Are alternative investments for you?

When invested in the right way through diversification and the appropriate amount of risk, alternative assets can be a source of alpha

ALTERNATIVES are all the rage – this is normal as they traditionally outperform when market returns are negative. They give retail investors (and especially accredited investors in Singapore) an increasing number of opportunities to access and invest in an asset class traditionally reserved for institutions such as sovereign wealth funds.

Alternative investments do not fall into the conventional category of publicly traded stocks, bonds and cash. They typically include private equity, private real estate, private credit and hedge funds.

Private equity is the largest and most popular, and can be divided into sub-asset classes depending on the stage of the company’s growth and profitability – such as venture capital, growth capital, buyout and distressed, among others.

Private equity firms generally take a meaningful ownership share of a company and help add value to the management team, or even directly operate the company to grow its business. This is with a view to exiting after a multi-year investment period that is typically much longer than public market investing.

Private credit is a fast-growing segment of alternatives that includes direct lending, distressed debt and mezzanine debt. It has been growing as an alternative asset class as companies stay private for longer, and as banks pull back loans to private borrowers after the 2008 financial crisis, and investors look for less volatile income. Typically, private credit allows for higher yield due to the longer-term nature of the underlying debt.

The size of the private assets market is about US$13 trillion globally. While this is still a fraction of the public securities market, it has been rapidly growing with an ever-increasing allocation by traditional institutional investors.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

A new growth spurt is also driven by individual investors as the market gets disintermediated by both traditional banks such as private banks, and new players such as Endowus.

A recent Goldman Sachs survey on family offices shows that family offices have allocated 26 per cent of their assets to private equity.

Hedge funds are around US$4 trillion in asset size. Hedge fund strategies are broken down into long-short equities, quant, macro, credit relative value, and arbitrage, among others. The hedge funds that have seen the most demand recently are the multi-strategy, multi-manager platform hedge funds which have been able to generate solid and consistent returns uncorrelated to global equity or bond markets.

Depending on the individual’s specific needs and circumstances, the three main reasons investors might consider investing in alternatives are: to improve returns; lower volatility and correlation; and further diversification.

The global public equities market has returned an average 7 per cent per annum over a multi-decade period. There are only a few ways to improve returns above the public equity beta over a longer-term period. These include alpha; illiquidity premium; and leverage.

Alternative investments have a higher chance of alpha generation in private opportunities that are available only for a small group of investors. There may also be greater flexibility to achieve alpha with the absence of benchmarks and the use of shorts and derivatives.

It also has an illiquidity premium as long-term capital that does not need to be withdrawn can demand higher returns from companies that need funding.

Lastly, leverage. Many private equity funds and hedge funds use leverage to enhance returns if the underlying asset has strong fundamentals and/or has relatively little risk.

Lower volatility and correlation

Alternative investments tend to have lower volatility compared with the public markets, as private equity firms would value their funds (mark to market) on a less-frequent basis, often based on “events” such as the pricing of the latest fundraising round. Thus, they are not subject to the daily volatility of public markets.

Hedge funds tend to have lower volatility and correlation because of their use of shorts and derivatives. The idea of a hedge fund is to “hedge” the risks. They would at least partially hedge market risk (or public equity beta), and thus lower its volatility and correlation.

