New private home sales more than double year on year in H1 2025 to 4,634 units

This comes despite a sales volume dip in June; momentum is likely to pick up as more projects hit the market

[SINGAPORE] Developers in Singapore sold around 4,634 private homes (excluding ECs) in the first six months of 2025 – more than double the 1,889 units moved in the same period last year.

The half-year tally is also 37 per cent higher than the 3,383 units sold in H1 2023, and nearly 10 per cent more than 4,222 units sold in H1 2022.

Figures from the Urban Redevelopment Authority (URA) on Tuesday (Jul 15) showed that the strong showing came despite a 12.8 per cent month-on-month decline in the number of units sold in June amid the school holiday lull.

Monthly sales were also muted in May, with just 312 new private homes sold, as new launches in the second quarter of 2025 were few and far between.

Analysts said sales are expected to pick up in the coming months as a wave of new projects hit the market.

ERA chief executive officer Marcus Chu pointed out that, in Q3 alone, an estimated 4,154 new units will be launched for sale across Singapore.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The prime Core Central Region (CCR), in particular, will see four new launches, including the 301-unit Upperhouse at Orchard Boulevard and the 348-unit The Robertson Opus. Both are slated to be marketed this weekend.

Some of these new launches will be in prime areas that have had limited new supply in the past couple of years, said Knight Frank research head Leonard Tay.

CapitaLand’s 343-unit LyndenWoods condominium – the first residential project in the Singapore Science Park – launched over the weekend, with a take-up rate of over 94 per cent at an average price of S$2,450 per square feet (psf).

This shows that buyers were not concerned about the increase in holding period for seller’s stamp duty, as strong household balance sheets continue to support investments in long-term assets, said Huttons Asia senior director of data analytics Lee Sze Teck.

Wong Siew Ying, PropNex head of research and content, said LyndenWoods’ strong performance “could help to generate some buzz in the new home sales market over the next few weeks as more launches come up”.

She added that the slower growth in private home prices – up 0.5 per cent in Q2, according to URA flash estimates – as well as a more benign interest rate environment and better economy could lift buying sentiment further.

Lee said developers also appear to be more confident in the market, going by participation and bids for state land tenders in recent months. Last week, a private housing site in Chuan Grove drew seven bids, with the top bid of S$703.6 million or S$1,376 psf from a Sing Holdings-Sunway Developments joint venture.

“The competition for buyers among upcoming launches and the need to sell out before the (five-year) additional buyer’s stamp duty deadline will create an urgency to launch as soon as possible,” Lee pointed out. “Developers are competing for the first mover to launch and sell ahead.”

In June alone, developers sold 272 private homes as 187 new units came to market. Just two projects were launched for sale in the month – the freehold Amber House with 105 units in the Amber Park area, and the 107-unit freehold Arina East Residences in Tanjong Rhu.

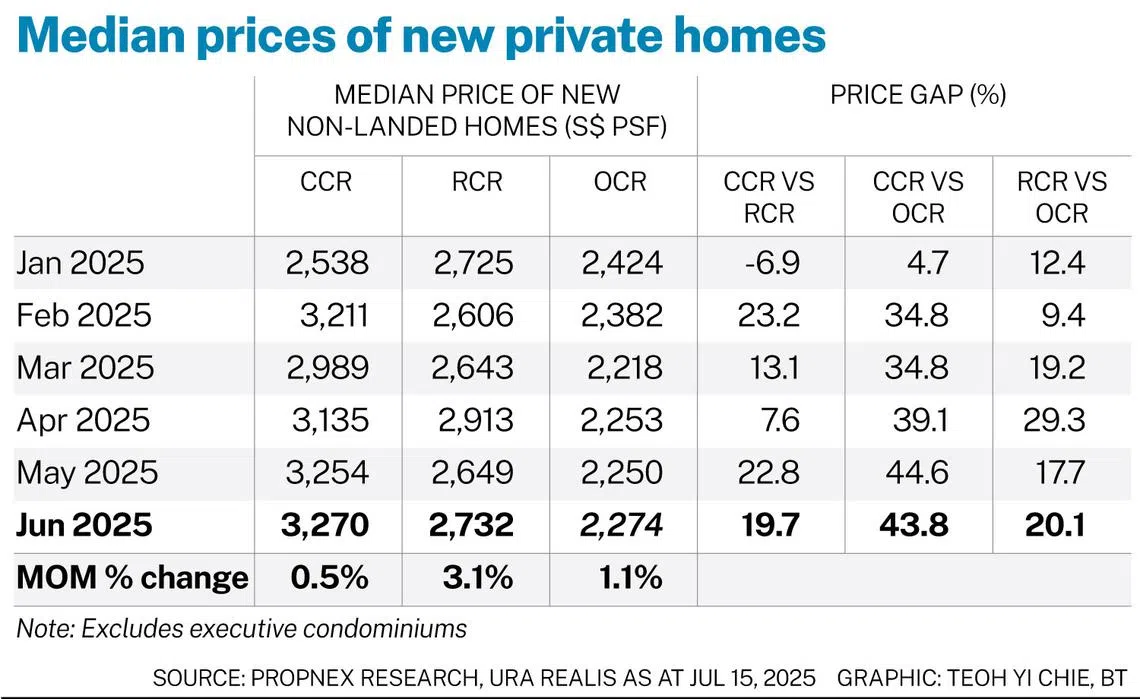

Wong noted that the median unit price of new non-landed homes rose across the board, with the Rest of Central Region (RCR) seeing the biggest jump of 3.1 per cent month on month to S$2,732 psf. The price increase was just 0.5 per cent to S$3,270 psf in the CCR, and 1.1 per cent to S$2,274 psf in the suburban Outside Central Region (OCR).

The price gap between the CCR and RCR also narrowed to 19.7 per cent in June – the tightest it has been in the last few years, said Wong.

Realion Group chief research and strategist Christine Sun pointed to continued interest in ultra-luxury condominiums, with four units sold for over S$10 million apiece – more than the three such transactions in May.

The priciest non-landed transaction was a 5,285 sq ft unit on the 55th floor of the 99-year leasehold Skywater Residences, at S$30.9 million or S$5,841 psf on Jun 19.

Another 11 new condos were sold for between S$5 million and S$10 million in June, higher than the eight units moved in May, Sun noted. These were units at the 99-year leasehold Irwell Hill Residences and Canninghill Piers, both in River Valley; the 99-year leasehold Union Square Residences along Havelock Road; and the freehold Watten House in Bukit Timah.

“Some of these buyers are turning to real estate as a form of value preservation, especially during periods of broader economic and market uncertainty,” said SRI head of research and data analytics Mohan Sandrasegeran. “Well-located homes in Singapore are viewed not only as luxury residences, but also as stable financial assets that offer long-term capital security.”

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.