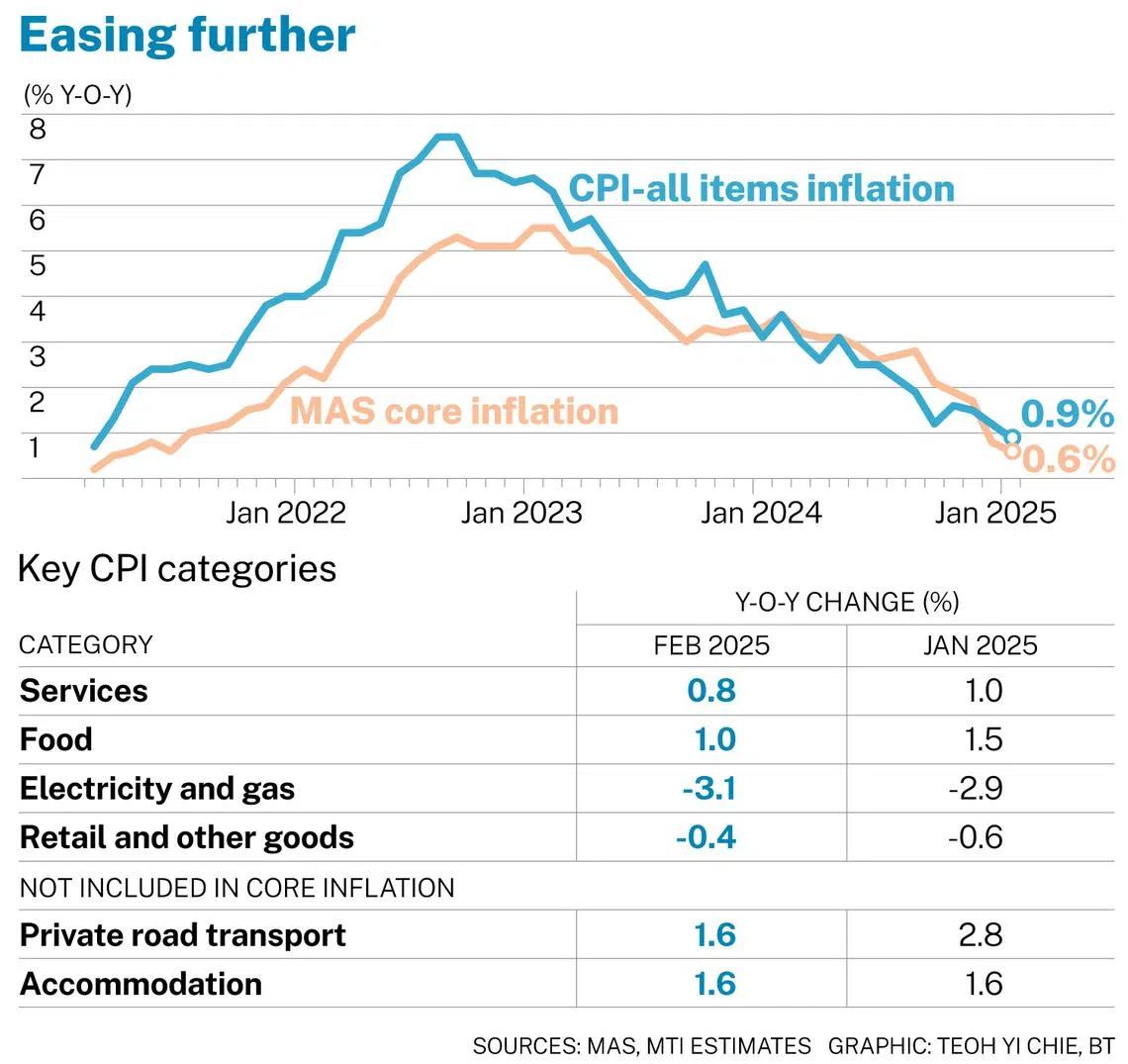

Singapore core inflation dips further to 0.6% in February, lowest in nearly 4 years

Headline inflation eased to 0.9% year on year in February, down from 1.2% in the previous month

[SINGAPORE] Singapore’s inflation fell further in February to the lowest levels in nearly four years, driven by slower price increases across most broad core categories, other than retail and other goods, data from the Singapore Department of Statistics showed on Monday (Mar 24).