Broader diversification

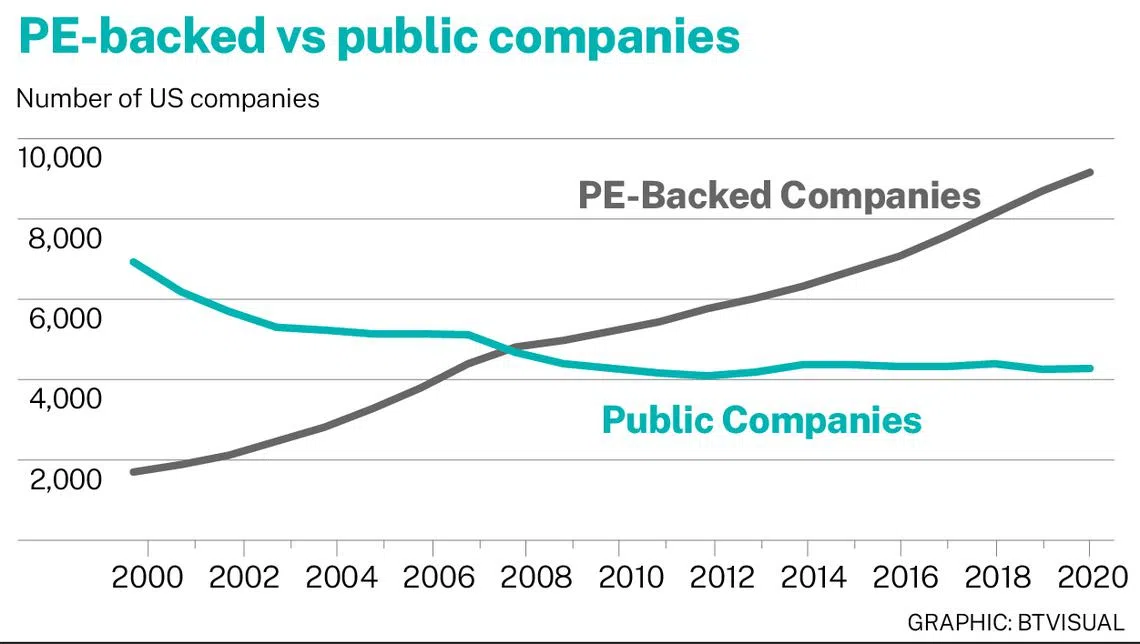

Alternatives can provide broader diversification for a portfolio, as it gives access to private companies that are otherwise not available in public markets. The universe of private companies is getting larger as companies stay private for longer.

Alternatives would also likely have more flexibility to include segments that are harder to access. These include aircraft leasing, ownership of sports franchises, senior housing and music intellectual property (IP).

