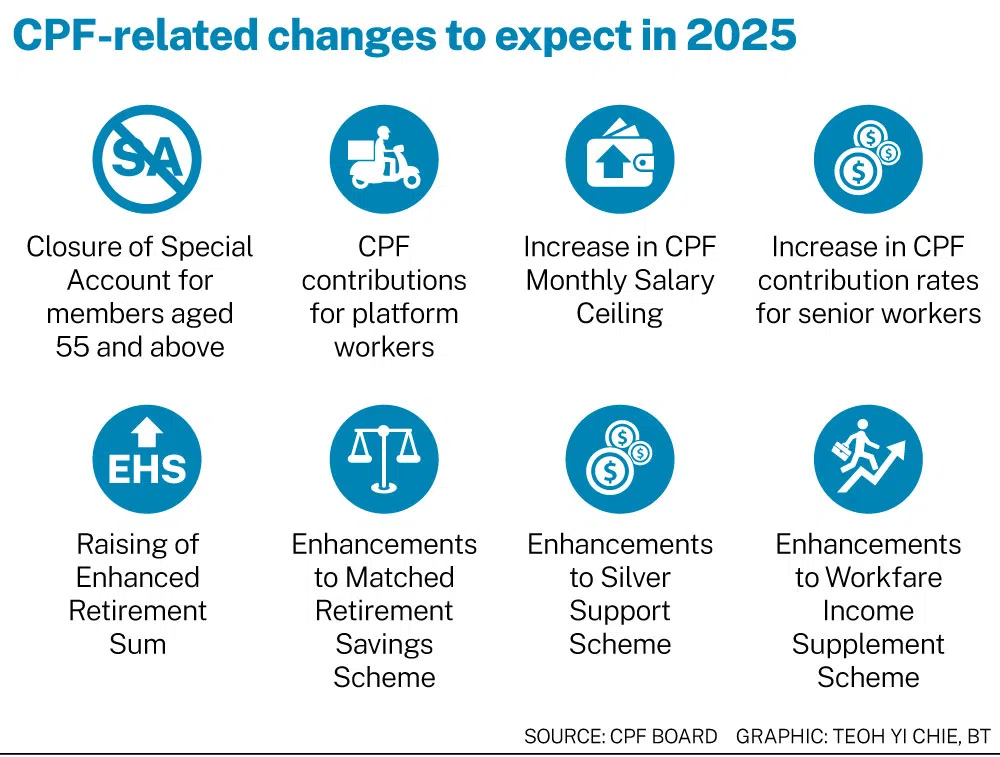

Eight CPF-related changes to take place in 2025

The measures aim to help members build up their savings for retirement, housing and healthcare

THE Central Provident Fund (CPF) Board is implementing several changes next year to ensure the CPF system remains relevant, and to help members build up their savings.

On Monday (Dec 16), the board highlighted CPF as a key pillar of Singapore’s social security system to support members in setting aside savings for the three fundamental needs of retirement, housing and healthcare.

Here are the changes to expect from as early as January 2025:

1. Closure of Special Account (SA) for members aged 55 and above

From the second half of January 2025, the SA of CPF members aged 55 and above will be closed. Savings in the SA will be transferred to either the Retirement Account (RA) or Ordinary Account based on the members’ respective full retirement sums. Those with existing CPF Investment Scheme investments under the SA may continue to hold them, with proceeds to go to their RA after their SA is closed.

2. Higher Enhanced Retirement Sum (ERS)

From Jan 1, 2025, the ERS will be raised to four times the basic retirement sum (BRS) to S$426,000. This is up from the current S$308,700, which is three times the BRS. CPF said this will allow more members to set aside a higher amount in their RA and, correspondingly, receive higher monthly payouts, should they wish to do so.

3. Enhanced Matched Retirement Savings Scheme (MRSS)

The matching grant cap for this scheme will be increased to S$2,000 per year from S$600 per year currently. Effective Jan 1, the age cap of 70 will also be removed allowing for about 800,000 CPF members aged 55 and above to be eligible for the MRSS. Tax relief for cash top-ups that attract the matching grant will also be removed as the grant is a benefit in itself. However, cash top-ups which do not attract the matching grant will continue to qualify for tax relief.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

4. Increased quarterly Silver Support Scheme payments

Starting from Jan 1, quarterly Silver Support Scheme payouts will be raised by 20 per cent. The qualifying household monthly income per person threshold will also be increased from S$1,800 to S$2,300. The quarterly payments will continue to be tiered based on HDB flat type and household monthly income per person.

5. Workfare Income Supplement Scheme (WIS) changes

The qualifying income cap for the Workfare Income Supplement is to be raised to S$3,000 from S$2,500 previously – a change which CPF expects to benefit about half a million lower-income workers. Eligible workers can receive up to S$4,900 of workfare payments per year with effect from 2025, as compared to S$4,200 per year today.

6. CPF contributions from platform workers

From Jan 1, CPF contributions will be deducted from platform workers as and when they earn. It will be mandatory to gradually increase CPF contributions for platform workers born on or after Jan 1, 1995, to 20 per cent by 2029, while contributions from platform operators should reach up to 17 per cent. Platform workers born before 1995 may opt in for the increased contributions or choose to continue contributing only to their MediSave Account without receiving platform operators’ share of CPF contributions.

SEE ALSO

7. Higher CPF monthly salary ceiling

The CPF monthly salary ceiling will be raised from Jan 1 to S$7,400, while the annual salary ceiling of S$102,000 stays unchanged. CPF said this increased ceiling can help boost members’ overall total monthly earnings after factoring in higher CPF contributions from employers.

8. Higher contribution rates for senior workers

Starting Jan 1, the CPF contribution rates for members aged from above 55 to 65 will be raised by 0.5 percentage point for employers, and one percentage point for employees. A one-year CPF transition offset, equivalent to half of the 2025 increase in employer CPF contributions, will be provided to employers to cushion the impact on business cost.

Amendment note: An earlier version of this story said the closure of Special Account (SA) for members aged 55 and above will occur in the second half of 2025. It should be the second half of January 2025.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.