How seriously at risk is China’s property market?

The root causes of the country’s property sector woes can be traced to misguided incentives in the 1998-2003 housing reform but a systemic fallout is unlikely

CHINA’S housing market has entered a structural downtrend as the population ages and per capita housing space approaches the developed market average. However, the market’s contraction since late-2021 has been particularly swift.

Beijing’s efforts to reduce debt in the property sector have led to a liquidity squeeze that has shaken homebuyers’ confidence in developers’ ability to deliver pre-sold homes. These factors have heightened the structural pressures in this market.

The scale of the problem

The direct impact: It is estimated that real estate investment accounts for 25 per cent of China’s total fixed-asset investment in construction, property services and supply, as well as related sectors including energy, financing, furniture, transport and storage. From this perspective, a 10 per cent fall in property-related activities could cut already slowing GDP growth by 2.5 percentage points.

The wealth effect: A 2019 survey by the People’s Bank of China (PBOC) showed that housing accounted for almost 60 per cent of household assets. This suggests that falling property prices would hit household wealth and consumption.

Banks’ exposure: Mortgage loans have risen from less than 1 per cent of total loans in 1998, when the housing reform started, to 20 per cent today. Banks’ direct and indirect exposure to the property sector is estimated at more than 50 per cent of their total loans, raising concerns about systemic risk should the property market crash.

Developers’ reliance on revenues from home sales (including pre-sales) for financing has aggravated such concerns. The pre-sale model significantly increases developers’ indebtedness. Developers often receive government licences to sell homes immediately after laying the foundations. This enables them to raise cash quickly to buy more land, which is then used to collateralise more borrowing.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Liquidity problems arose when new home sales, and hence revenues, dropped sharply. The government’s restrictive property financing policy aggravated the liquidity squeeze, leading to a rise in developer defaults and financial system credit risk.

Catalyst for the downturn

The root of the current downturn can be found in the 1998-2003 housing reforms and the subsequent economic boom that resulted in speculative excesses and destroyed housing affordability.

In August 2020, to force developers to reduce their burgeoning debt, China implemented a “three red lines” policy:

- Developers’ liabilities should not exceed 70 per cent of their assets, excluding advance proceeds from projects sold on contract.

- Developers’ net debt should not exceed their equity.

- Developers must hold cash at levels at least equal to their short-term borrowings.

Developers who cross any of these limits would face formal restrictions on their borrowing.

Arguably, this policy is behind the current downturn. Property market activity started to contract sharply, while anti-speculation measures added to the woes.

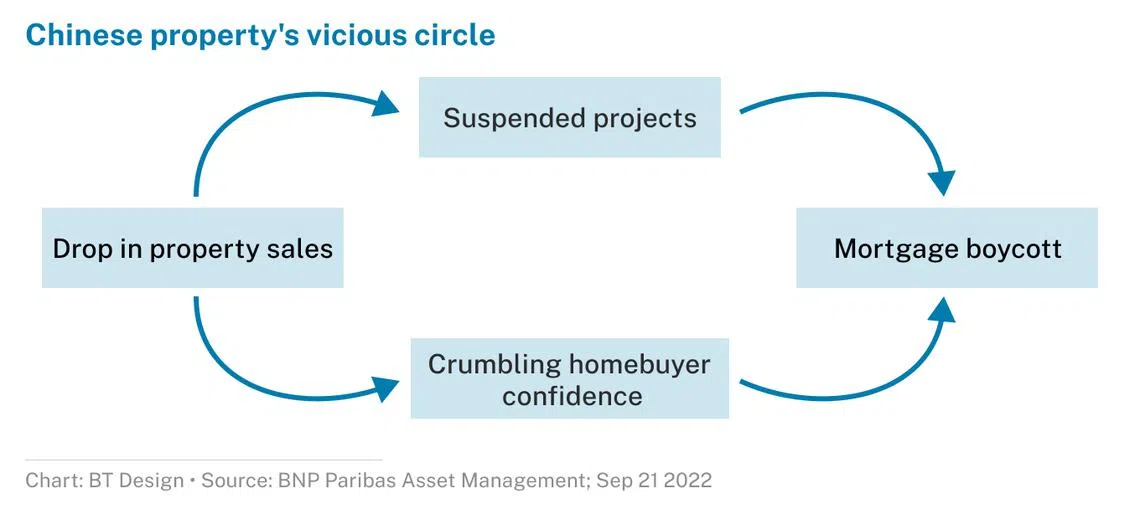

The plunge in housing sales and presales since early 2022 has further tightened developers’ liquidity, leading them to suspend pre-sold projects that have not been completed. This prompted homebuyers to withhold mortgage payments, eroding market confidence and reducing sales further.

This, in turn, forced more developers to suspend projects, creating a vicious cycle of yet lower confidence, more mortgage boycotts, and a further drop in sales.

Systemic risk?

Nonetheless, a systemic fallout is unlikely, in our view. The banking system has a buffer of 7.8 trillion yuan (S$1.5 trillion) in Tier-1 capital, which is well above the requirements under Basel II rules, according to our estimate. This is almost double the estimated four trillion yuan in debt of the 12 worst affected developers, and 9.5 times more than the estimated non-performing mortgage loans stemming from the mortgage boycott.

One can reasonably expect more property company defaults and sector consolidation in the short to medium term as weak developers exit the market. This process will likely drag further on already slowing gross domestic product (GDP) growth, with a cascading effect on other industries including cement, construction, building materials and consumer discretionary. Importantly, it could jeopardise jobs.

However, the long-term impact may not be negative. It depends on how the “creative destruction” process unfolds as old sectors make room for new ones.

If the labour and capital no longer needed for the property sector can be redeployed effectively in emerging sectors that are focused on high value-added manufacturing and technology, productivity and long-term GDP growth may rise.

What appears certain is that property and construction will go into secular decline and eventually cease to be major drivers of GDP growth.

The writer is senior market strategist (Asia Pacific), BNP Paribas Asset Management

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.