Core consumer price index (CPI), which excludes private transport and accommodation, dipped to 0.6 per cent year on year, extending the sharp drop to 0.8 per cent in the January. This is the softest print since June 2021.

On a monthly basis, however, core inflation edged up by 0.1 per cent.

Headline inflation eased to a four-year low at 0.9 per cent year on year in February, down from 1.2 per cent in the previous month. Sequentially, it increased by 0.8 per cent.

February’s showing came in a notch lower than what private-sector economists polled by Bloomberg were expecting: 0.7 per cent for core inflation, and 1 per cent for headline CPI.

In a statement that was nearly identical to the one issued last month, the Monetary Authority of Singapore (MAS) and Ministry of Trade and Industry (MTI) reiterated their inflation outlook, noting that while the escalation of trade frictions could be inflationary for some economies, their impact on Singapore’s import prices is likely to be offset by “disinflationary drags exerted by weaker global demand”.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

However, the authorities now deem uncertainties in the external environment, which have an impact on the outlook for inflation, to be “heightened”.

MAS’ next move

Several economists pointed out that the expression may hint at MAS’ next monetary policy move slated for April.

Citi economist Kit Wei Zheng believes a forecast downgrade is near, saying: “As risks to inflation were seen to largely hinge on growth in the January MPS (monetary policy statement), and heightened uncertainties from tariffs likely bias growth forecasts lower... we interpret this as a hint on an imminent MAS forecast downgrade.”

Edward Lee, chief economist for Asean and South Asia at Standard Chartered, said MAS may take a “wait-and-see” approach, with risk now slanted towards another pre-emptive loosening next month.

The severity of upcoming US tariffs to be implemented on Apr 2 could weigh on MAS’ decision, he added.

“The good news is that Singapore has escaped mention so far, but will still get indirect negative growth effect from trading partners,” he said. “And if Singapore does not escape direct tariffs, this will increase the risk of an earlier than expected easing.”

OCBC chief economist Selena Ling believes there is room to ease monetary policy since core inflation has now subsided well within MAS’ core inflation forecast of 1 to 2 per cent. The official outlook for headline inflation is 1.5 to 2.5 per cent.

Still, the timing of such a move is a “toss-up”, she said, since the inflationary impact spillover into economies outside the US is still unclear at this juncture, “given the frequent flip-flops of tariff announcements”.

“For now, many central banks may prefer to err on the side of downside growth risks,” added Ling. “If MAS chooses to remain static in April, this does not preclude an easing down the road but may just signify a ‘wait-and-see’ mode at this juncture.”

Meanwhile, several economists said they were lowering their full-year inflation outlook.

UOB associate economist Jester Koh said he is cutting his core outlook to 1 per cent, from 1.3 per cent, while keeping his headline CPI forecast at 1.3 per cent.

“Should tariffs and trade tensions continue to escalate, deflationary risks could surface due to the effects of weaker global demand while imported inflation could stay muted – especially as China continues to experience an extended period of deflationary pressure,” he said.

Citi’s Kit is shaving 0.1 percentage point off his core forecast to 0.7 per cent. “Our forecast anticipates weak momentum in February continuing into March on softening demand and pricing power,” he said.

Disinflation in most categories

Private transport costs rose at a slower pace of 1.6 per cent year on year in February, compared with 2.8 per cent in the previous month. This was due to smaller increases in car and petrol prices, MAS and MTI said.

Food inflation also moderated, coming in at 1 per cent year on year, as the pace of increase in the prices of non-cooked food and prepared meals slowed. It was 1.5 per cent in January.

Services inflation eased to 0.8 per cent year on year, from 1 per cent previously. This was because of lower airfares and a steeper decline in holiday expenses.

Electricity and gas prices fell more steeply to -3.1 per cent year on year, extending from January’s -2.9 per cent. This was attributed to a larger drop in electricity prices and a decline in gas prices.

Accommodation inflation was unchanged at 1.6 per cent year on year as smaller increases in housing rents were offset by larger increases in housing maintenance and repair costs.

Retail and other goods was the only category that bucked the trend with inflation increasing to -0.4 per cent year on year, from -0.6 per cent in January. This was due to smaller declines in the prices of clothing, footwear, as well as furniture and furnishings.

Copyright SPH Media. All rights reserved.