MOH scraps full-deductible IP riders to tame rising private healthcare bills

The co-payment cap, which applies after the deductible, will also double to S$6,000

[SINGAPORE] Come April next year, insurers will no longer be allowed to sell Integrated Shield Plan (IP) riders that fully cover a patient’s minimum deductible – a move welcomed by industry players in curbing ballooning private healthcare costs.

Premiums for new riders are expected to fall by about 30 per cent under the revised rules, translating to average annual savings of S$600 for private-hospital IP rider policyholders and S$200 for those on public-hospital IP riders.

From Apr 1, 2026, riders under the IPs will no longer be permitted to cover the government-mandated deductible. This is currently allowed.

The co-payment cap – applied after the deductible – will also double to S$6,000, the Ministry of Health (MOH) said on Wednesday (Nov 26). The cap has been unchanged since its introduction in 2018.

Existing policyholders – riders are typically renewed yearly – will not be affected, and insurers may continue selling riders under the current regime until Mar 31, 2026.

Those who purchase such riders between Nov 27 and Mar 31 must, however, transition to the new requirements by Apr 1, 2028. Insurers must also inform new policyholders of the upcoming changes, said MOH.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Surging IP rider premiums

IPs are optional private insurance plans that provide coverage in addition to what’s offered by MediShield Life, Singapore’s compulsory basic health insurance scheme. Riders are optional add-ons to an IP. They have to be paid fully in cash, and are meant to reduce a policyholder’s out-of-pocket costs when making a hospital claim.

They typically cover two types of out-of-pocket costs: deductibles and co-payments. A deductible is the fixed amount that must be paid each policy year before insurance kicks in. After the deductible is paid, a co-payment applies. By default, patients pay 10 per cent of the remaining bill, though riders typically reduce this to 5 per cent, with a cap.

