Can ChatGPT replace my financial adviser?

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

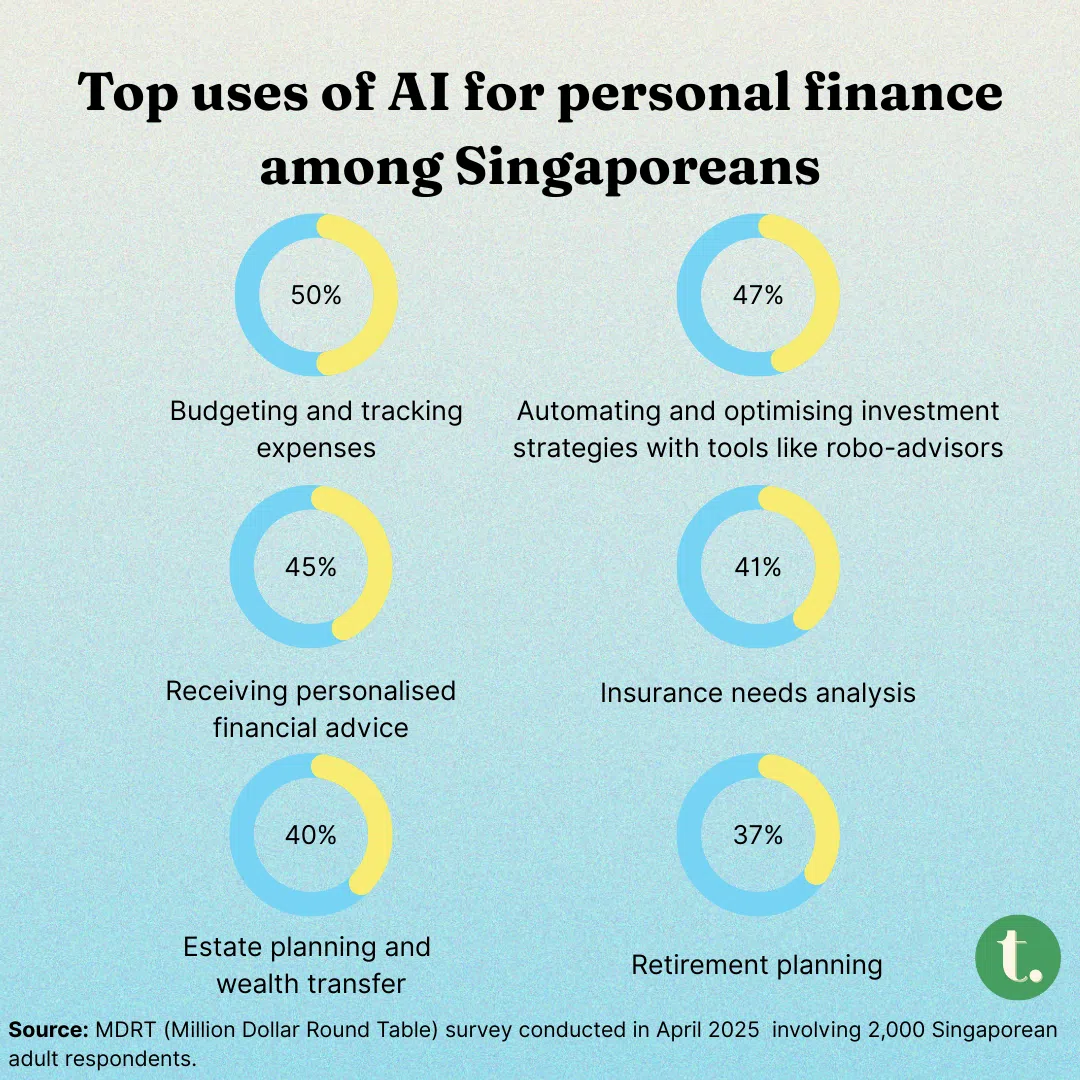

[SINGAPORE] It turns out I’m late to the game. More than four in five Singaporeans say they use AI tools to manage money, especially among Gen Zs and millennials, survey findings released in July by financial advisers association Million Dollar Round Table showed.

