The new Bitcoin and Ethereum perpetual futures on SGX: How do they work?

They aim to meet rising institutional crypto demand by linking traditional finance and crypto-native ecosystems

[SINGAPORE] Cryptocurrencies’ upward trajectory for most of 2025 continues with the Singapore Exchange’s (SGX) launch of perpetual cryptocurrency futures on Monday (Nov 24).

The move, first announced in March, further reinforces Singapore’s leadership in the digital asset space and makes SGX one of the first exchanges in the world to offer such a derivative.

Japan’s Osaka Dojima Exchange has also reportedly been exploring Bitcoin futures, while US exchanges such as the Chicago Mercantile Exchange and Cboe Global Markets are planning to launch similar products.

The launch of Bitcoin and Ethereum futures on SGX aims to meet rising institutional crypto demand by linking traditional finance and crypto-native ecosystems.

Perpetual futures account for more than US$187 billion in daily average volumes globally, with Asia at the epicentre of growth, but remain largely priced off and settled on offshore platforms outside the region, said SGX.

So what are these perpetual Bitcoin and Ethereum futures, and how do they work? The Business Times takes a look.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

What are “perps”?

A futures contract is effectively a legal agreement where one party must buy or sell a commodity, asset or security at a predetermined price on a predetermined date. A perpetual future is very similar, except it has no expiration date.

That means that traders do not need to own or deliver the underlying asset and can freely speculate on its price and movements.

Coinbase, one of the world’s largest cryptocurrency exchanges, said in a 2024 blog post that perpetual futures – or “perps” – constitute the majority of cryptocurrency trading volumes.

Bitcoin perps had a daily average volume of US$57.7 billion on weekdays in the first quarter of 2024, three times larger than the US$18.8 billion average weekday spot volume.

Perps dominate cryptocurrency trading because they match its characteristics well. Crypto trades 24/7, has no physical delivery needs and often spans fragmented spot markets, making continuous contracts more practical than fixed-expiry futures. SGX’s perps will trade for 22.5 hours and across five days.

Traditional assets such as commodities, equities and interest-rate futures instead rely on contract expiries for settlement, delivery and risk management. Regulators also enforce limits on leverage and contract structure, making perpetual contracts impractical and risky for these markets.

Except for the tail end of 2022, following the collapse of cryptocurrency exchange FTX, perps have been the dominant means for trading Bitcoin exposure since late 2020, said Coinbase. They have also become “increasingly utilised” compared to fixed-term futures as measured by notional volume.

Part of the popularity of perps is the oft-easy access to borrowed funds, alongside the removal of rollover costs associated with fixed-term futures, added the exchange.

Perps use a funding rate mechanism to keep their prices aligned with the security’s spot price. This mechanism involves regular payments between the buyer and seller of the contract, calculated based on a combination of the perp’s price, the underlying security’s spot price and an interest rate component (the cost of borrowing or lending the underlying asset).

The payments formula sometimes also includes a cap and a floor to set a maximum and minimum funding rate.

“The funding rate mechanism enables perps prices to track spot prices with a similar precision as fixed-term futures. This makes perps popular not only for directional speculation, but also for hedging or arbitrage strategies,” said Coinbase.

Hassan Ahmed, head of country for Coinbase Singapore, said the funding rate was “almost like a rubber band”. As the price for the perp moves too far away from the security’s spot price, the funding rate gets more expensive.

That allows buyers (or longs) to pay sellers (or shorts) if the perp price is above the security price, and the inverse if it is below the security price.

Ahmed estimated that 90 per cent of trading in crypto markets is on perps and that perp trading has “only gotten bigger” over the years.

Such is the popularity of perps that the derivative is being brought over to equities as well. US-based software firm Architect Financial Technologies in October introduced the first regulated exchange for trading perpetual futures on traditional underlying asset classes. These include foreign currencies, interest rates and stock indices.

While perps have a few benefits, such as being able to hold onto the contract indefinitely, having greater liquidity than the security’s spot market (or even options) and being able to more efficiently use capital through leverage, there are risks as well.

The existence of leverage implies amplified returns, which applies to the downside as well as upside. The threat of liquidation – especially if working with limited capital – also requires a carefully planned risk management profile.

Still, investors using SGX’s perps will not have positions immediately liquidated if the market suddenly shifts. Instead, they will receive margin calls and will need to top up their collateral.

Bitcoin, Ethereum futures seen to boost market further

SGX’s introduction of Bitcoin and Ethereum perps is a way to “meet the crypto market where it is” as the derivative is “widely understood and accepted”, said Ahmed.

Ahmed added that Bitcoin and Ethereum perps could be a boost to the exchange itself.

Singapore has been looking for ways to revitalise SGX. In February, it unveiled the S$5 billion Equity Market Development Programme.

