CPF, loan rule changes reinvigorate demand for older HDB flats: OrangeTee

DEMAND for older HDB flats in Singapore spiked in the second quarter this year, following policy updates in May which may have given a "new lease of life" to the overall HDB resale market, OrangeTee & Tie said on Tuesday in its latest quarterly report on HDB trends.

Some 564 HDB flats that were 40 years old and above were sold in May-June this year, a 40 per cent surge from 403 units in the year-ago period, while resale transactions for flats between 30 and 40 years old rose 10.4 per cent to 1,219 units.

In early May, the government updated rules on Central Provident Fund (CPF) usage and HDB housing loans. Homebuyers now have greater flexibility to use their CPF to pay for the property and may obtain larger housing loans as long as the remaining lease of the property can cover the buyer till the age of 95.

Total HDB resale transactions grew 29.8 per cent from the previous quarter to 6,276 units in Q2 this year - marking the first increase in sales volume since Q3 2018. For the first six months of this year, there were 11,111 resale transactions for HDB flats, up 6.8 per cent from the year-ago period.

While the second quarter usually sees an uptick in sales activity, total transactions for Q2 2019 also increased 5.6 per cent from a year ago.

"This indicates that apart from a seasonal effect, the recent CPF changes may have been a major catalyst that spurred buying demand last quarter," OrangeTee said.

The policy changes were meant to improve the liquidity of the resale market and make it easier to buy and sell older flats.

"There were many concerns raised about the depreciating value of older flats in the earlier part of last year, and many sellers were struggling to find a buyer," OrangeTee said.

"Therefore, the year-on-year increase (in Q2 sales of older flats) is commendable and could signal that the recent policy changes may have started to take effect in helping to spur demand for older flats," it added.

As for younger flats below 10 years old, their sales volume also increased substantially in the second quarter, although this may be attributed more to a surge in housing supply of flats reaching their five-year minimum occupation period (MOP) rather than the policy changes, OrangeTee said.

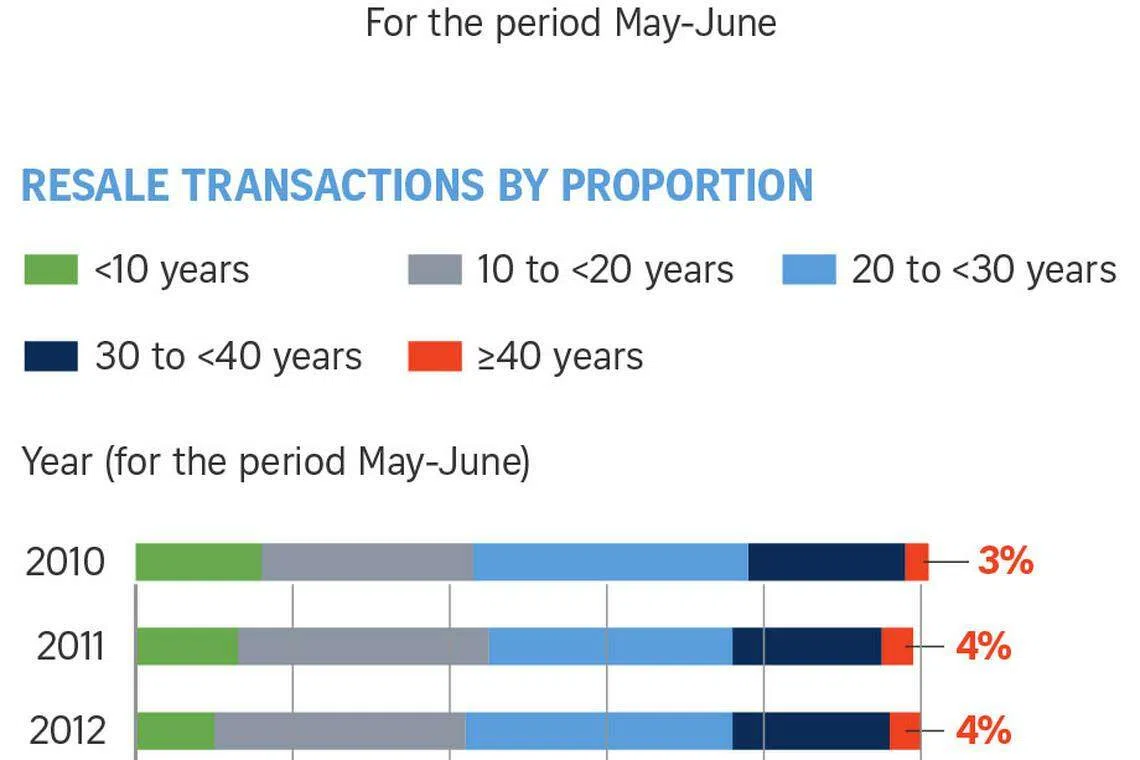

In terms of market share, older flats have also taken a larger slice of the pie during May-June 2019.

Flats that are 30 years old and above made up 44.9 per cent of total resale transactions during the period, up from 40.6 per cent in May-June last year. Of these, flats aged 40 years and above increased their market share to 14.2 per cent, from 10.8 per cent a year ago.

Conversely, the market share of younger flats between 10 and 30 years old shrank to 35.8 per cent from 43.4 per cent a year ago.

This shift in demand towards older flats may have resulted from the policy changes, OrangeTee said.

Furthermore, four and five-room HDB flats above 30 years old saw a larger surge in sales volume compared to younger and smaller flat types.

The number of resale transactions of four-room flats and five-room flats - both aged 40 and above - respectively climbed 53.5 per cent and 54.5 per cent from a year ago.

On the other hand, sales dipped for younger flats between 10 and 30 years old, across all flat sizes.

Mature estates such as Bukit Batok, Geylang and Bedok saw the biggest year-on-year increase in resale transactions for flats aged 30 and above, up 46 per cent, 31 per cent and 29 per cent respectively in May-June this year.

OrangeTee said that its ground observations were in tandem with the data findings, with more sales inquiries received for older flats after the new regulations were introduced.

"Some potential buyers who wish to live near their parents in mature estates may now be able to get a housing loan or fully use their CPF to buy an older flat in the vicinity," the firm said.

"These buyers could have faced loan restrictions previously because the ability to obtain a loan depended on the age of the flat, but now the buyer's age is taken into consideration together with the balance lease of the flat," it added.

Due to the improving sentiment and revival of buying interest for older flats, the pace of decline of HDB resale prices slowed down marginally to 0.2 per cent in the second quarter, compared to the 0.3 per cent drop in the first quarter this year.

"While this is the fourth consecutive quarterly decrease, prices have dipped less than 1 per cent over the past year, indicating that the price decline has largely stabilised," OrangeTee said.

Looking ahead, the HDB resale market may continue to benefit from the new policy changes and older flats may see a revival in demand, OrangeTee said.

The consultancy added that although sales volumes in the resale market may trend upwards in the coming months, a price recovery may not be as quick, given the growing supply of HDB resale flats and the influx of HDB flats reaching their MOP this year.

OrangeTee maintained its full-year price forecast of between -1 and -2 per cent for HDB resale flats for 2019.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Property

US single-family housing starts plunge in March

CDL unit sells 65 units at The Residences at W Sentosa in latest sales relaunch

Data gaps, privacy needs of the rich make anti-money laundering checks tough, say agencies

CDL unit markets unsold units at The Residences at W Sentosa at 40% less than 2010 launch price

China developers slash prices by 40% at luxury Hong Kong apartment project

URA awards Zion Road, Upper Thomson sites to sole bidders at lower-than-expected offers