It’s no surprise, given Singapore’s standing as the country with the highest per capita usage of ChatGPT worldwide. About one in four of us use it weekly, according to its creator OpenAI.

The question is whether using large language models (LLMs) like ChatGPT to plan your finances is a smart idea.

🩺 Portfolio check-up

I started with a simple request: “Can you review my investment portfolio and do a financial check-up?”

ChatGPT didn’t just jump in with answers. It asked about my assets, debts, goals and age. Not bad.

Its verdict was that my portfolio was “very healthy”. It was diversified, disciplined and on track for retirement. I didn’t tell it what my target for retirement was or when I wanted to retire, but thank you, ChatGPT.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Admittedly, my portfolio isn’t exactly sexy. Most of my money sits in a global stock market index fund, plus some gold as a hedge.

Still, ChatGPT flagged that being 90 per cent in equities made me aggressive by textbook standards, but added that my Central Provident Fund (CPF) balances, which act like bonds, brought my true risk closer to moderate.

That actually aligned with my investment philosophy, even though I hadn’t mentioned it.

It also considered the local context. For example, when I mentioned saving for renovation costs for my future Build-to-Order flat by 2028, it suggested pausing my stock investments and parking future savings in a high-yield account, Treasury bills (T-bills) or Singapore Savings Bonds (though it overstated their yields).