Last week, SGX announced further measures to strengthen the Singapore equities market through a dual-listing bridge between SGX and Nasdaq, as well as a “Value Unlock” programme to help listed companies strengthen investment engagement.

Ahmed believes that the introduction of perps on SGX will also be a boost to the crypto market in Singapore.

“Just in terms of ecosystem expansion, market access, credentialling… it’s actually a very strong positive signal that we’re excited about,” said Ahmed. “Overall, I’ve always seen this as expanding the pie.”

He pointed out that many market participants including investment banks, family offices and high-frequency traders would likely have been looking to get crypto exposure, but would have been limited without nationally approved exchanges offering crypto products such as perps.

SGX’s perps will be limited to institutional, accredited and expert investors, with the Monetary Authority of Singapore describing crypto as “highly hazardous for retail investors” on its website.

However, Ahmed believes that the US’ crypto push this year has “reset” the playing field and begun exerting pressure on existing regulators to find ways to preserve their digital asset leadership. That pressure could potentially spur the stance against retail involvement to change in the future, speculated Ahmed.

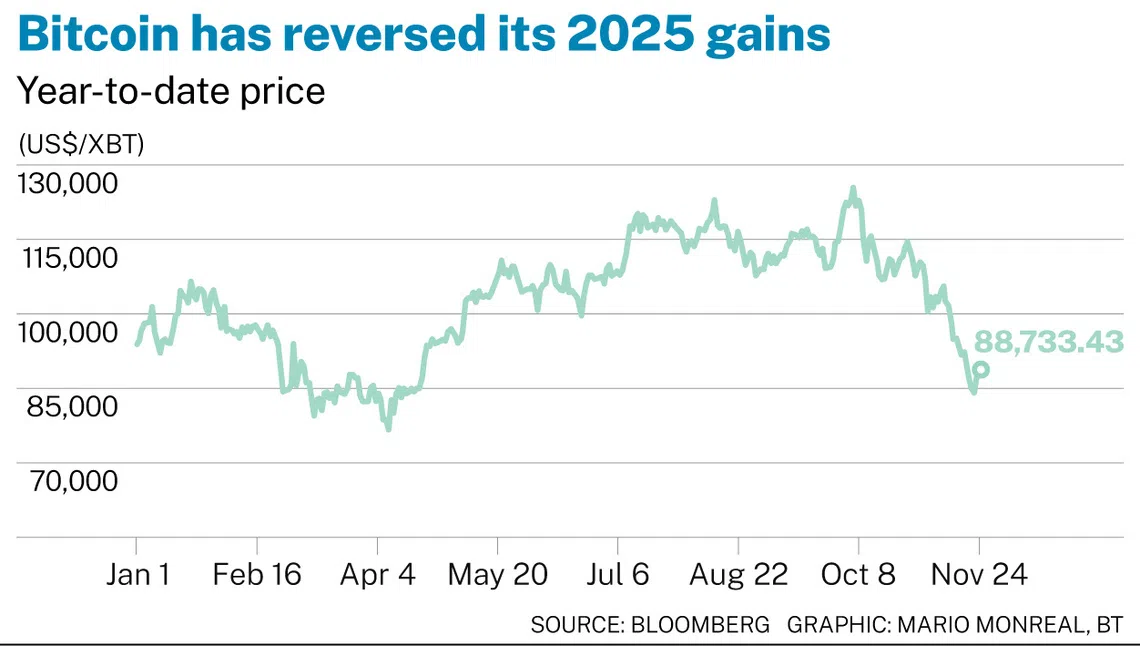

Bitcoin futures introduced just as gains wiped out

The introduction of the perps comes at a time when a correction in Bitcoin has erased the gains it made in 2025. The cryptocurrency peaked at US$126,251 just last month, before falling below US$90,000.

Ahmed said the long-term fundamentals of Bitcoin and crypto haven’t changed, despite the reversal in fortunes, and SGX’s launch of perps during a downturn can actually be a positive.

“The key benefit of launching during a downturn is that institutions get to see the value of perps as genuine risk-management tools rather than speculative instruments,” he said. “From a risk perspective, the same principles apply: perps carry leverage, funding rates move with market sentiment and participants need to understand liquidation dynamics.”

Still, investors participating in SGX perp trading should “understand what they are signing up” for when adding such leverage to their portfolios.

“Maybe there’s some more education, even to institutional participants, that (SGX is) going to have to do along the way,” said Ahmed.

He pointed out that Bitcoin’s volatility has fallen over the years. In 2025, every company in the Nasdaq 100 index became more volatile than Bitcoin during the Fed rate cut as measured by three-month realised volatility, according to cryptocurrency exchange and wallet service Cex.io in September.

For institutional investors, this relative stability combined with the safety of a regulated exchange could be the turning point. If Bitcoin behaves more like a tech stock and less like a lottery ticket, then SGX’s new perps may have arrived at the exact moment traditional finance is ready to embrace them.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.