Hurdles and risks

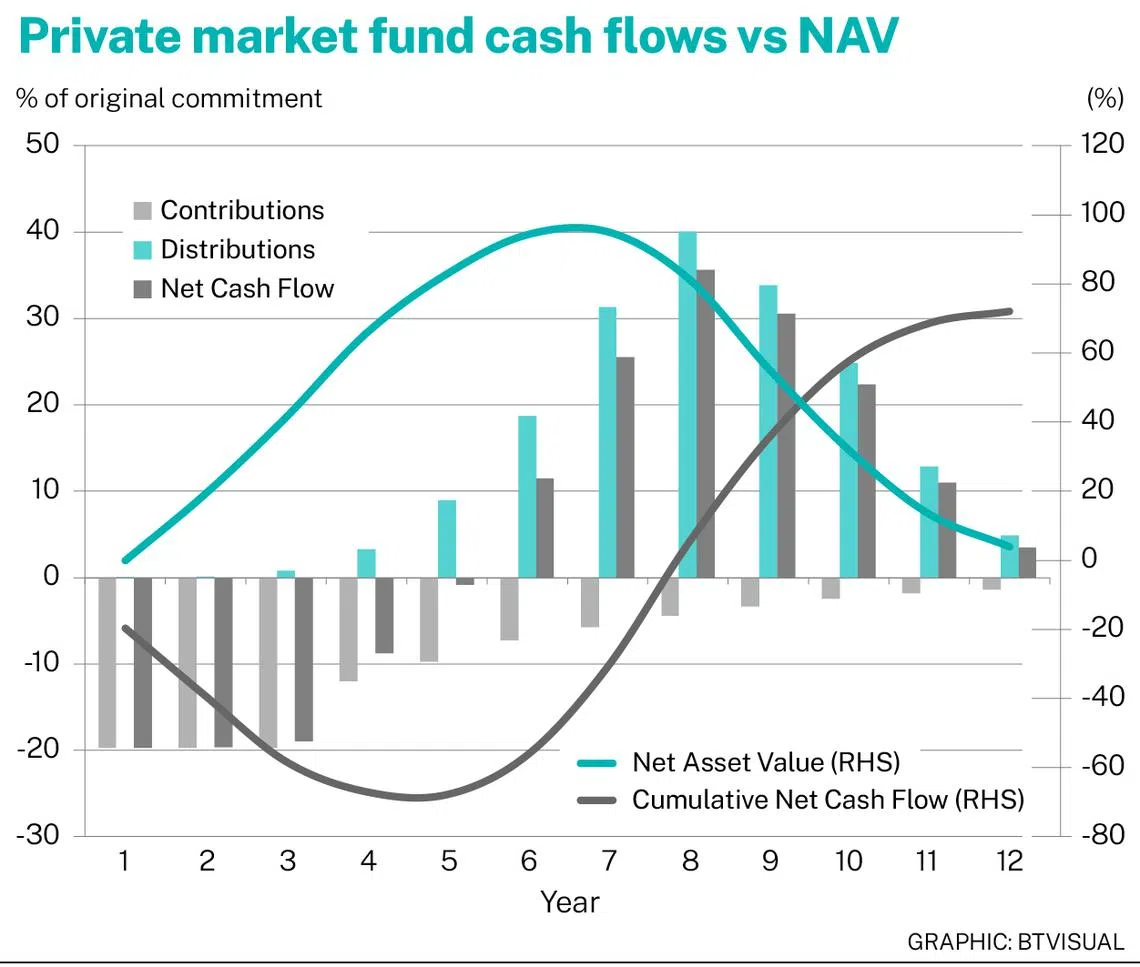

In the past, alternatives were not widely available for the general public due to lack of access, large minimum investment hurdles and high costs. Moreover, most private market funds have a “J curve” as shown in the accompanying chart which makes it difficult for individual investors to manage their cash flow as capital calls are typically made over time.

Many new digital players have been expanding access to alternatives offerings. Some factors help to facilitate access for individual investors. One is a lower minimum investment amount; second, a better liquidity hurdle to reduce angst that comes from investing in illiquid assets; and third, an open-ended structure with the investors’ money fully invested as managing capital calls is difficult and adds further risk for individuals.

While alternatives as an asset class have provided meaningful benefits to long-term investors, it is also important to understand the risks.

Liquidity is a key risk because of the long fund life, notice periods, gates and lock-ups that make it hard to access your capital. This is due to the potential mismatch of the liquidity of underlying investments and the liquidity needs of investors.

Moreover, liquidity in investments that are not diversified by region, vintage or asset class may be at risk in times of crisis. Hence, it is important to be invested in alternatives that are as diversified as possible.

Leverage is another key risk. Leverage is a double-edged sword that can be powerful when used properly, but dangerous when it is abused.

Cost is also a risk that can dilute the performance of a portfolio over the long run. Cost can include anything from a high management fee and performance fee – also known as carry – or the overuse of beta hedging that dilutes market performance.

Alternative investments such as hedge funds are not as regulated as fund vehicles such as unit trusts. This means the disclosures may not be as standardised as other retail products, and information may be less accessible. While there is a place for alternatives in your portfolio, a proper understanding of the benefits and risks would determine the right allocation for you.

Improving access to private and illiquid assets for individual investors is an important part of democratising wealth management.

However, it is also important that alternatives are approached in the right way for the right reasons. Otherwise, they may struggle to generate returns comparable to investing in a passive equities index or a 60:40 balanced portfolio.

The evidence is clear that when invested in the right way through diversification and the appropriate amount of risk, alternatives are a great source of alpha. It is important to have a trusted, independent, and professional adviser to guide you and help to achieve good outcomes.

The writer is chief investment advisory officer, Endowus, an independent wealth platform advising over S$5 billion in individual and family client assets across public and private markets

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Share with us your feedback on BT's products and services