😧 Investing in a tariff-fying world

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

[SINGAPORE] China and the United States have agreed to reduce reciprocal tariffs on each other for 90 days and commit to trade talks, a move that has calmed investors fearing a global slowdown.

Knowing that, how should you invest differently? Buy stocks, they say – but which ones? Stocks from practically every developed country will benefit. Or buy the US dollar, which investors have fled from since the tariffs? Perhaps sell gold, which investors have lately been turning to for safety?

The problem, as you may have already realised, is that unless you had insider knowledge that the tariff pause was going to happen, it’s probably too late to do all of these things.

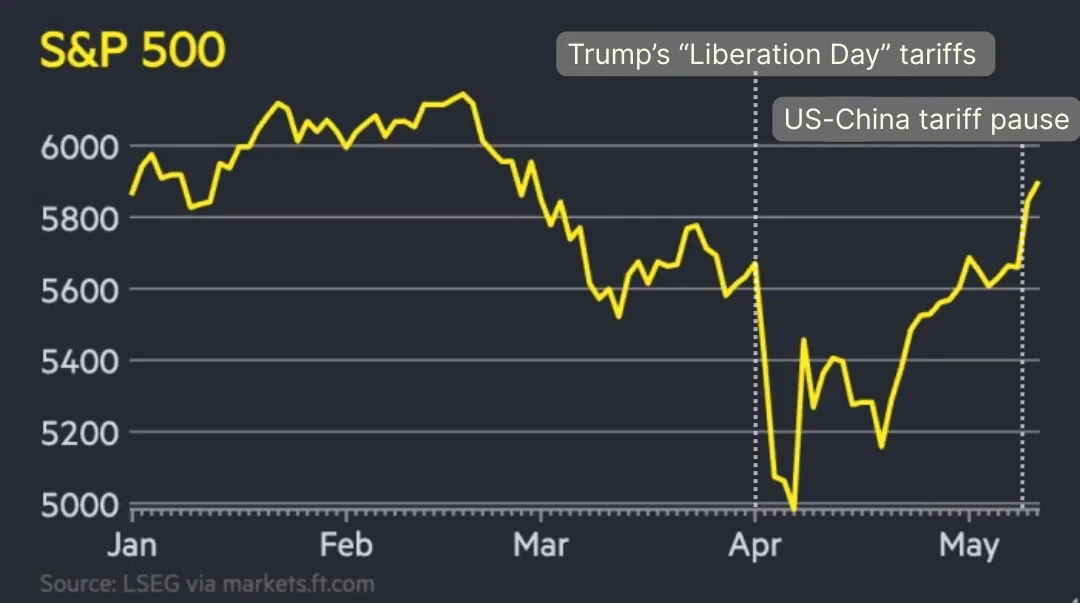

The S&P 500 stock market index jumped 3.3 per cent (that’s huge for an index) on Monday (May 12), following the tariff pause announcement. The US dollar surged while gold lost 2.7 per cent.

Some may say that the news of the tariff pause is “priced-in”. As regular Joe investors, that’s the challenge we often face.

We’ll often be late if we try to make short-term trading decisions based on the news we read. (Trading bots and professional traders would have reacted before we finished reading the article.)

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

We’re at the stage now where the US tariffs on most countries, including China, have been temporarily lowered. (Additional tariffs on Chinese imports were reduced from 145 per cent to 30 per cent, and the universal 10 per cent tariffs on most countries remain in place.)

While financial markets cheered the move, businesses are still unsure of what will happen after the 90 days. So, how should we invest when the future is so uncertain?

🕜 How long is “long term”?

Firstly, don’t panic and avoid knee-jerk reactions. One of the golden rules of long-term investing is to stay invested and not panic sell at the first hint of trouble.

Your stock investments may rise and fall dramatically from week to week. But zoom out, and you’ll see that stocks will rise over the long term.

But there’s nuance to this truism – I’ll touch on two.