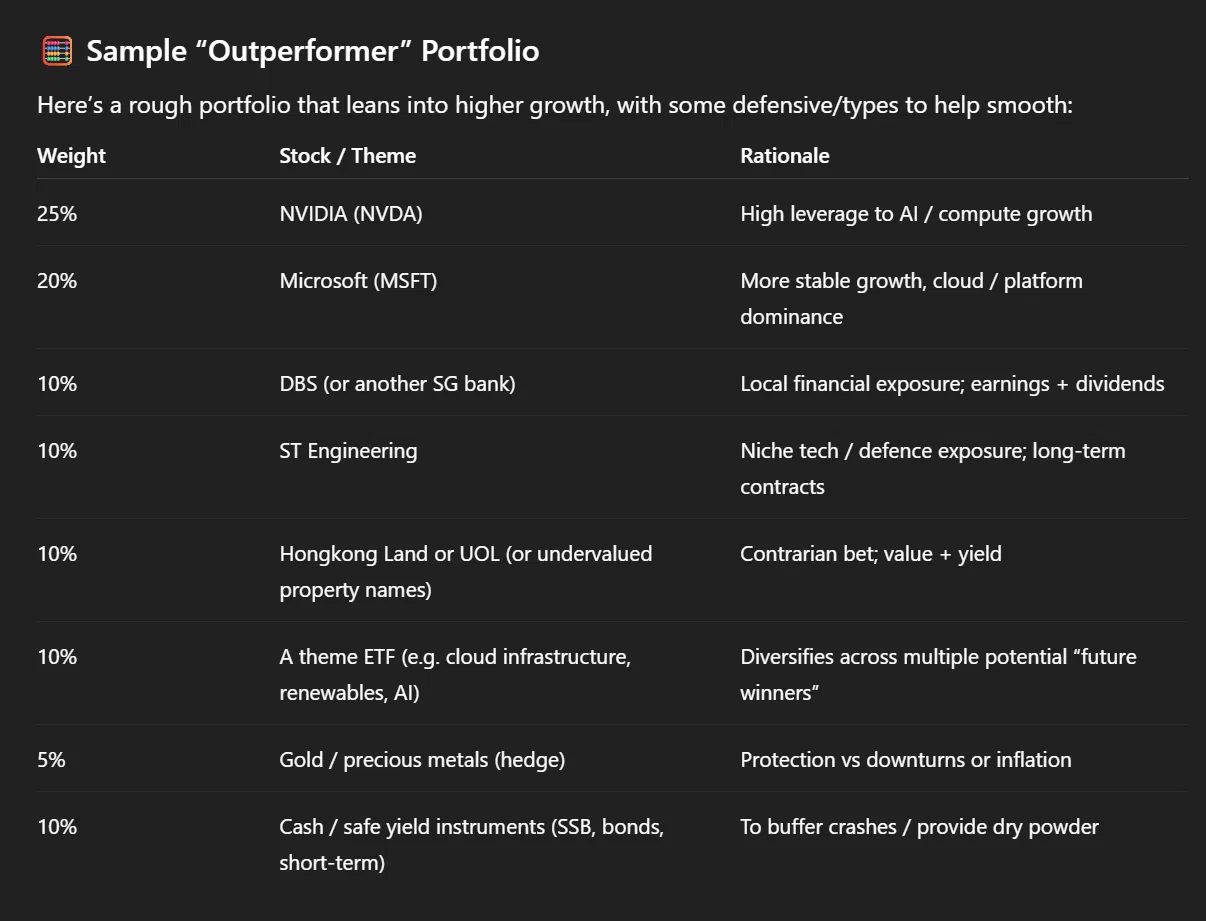

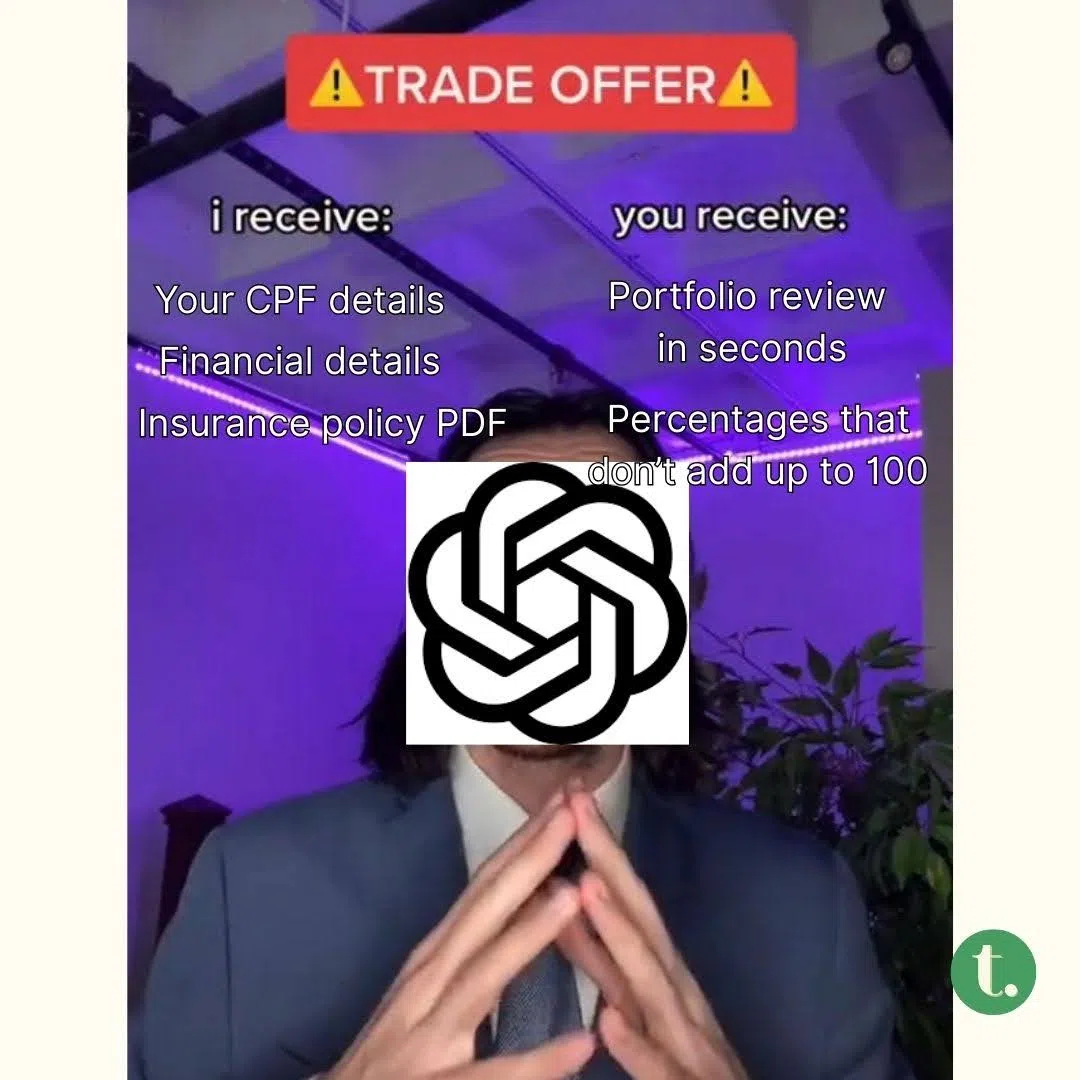

Sure, there were hiccups. When breaking down my investments, the percentages added up to 105 per cent. Some other figures were off. But overall, it gave logical and practical advice.

🎯 The “beat the market” test

Next, I got cheeky. I told ChatGPT: “Build me a portfolio that can beat the market.”

First, it warned that higher risk means higher volatility and that picking stocks is riskier than holding broad ETFs. A good caveat.

However, the stock picks it gave me were predictable: Nvidia, Microsoft, DBS and ST Engineering – companies that have already done well in the past year and are on many people’s radar.

Sure, that doesn’t make them bad picks. But it echoed what experts have observed. A recent study published in the Plos One scientific journal found that large language models, like ChatGPT, tend to reinforce human biases in investing.

They favoured American companies, trendy sectors like technology and consumer goods and often suggested companies that are already hot.

I also noticed how easily it validated my assumptions instead of challenging them.

When I questioned its suggestion to hold real estate investment trusts (Reits) and dividend stocks like utilities, it quickly backtracked and affirmed my belief that I don’t need income investments while I’m in my 20s.

🚩 Red flags

Investments aside, I also wanted to know if AI could help with the bane of adulting: insurance contracts (something I wrote about before).

