💳 What happens when you miss a credit card payment?

Straight to your inbox. Money, career and life hacks to help young adults stay ahead.

- Find out more and sign up for thrive at bt.sg/thrive

⚡ Shocker

At a media briefing by OCBC on the results of a survey of Singaporeans’ financial habits on Nov 14, I came across this shocking statistic.

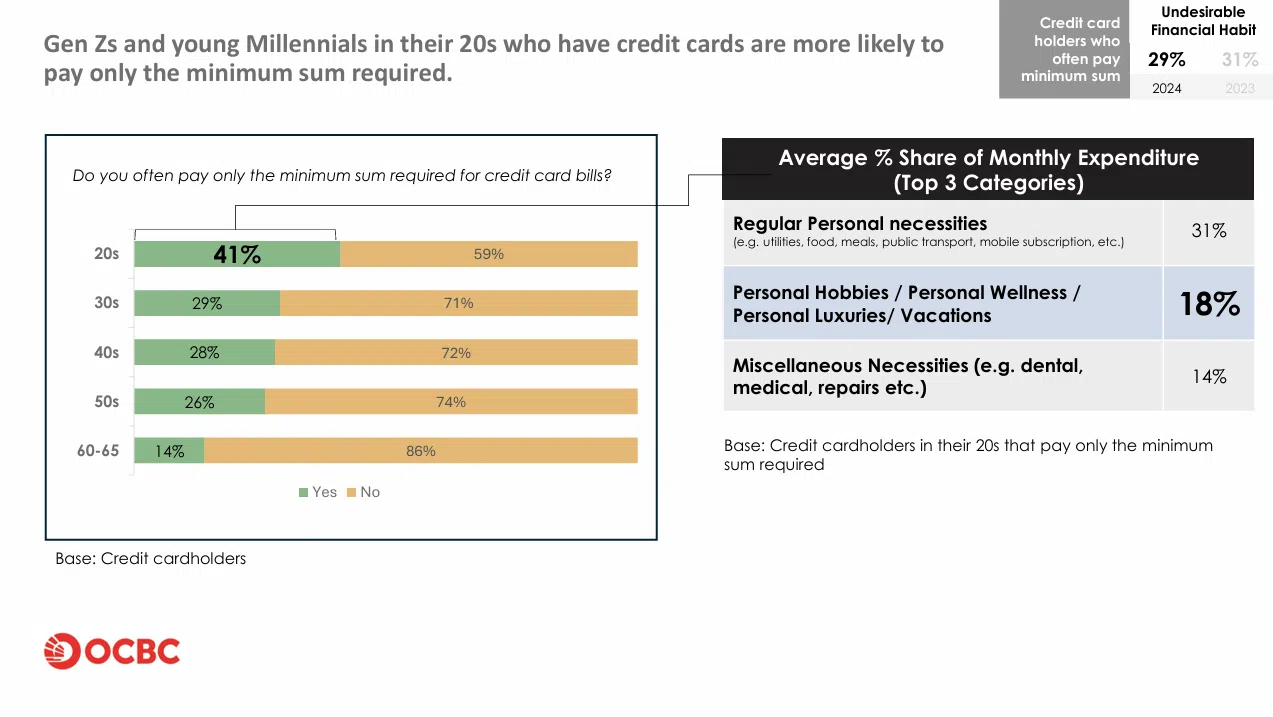

- Some 41 per cent of working adults in their twenties say they often pay only the minimum amount required for their credit card bills.

Credit cards are one of the worst things to owe money on, with interest rates around 26 per cent in Singapore. In comparison, a home loan is about 2.5 per cent and a student loan about 5 per cent.

Sometimes, we may need the extra cash for necessities, which makes up the biggest share of monthly expenditure.

But the second highest category, by percentage of monthly expenditure, was personal hobbies, wellness, luxuries and vacations, according to OCBC’s latest Financial Wellness Index 😱.

In fact, the survey found that 27 per cent of people in their twenties are spending beyond their means to keep up with their peers, up from 19 per cent in the last year’s edition of the survey.

If you’re unable to pay your credit card bills in full every month:

A NEWSLETTER FOR YOU

Friday, 3 pm

Thrive

Money, career and life hacks to help young adults stay ahead of the curve.

- PLEASE stop spending beyond your means

- AT THE VERY LEAST, don’t do it on a credit card!!!

💲 What happens when you don’t pay in full

Let’s assume you have an OCBC credit card. The bank charges an interest rate of 27.78 per cent per annum.

Like many banks, OCBC has a minimum payment of S$50, or 3 per cent of the total balance, whichever is higher.

If you don’t make full payment but make at least the minimum amount, you’ll be charged

- 27.78 per cent interest on the balance that’s unpaid

If you don’t even make the minimum payment, you’ll be charged:

- 30.78 per cent interest on the balance that’s unpaid

- All new purchases start incurring 30.78 per cent interest from the date each purchase is made

- S$100 late payment charge

Some banks also charge an overlimit fee whenever the total outstanding balance of your credit cards exceed your credit limit.

Here’s one way to think about how dangerous high interest debt is: You want to buy an ultra-rare collectible plushie worth S$10,000. Let’s call it a Bulala 🐵.

Set aside S$250 each month and it’ll take you 3 years and 4 months.

But charge it to your credit card now and it’ll take you 9 years and 6 months to clear your loan by paying S$250 each month. At this point, you’d have paid a total of S$28,441.82 for that Bulala.

🆘 What to do when you’re stuck in debt

To be sure, credit card delinquency rates – which counts payments more than 30 days past the due date – among consumers in their twenties remains low and stable at around 1.87 per cent.

That could suggest that young adults who don’t make full payment tend to pay off their loans fairly quickly.

Still, the general manager of charity Credit Counselling Singapore thinks it’s worrying that people aren’t paying off their credit card bills in full.

“It is a concern,” Tan Huey Min says. “Whether it’s not understanding (how credit card payments work), not having good money management behaviours, surviving on credit because of a lack of income, or plain ignorance.”

Late payments on your credit card bills can also decrease your credit score 💯.

Paying the minimum amount, however, does not impact your credit score, the Credit Bureau (Singapore) confirmed with thrive. So, try to at least pay the minimum if you’re unable to pay your bills in full.

In Singapore, a healthy credit score may not get you lower interest rates on your loans, notes David Baey, chief executive officer of Mortgage Master. But if you have a weak credit score, you may not be able to get loans when you need them.

We’ve previously written about spending within your means and how you should be paying off loans with the highest interest first.

If you’re struggling to pay off a large sum of debt across different banks, consider applying for a 🏧 debt consolidation plan with a bank.

All your loans will be consolidated with one bank, often at a lower interest rate, so you won’t have multiple due dates to keep track of, the Credit Bureau says. There will also be a fixed repayment schedule which makes it clear how much you should be paying by when.

That is, however, subject to whether a bank is willing to offer the plan to you. Otherwise, Credit Counselling Singapore also has a 📃 debt management programme that provides a structured repayment plan to pay off your bank at a reduced interest rate until your debts are settled.

The charity also runs a free weekly talk, in-person and online, on managing debt.

“Credit cards are not your money,” says Tan. “Unless you have enough savings to pay off what you charge to your card, don’t buy.”

TL;DR

- Credit cards are one of the worst things to owe money on

- Banks charge high interest rates even if you meet the minimum payment each month

- Yet, 41 per cent of people in their twenties often don’t pay their card bills in full

- For those struggling with debt, consider debt management plans

Copyright SPH Media. All rights reserved.