🔊 Let’s get loud (about our finances)

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

- Find out more and sign up for Thrive at bt.sg/thrive

😱 Scream and shout?

Would you tell everyone about your desire to save, spend less and manage your finances more prudently? As bizarre as this may sound initially, this phenomenon, also known as loud budgeting, is exactly what has been trending among young adults of late.

The hashtag has over 12.8 million views on TikTok, with many sharing very publicly about their money management decisions.

But is loud budgeting really something to shout about? As a personal finance strategy, how much credibility does it have?

Several financial advisors have in fact given the loud budgeting trend a stamp of approval recently. This is mainly because it advocates accountability, particularly since there’s a public commitment involved.

This comes as telling others why choosing not to spend money on a particular item can provide positive reinforcement and a sense of camaraderie for others out there who are also trying to be thrifty.

According to Lorna Tan, head of financial planning literacy at DBS, loud budgeting is actually a “progressive step” to manage one’s finances.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

“As loud budgeting involves being upfront about your financial circumstances and wanting to have more control in how you spend your money, it does reflect a person’s open commitment to financial security, which is laudable,” Tan tells Thrive.

For example, a loud budgeter may be very public about not dining at expensive restaurants and suggesting more affordable alternatives. Such a step not only shows determination, it also encourages financial planning and more open conversations around it, be it online or offline. This is a good change from shying away from money as a topic of conversation when it’s usually viewed as sensitive or something to be avoided.

“When there is more open dialogue about how people are better managing their finances, more viable solutions are likely to arise,” Tan adds.

However, can loud budgeting at some point take a wrong turn? “If targets are fundamentally unrealistic to meet, an individual could become very stressed and emotionally taxed,” says Tan.

Financial trends like loud budgeting should be anchored in realistic, sustainable goals that make sense for you. Scrimping and saving for the sake of doing so without having a clear idea of what you actually need will likely work against you in the long run.

“Quantifiable and well-defined objectives like saving for a wedding, one’s first home or a master’s degree can be useful in building an organised, realistic budget,” Tan adds.

🗣️ Walking the talk

But if loud budgeting just isn’t your thing, that’s fine. Here are some more mainstream budgeting practices that you might find more helpful:

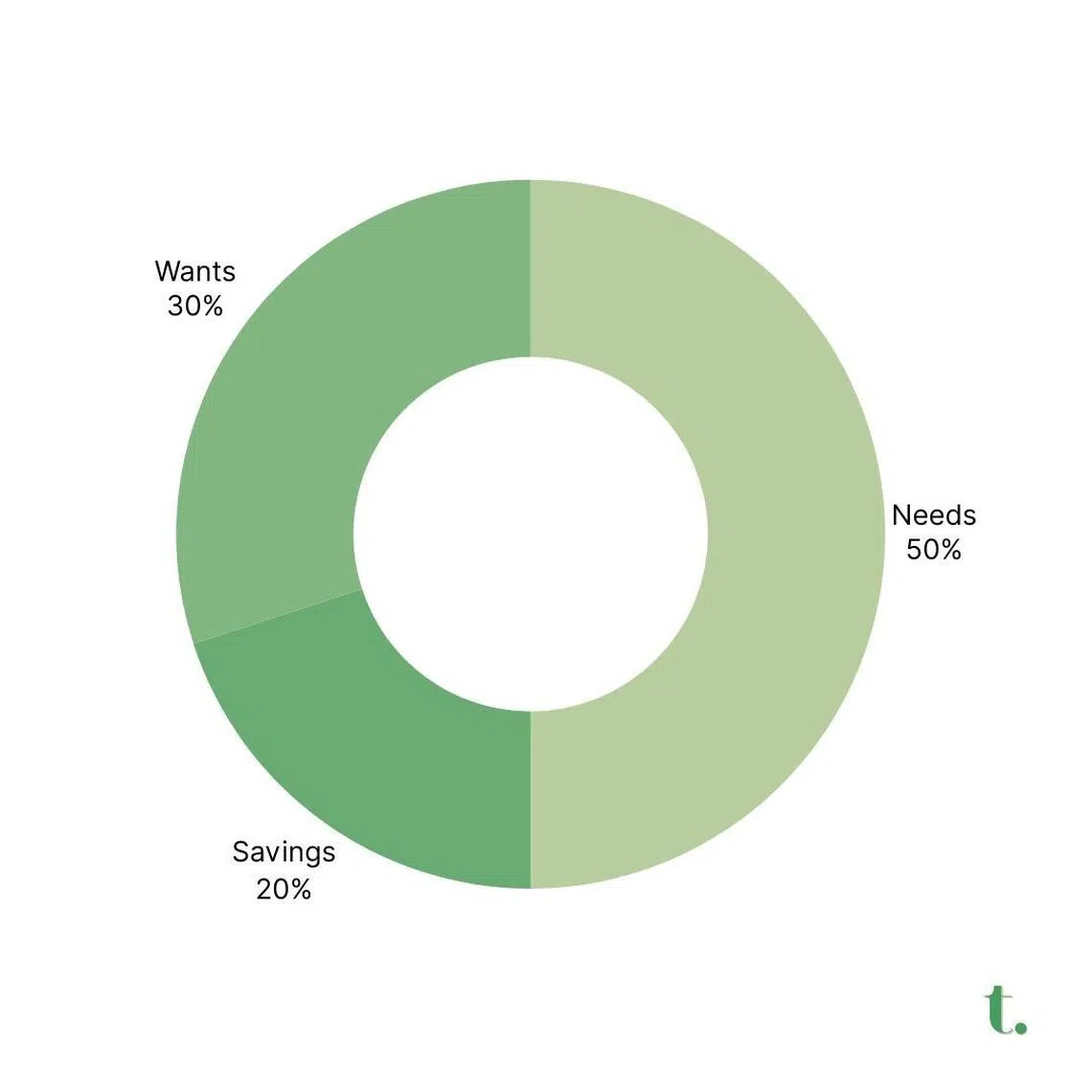

- Follow the 50/30/20 rule: This is a quick and easy way to organise what to do with your income to prioritise long-term success and stability. The formula goes – 50 per cent on needs, 30 per cent on wants and 20 per cent on savings. It’s a good way to start instilling discipline in the way you save and what you spend on, to reach your financial goals more efficiently. Of course, this also depends on your personal circumstances as well!

- Track your monthly expenses: By doing so, you will know exactly where your money is going and what you should be cutting back on. Some apps you can use to help you include MoneyManager, Spendee and Monefy. Banks also have such tools for you to utilise.

- Set aside emergency cash: It is important to have an emergency fund of at least three to six months of expenses for rainy days. Having this money on hand ensures that you can handle any contingencies and avoid the undesirable scenario of liquidating other investments at the wrong price and time.

- Make your credit card work smarter for you: Instead of just using debit cards, consider credit cards as they offer cash rebates and reward perks, helping you to save in the long run if you’re disciplined. (Note: Remember to pay your bills in full and before the due date each month. Do also refrain from signing up for more credit cards than you need to avoid incurring credit card debt.)

- Remember to reward yourself on occasion, too! Off the bat, budgeting can sound boring and restrictive and may leave you feeling deprived of the freedom to spend as and when you like. However, if you remember to consistently set aside small amounts of money for occasional treats or save towards a bigger reward like a dream holiday, you will feel less guilty about putting your planning on hold for these occasional indulgences.

So, will you be shouting your financial plans from the rooftops today? Whatever you decide, what’s probably most important is that you practise what you preach. The last thing you’d want to be as a loud budgeter is an empty vessel making the most noise.

TL;DR

- Loud budgeting involves being very public and vocal about the way you manage your money

- It does promote accountability for one’s financial decisions, and encourages financial planning and more open conversations around it

- Unrealistic targets while loud budgeting can create undue stress and pressure 😖

- Making an effort to track your monthly expenses can help you work towards not overspending or making rash, unnecessary purchases

- Most importantly, remember to walk the talk!

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.