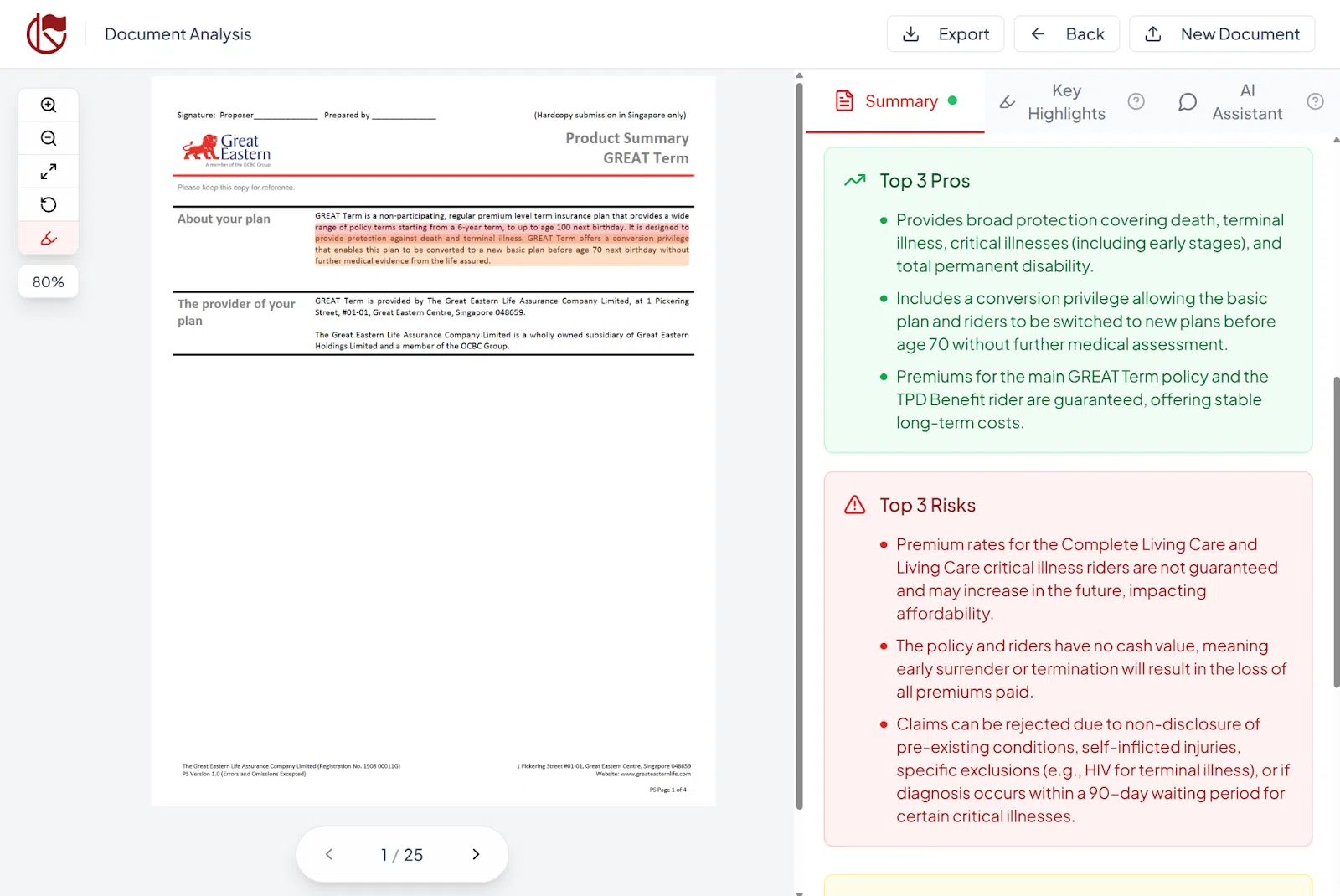

This time, I tried Redflags.sg, a free web app developed at a youth hackathon organised by the People’s Association and Open Government Products.

Upload your policy, and Redflags highlights key phrases as low, medium or high risk. It also picks out the policy’s top three pros and risks, key costs and commitments.

When I uploaded my term life plan, it reminded me that while the premiums for the main life insurance portion of the plan are guaranteed, premiums for my critical illness riders aren’t and may increase in the future – a detail that I had forgotten since signing up.

To be honest, this was the best use of AI I’d seen so far in this experiment and it’s a tool I’d gladly use the next time I buy insurance.

🧑💼 AI = good financial adviser?

Here are my takeaways:

- It’s fast: What might take hours over coffee with your ex-classmate-turned-financial adviser, ChatGPT spits out in seconds.

- Tailored to you: Unlike generic financial advice online, it adapts to your situation. That said, it also depends on your prompts. The more context you give, the more useful the output.

- No vested interests: Unlike some advisers, ChatGPT isn’t coming up with your personal finance plan while also trying to sell you insurance or investments at the same time.

- Yes-man problem: It won’t challenge your flawed assumptions unless you force it to.

- Great for learning: It gives you a very practical and relevant crash course in personal finance, making jargon less scary so you can approach money decisions more confidently. And it’s great when you have questions you’re too embarrassed to ask.

- Don’t blindly follow: Always cross-check information and do your due diligence, especially if you intend to act on the advice. AI still hallucinates!

For anyone already tracking expenses, setting goals and thinking seriously about their money, I believe that AI is a genuine boon. It speeds up the boring parts, translates the jargon, and importantly, tailors its advice for you with no hidden agenda.

That said, I fear that AI becomes the lazy way out of learning about personal finance. ChatGPT gives confident-sounding answers, but unless you push it, it won’t always explain the “why”.

Used well, AI is a great tool to learn the foundations of financial planning. But following its recommendations blindly is like betting on a football match without knowing the teams or the rules. And to make it trickier, AI still hallucinates.

In any case, if you’re using ChatGPT to make stock picks, realise that that doesn’t make investing any less risky than doing it yourself or even hiring a professional. As history shows, most active investors underperform the market over the long run.

Nobody, human or AI, knows for sure where markets are headed.

And please, make sure the percentages it gives you actually add up to 100.

TL;DR

- Many Singaporeans are now using AI for money advice

- ChatGPT can give personalised, locally relevant tips (like factoring in CPF), but it sometimes makes errors and won’t challenge your assumptions

- Apps such as Redflags.sg can help make things like decoding insurance documents less painful

- AI won’t replace financial advisers, but for those already making their own financial plans, it’s surprisingly useful

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.