📍 Where to invest your money in 2025

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

- Find out more and sign up for thrive at bt.sg/thrive

🧠 Decision paralysis

I’ve been reading up on what experts have to say about investing in 2025, and they all share common themes: How will US President Donald Trump impact investments? How will China react? Will his tariffs bring back inflation?

While these are great questions to ponder over, the reality is that for the vast majority of young investors like ourselves, the answer is quite straightforward – it doesn’t really matter.

Many of us are investing for retirement, which likely won’t be happening for at least another 20 to 30 years. By following time-tested investment strategies like staying invested and diversifying your portfolio, market corrections will likely show up only as blips in your overall investment journey.

More crucially, where you park your money should first be based on your needs and plans before you should even start considering predictions, even those by the smartest analysts.

If you’re preparing for a wedding or renovations later this year, it wouldn’t be wise to punt it all on volatile stocks, no matter how confident you are that stocks will do well this year. Unexpected scenarios can and will happen, and you don’t want to be forced into a position where you need to sell your stocks at a loss when it comes time to pay for those big-ticket items.

That said, here is a list of investments to consider based on your financial needs. Of course, the usual caveats apply – pay off your high-interest loans before you start investing and don’t take on more risk than you can handle or afford to lose.

🏦 High-yield savings accounts

While high-yield savings accounts aren’t technically investments, they continue to offer fairly good returns.

At interest rates of around 3 per cent for the better ones out there, the returns you get are comparable with treasuries and government bonds, with the added benefit of allowing you to withdraw your money instantly.

The catch is that banks typically need you to jump through certain hoops, such as crediting your salary or spending a minimum sum with the bank’s credit or debit card, in order to unlock higher tiers of interest. In fact, rates can go as high as 6 per cent or 7 per cent, but the requirements are harder to achieve.

Best for: Emergency funds. Money you’ll need to pay for your daily necessities.

📱 Cash management accounts

Over the past few years, a slew of cash management accounts have been launched in Singapore by robo-advisors, brokerage firms and a newcomer whose only business is their cash management account.

Practically, they work like bank savings accounts, with the potential of higher interest rates. Some also offer instant withdrawals.

Except, they’re not a bank so funds are not insured by the Singapore Deposit Insurance Corporation, though they often have other ways of making sure your money is safe.

Unlike banks, these accounts typically invest your money into short-term, low-risk assets like money market funds and short-term bond funds. So returns are not always guaranteed. Fees may also apply.

Best for: Emergency funds. Money you’ll need soon but you’re willing to take some risk.

📜 T-bills, SSBs

Why would you want to invest in Treasury bills (T-bills) or Singapore Savings Bonds (SSBs) if you can have comparable rates with a savings account?

For one, banks can change their interest rates at any time, whereas these allow you the certainty of locking in your interest rate for 6 months to 10 years.

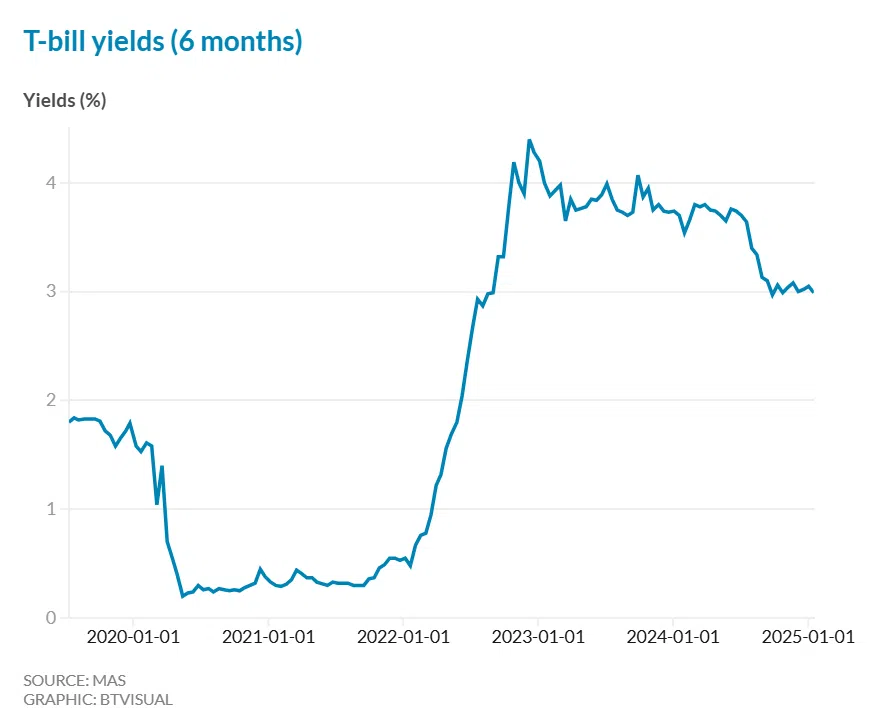

Despite a series of interest rate cuts by the US Federal Reserve, which affects rates in Singapore, T-bill rates are still holding steady at around 3 per cent. With concerns over inflation being sticky, rates are still expected to remain attractive in 2025.

But you might want to consider how much you allocate to fixed income. A recent DBS study found that for those aged 25 to 44, over half of their investments go to instruments such as T-bills and SSBs. Given the longer time horizon that they have, young investors might lose out on potentially higher returns by playing it too safe.

Best for: Money you’ll need for big-ticket purchases in the near future, such as renovation costs for your new flat. Conservative investors who want guaranteed returns.

💼 Corporate bond funds

These are similar to government bonds, except you’re making a loan to a company and not a government. It’s for this reason that corporate bonds tend to offer higher interest rates than government bonds, since the risk of a company collapsing is higher.

Bond funds help to spread the risk by pooling together bonds from different companies and have lower entry prices than individual bonds, which can go well into the six digits.

While bonds are usually seen as safer than stocks, some high-yield bonds – known as junk bonds – can carry a high risk.

Best for: Investors who want to receive regular dividends with potentially higher yield than government bonds. Investors who want to diversify their investments.

🦁 Singapore stocks, Reits

The Straits Times Index, which tracks the performance of Singapore’s top 30 companies, outperformed major global counterparts last year. In US dollar terms, the index was up 19.8 per cent in total returns including dividends.

Analysts are expecting Singapore stocks to outperform in 2025, but with caveats. While it’s unlikely to repeat 2024’s high, analysts say the market will remain stable.

But beware of falling for home bias. Investing in Singapore stocks isn’t inherently safer than investing overseas even if the companies sound and feel more familiar to you.

Best for: Money you want to grow for retirement.

📈 Global stocks

A well-diversified index fund of the biggest companies in the US or the world is one of the most popular ways for young investors to get exposure to global stocks.

Young investors can benefit from the higher potential returns and are more able to withstand the higher levels of volatility because of their longer investment horizon.

Many analysts are expecting solid gains for global stocks, including in the US where fears of a recession have subsided.

Best for: Money you want to grow for retirement.

That said, if you’re already on track with your savings and investment goals, there’s no harm spending it on a short holiday or waging it on some post-CNY hangover mahjong sessions.

That’s why it’s important to keep track of your savings at least once a year so that you can have fun with your money once in a while, guilt-free. (Not that we’re promoting gambling, of course.)

TL;DR

- Investment predictions are just that – predictions

- What’s more important is investing based on your needs and plans

- If you need the money in the short-term, consider savings accounts, T-bills, cash management accounts

- If you’re saving that money for retirement, make your money work harder by investing in longer-term assets

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.