at CBRE

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.