🧹 Spring clean your finances

- Find out more and sign up for Thrive at bt.sg/thrive

🍊 Financial housekeeping

A cluttered bedroom can stress you out. The same goes for your finances. When you have funds invested all over the place and a leaky bank account that drains money away into who-knows-what every month, it’s hard to make informed decisions about your money.

With bonus season having just passed us and the hongbaos starting to flow in, it’s as good a time as any to do some financial Marie Kondo-ing 🏮.

1. Clear out your debt

At the risk of sounding like a broken record, please clear your bad debts. There’s a reason why any article related to financial planning talks about this and why it’s No. 1 on our list: Debt can very easily snowball and derail your life plans.

One of the scariest types of debt you can have is credit card debt, which has interest rates of over 25 per cent per annum. When you have multiple debts, a cost-effective method is to meet the minimum payments on all your loans, then start paying off debts with the highest interest rate.

Even if you have “good” debt like student loans, calculate if it is worth paying down the principal with your bonus from work or hongbao money. It doesn’t make sense to buy 10-year Singapore Savings Bonds at 2.88 per cent when the interest rate on your tuition fee loan is upwards of 4 per cent per annum. Furthermore, student loans usually allow you to make early repayments without penalties.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

2. Trash your unused credit cards

Applied for a credit card for a Dyson hairdryer as a sign-up bonus? If you don’t intend to use those cards, remember to cancel them before the bank starts charging you an annual fee. Lower-end card fees can reach about S$200 each, or the equivalent of hongbaos from four generous aunties.

While you’re at it, check if your bank has made any changes to the requirements for cashback or miles rewards for your credit card spend.

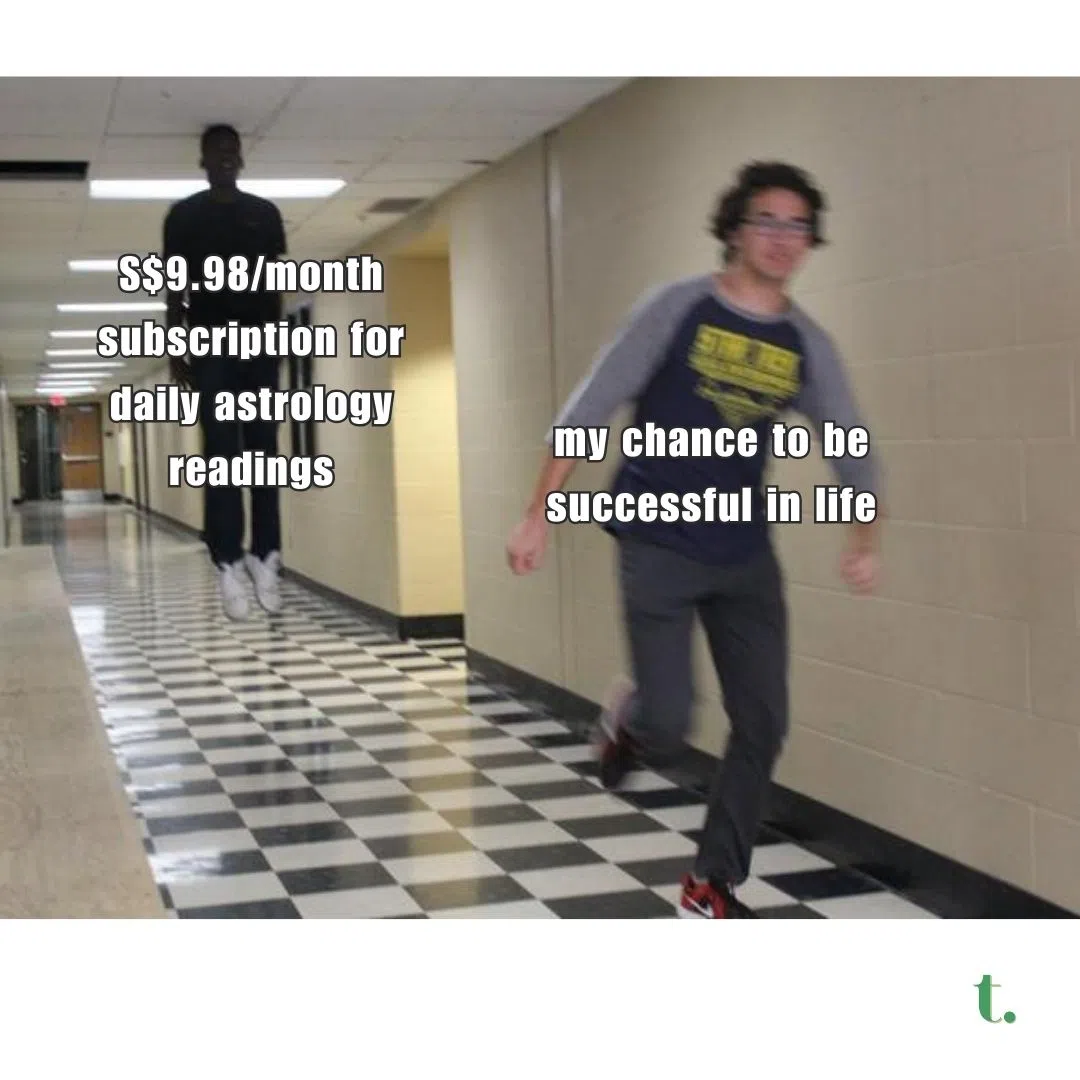

3. Kill your unwanted subscriptions

With every company going down the Netflix route of imposing recurring subscriptions, it’s easy to forget what you’re paying for every month.

Look at your bank statements to see whether you’re paying for any unwanted services. Remember when you resolved last year to exercise more and signed up for that gym membership? Perhaps it’s time to be honest with yourself…

4. Refresh your budget

Since you’ve already downloaded your bank statements, why not tally up your spending over the last year while you’re at it? Coming up with a budget is easy, but where many people fail is in tracking their spending.

For myself, at least, I often underestimate how much I spend every month. This is especially true when I factor in bigger purchases – like anniversary dinners or birthday presents – because I tell myself they are a “one-off” when they’re actually not.

With actual numbers rather than guesstimates, you’ll be able to better gauge whether you need to adjust your spending this year.

5. Take inventory of your assets

You don’t have to be rich to lose track of your wealth. It’s actually fairly common when you own investment products on different platforms or spread your cash across multiple savings accounts or digital banks to maximise interest on your savings.

Take stock, perhaps on a spreadsheet, of where all your money is. Find out how much savings you have accumulated (this will be helpful in the next step).

Review your investments. Do you need to rebalance your portfolio because you made crazy gains on one stock? Does your thesis for your stock picks still hold, or have there been new developments in those companies? If you’re holding bags, is it time to cut your losses and deploy that money elsewhere?

6. Revisit your financial goals

Lastly, now that you have a clearer picture of your financials, check in on your money goals. Are your income and savings on track to get you where you need to be? Maybe you estimated that you would earn more money than you did by now, or you didn’t factor in that inflation would add so much to your costs.

Revisiting your financial goals regularly allows you to assess them more objectively, away from the emotions of the time you set them. It’s a good habit to have, so you’ll always have time to make adjustments if you’re falling behind on your goal.

And if you find out you’re on track, it’s encouraging to see how far you’ve come or maybe help you feel less guilty about treating yourself once in a while!

TL;DR

- It’s a good idea to extend the habit of spring cleaning your home to your finances

- Some financial housekeeping will help you cut down on unnecessary spending

- It’ll help you get a sense of where your money is going every month

- Reviewing your finances regularly helps you stay on track with your money goals

Copyright SPH Media. All rights reserved.