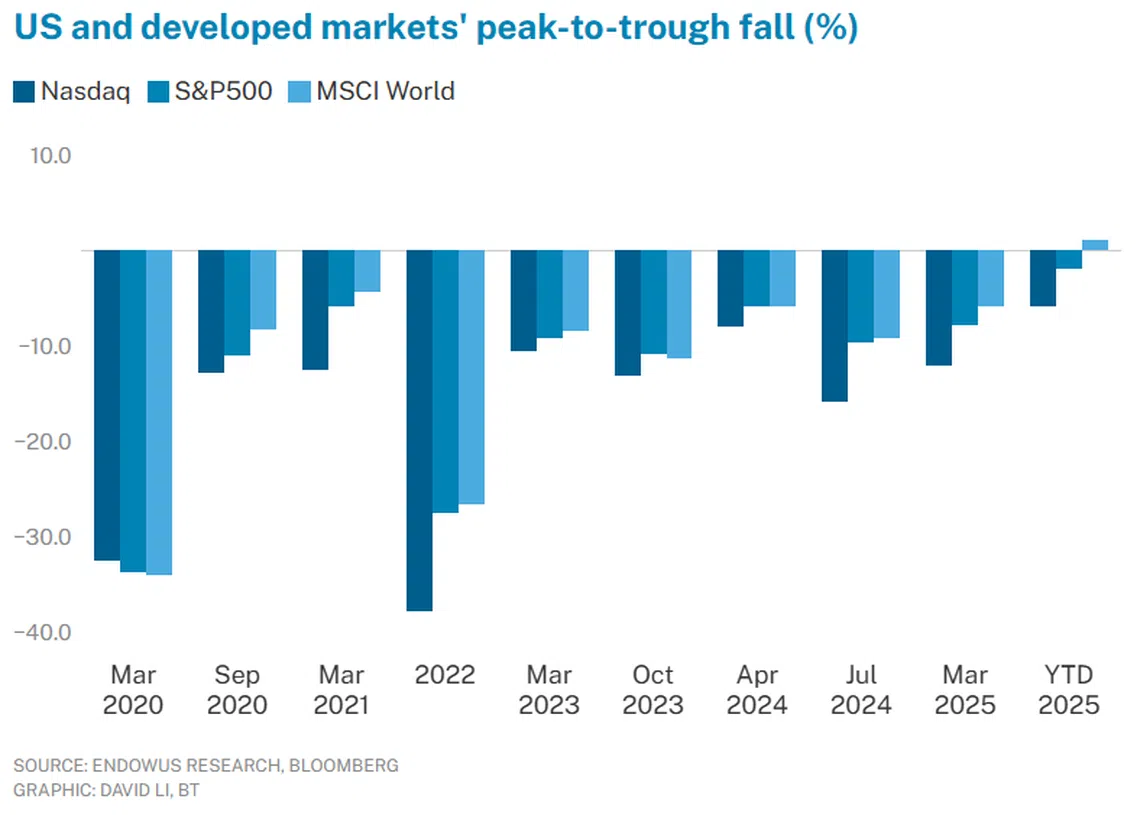

Firstly, the US stock market often bounces back quickly after a decline. This may take months or a couple of years. Some crashes have taken longer.

If you had invested in the S&P 500 index before the dot-com bubble in 2000, your investment wouldn’t have grown even after 10 years had passed. Going further back to the Great Depression in the 1930s, the S&P 500 took 15 years to recover.

Christopher Tan, chief executive officer of wealth advisory firm Providend, notes that it was during this time that the US enacted the Smoot-Hawley Tariff Act, now widely blamed for worsening the Great Depression. The Act raised US tariffs on foreign imports by about 20 per cent – sounds familiar?

While there’s no telling if history will repeat itself, it’s important to prepare for the possibility of prolonged drawdowns to our portfolios. And if we can’t stomach that, take steps to strike a balance that’ll help us sleep well at night.

🧺 What you’re invested in matters

Secondly, we’ve so far been talking about the S&P 500, the de facto measure of the US stock market that tracks the performance of the 500 leading companies listed in the US.

It’s often said that all you need for investments is to buy an S&P 500 index fund, and you’re set. While investors who followed this bit of advice have profited greatly, experts have warned that investors who hold only an S&P 500 index fund may not be diversifying their investments enough.

While the US market has done well over the past 100 years, there’s a growing worry that things will not remain the same in the future, especially given US President Donald Trump’s on-again, off-again stance on tariffs.

With volatility ahead, many analysts recommend reducing risk to protect your capital. After all, Trump’s trade war has only paused, not ended, and the US’ 10 per cent tariffs on most foreign goods are still in place.

But rather than sell off your investments and wait for things to settle down, consider spreading your funds across different assets and geographies.

Diversify by geography: If you’re heavily invested in the US stock market, consider adding stocks or index funds from countries as well. Alternatively, you may wish to invest in a fund that tracks a globally diversified index such as the MSCI All-Country World Index or the FTSE All-World Index.

An added benefit of diversifying your portfolio beyond the US is that it reduces currency risk. With the recent weakening US dollar, those heavily invested in US stocks may have experienced their portfolios losing value in Singapore-dollar terms.

Diversify by assets: If you’re heavily invested in stocks, consider adding other asset types into your portfolio that can cushion the volatility in the stock market.

Commonly, investors have turned to bonds for this because they tend to do well when stocks do badly. But this hasn’t been the case in recent years, such as in 2022 when both stocks and bonds suffered negative returns.

Alternatives include gold, which has been the best-performing asset class this year. Gold prices surged more than 20 per cent this year to date, but many analysts believe it can go higher.

Gold is often described as a safe haven asset because it is a reliable store of value through times of geopolitical uncertainty and inflation. Central banks around the world have also been buying up gold as they seek to diversify their reserves from the US dollar.

Financial advisors typically recommend not holding more than 10 per cent of your portfolio in gold, in the same way you won’t want to hold too large a percentage of an individual stock.

TL;DR

- The US’ tariff actions have made stock markets extremely volatile

- While the S&P 500 has recovered since tariffs were introduced, experts warn that things are still uncertain

- Even investing in an index fund can result in prolonged periods of downturn

- Experts recommend diversifying across asset classes and geographies

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.