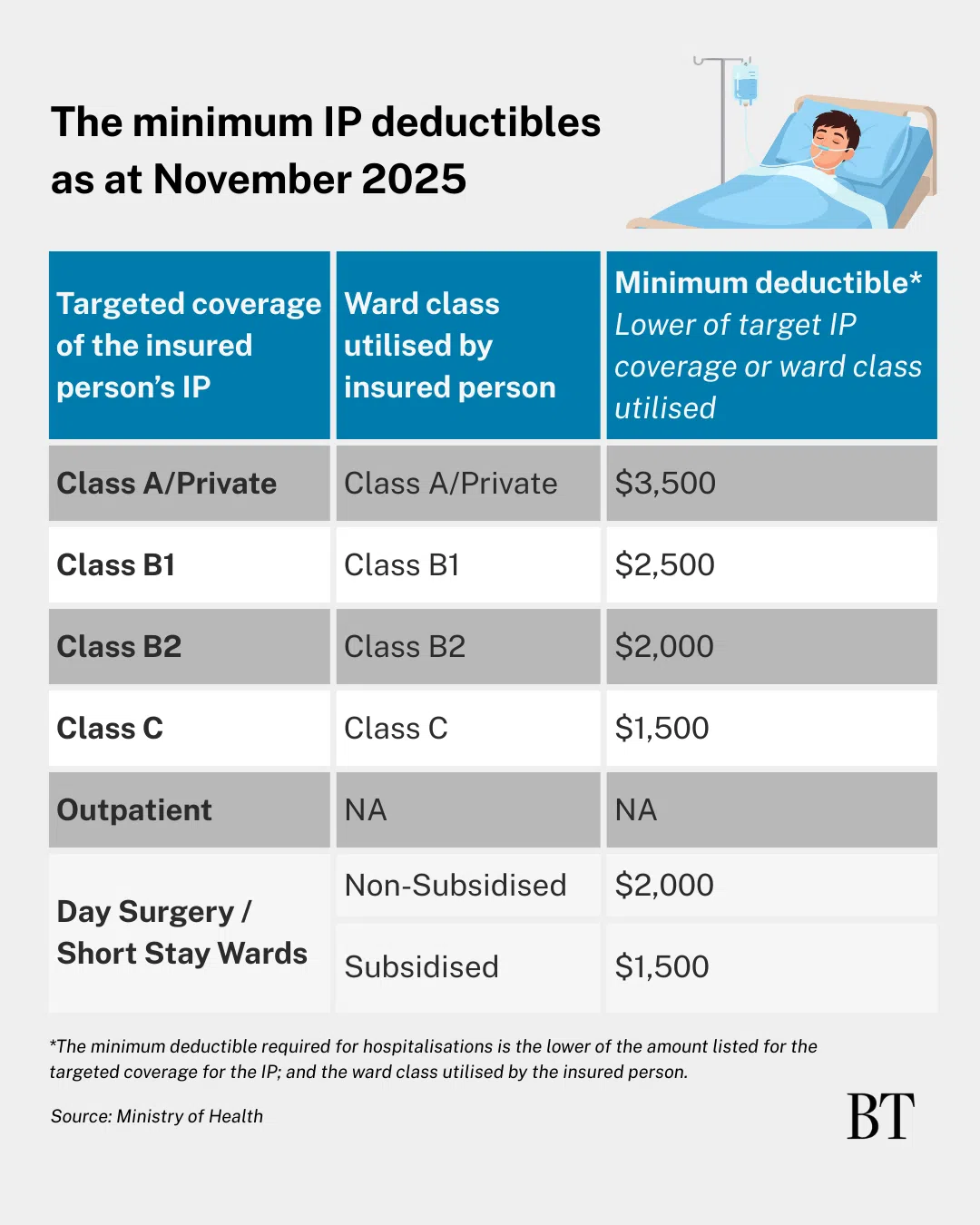

MOH sets the minimum deductible for each ward class; for instance, the deductible for private hospital and Class A wards is S$3,500.

About 71 per cent of residents – around three million people – hold IPs. Of these, about two million also have riders. Two in three rider holders enjoy “maximum coverage”, meaning they pay only the deductible and a minimum 5 per cent co-pay, capped at S$3,000.

The riders being phased out go further: they fully cover the deductible.

These products have long been associated with what Health Minister Ong Ye Kung has called the “buffet syndrome”, where “overly generous” coverage leads to more hospital visits or unnecessary treatments.

Claims patterns reflect this. Private-hospital IP policyholders with riders claimed 1.4 times as often as those without riders, and their average bill size was also 1.4 times higher, MOH’s 2023 data showed.

This behaviour has contributed to a sharp rise in private-hospital bills. The median bill climbed from S$9,100 in 2019 to S$15,700 in 2024 – a compound annual growth rate of 11.5 per cent.

Insurers have responded by raising premiums for riders “significantly” to keep up with claims, said MOH, with rider premium growth “significantly outstripping” that of IPs.

The latest changes will “increase cost discipline over minor episodes, and reduce over-servicing and over-consumption associated with non-essential hospital admissions or treatments”, the ministry added.

Change in patient behaviour

Some borderline cases illustrate how patient behaviour could shift.

Dr Desmond Wai, a gastroenterologist at Mount Alvernia Hospital, said some patients request overnight admissions even when a ward stay is not medically necessary.

These patients often proceed for “peace of mind” because their riders fully cover the MOH-mandated deductible, leaving them with no out-of-pocket cost.

With riders no longer allowed to cover the deductible, such patients will have to pay it themselves – a change Dr Wai believes will prompt some to “think twice”, helping reduce unnecessary utilisation and overall healthcare costs.

“I think MOH has recognised that the premium for riders is rising so much that if you don’t do anything, there will be no business for everybody,” he said. “I think it’s good that they’re doing something to control it.”

In the short term, the changes could nudge some patients towards public hospitals, where subsidies are higher and deductibles are lower. This could reduce private-hospital patient volumes, he estimated.

“Having said that – and we see this all the time – we wonder whether (the) government hospitals can cope with a sudden surge in the patient (load),” he said. Longer waits could then push some back to private hospitals.

Cost savings

Industry players welcomed MOH’s announcement and pointed to the potential savings for consumers already on such riders.

“While coverage levels of these new IP riders will expectedly be lower, policyholders can expect these riders to be more affordable compared to existing riders in the market,” said the Life Insurance Association Singapore.

Alex Lee, president of the Singapore Actuarial Society, said that for those who do not currently have a rider, it may make more sense to wait for the new versions rather than rush to buy the existing ones during the transition period.

“Unless you’re so sure you’re going to the hospital in the next two years,” he said, consumers would likely be better off taking up the new riders once insurers begin offering them.

The money saved could then be set aside and used to pay the deductible if a hospital visit is needed, he suggested.

While Wednesday’s move is a “welcome” one, Christopher Tan, group chief executive officer of wealth advisory firm Providend, said “we must be careful not to place the bulk of responsibility on patients alone”.

“Addressing this challenge requires tackling the other structural drivers as well – such as reducing unnecessary treatments and preventing medical institutions from over-servicing,” he added.

MOH is working on several initiatives on that front, he noted, including fee benchmarks, enforcement against a small minority of errant doctors, and exploring a not-for-profit private hospital.

“I certainly hope that more can be done, especially on preventing a small minority of doctors from prescribing more expensive procedures to a patient when a cheaper alternative is available,” Tan said.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.