A beginner's guide to investing

Here are the first steps to take before you start trading

Claudia Tan HS

INVESTING can be daunting if you have no idea where to start. And it does not help that FOMO (fear of missing out) creeps in when investment-savvy peers are constantly posting about chasing meme stocks or buying the dips.

This inertia to start is legit. Fret not - it is all right to begin investing only when you feel like you are up for it.

If you are ready to buy your very first stock, however, here is how to get started. (And if you are not, save this cheat sheet for when you are all set).

To invest in stocks listed on the Singapore Exchange (SGX), you need two accounts: a central depository (CDP) account and a trading account. We will get to investing in global markets later.

What is a CDP account?

The CDP is managed by SGX. It acts like a safe to hold the shares you have bought, regardless of which brokerage you use to buy them.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Even if the brokerage you use goes belly-up, the shares will be untouched with the CDP.

How to open a CDP account?

- Make sure you have a savings or current bank account with one of the following banks: Citibank, DBS/POSB, HSBC, Maybank, OCBC, Standard Chartered Bank or UOB.

- Fill up the CDP online application form on SGX's website.

Tip: For Singapore citizens and permanent residents, you have the option of signing up using SingPass for a much quicker application process. The CDP account opening form will be pre-filled with your details retrieved from Myinfo.

- You will get your CDP account number via e-mail in about 15 minutes and your CDP Internet password will be mailed by post within the next few days.

- Log in via SingPass or CDP Internet user ID and password to view your stock portfolio and account statements.

What is a trading account?

It allows you to buy and sell shares on the Singapore market and across global exchanges. You can also access other investment products such as bonds. There are at least 11 brokerages in Singapore that offer CDP-linked trading accounts.

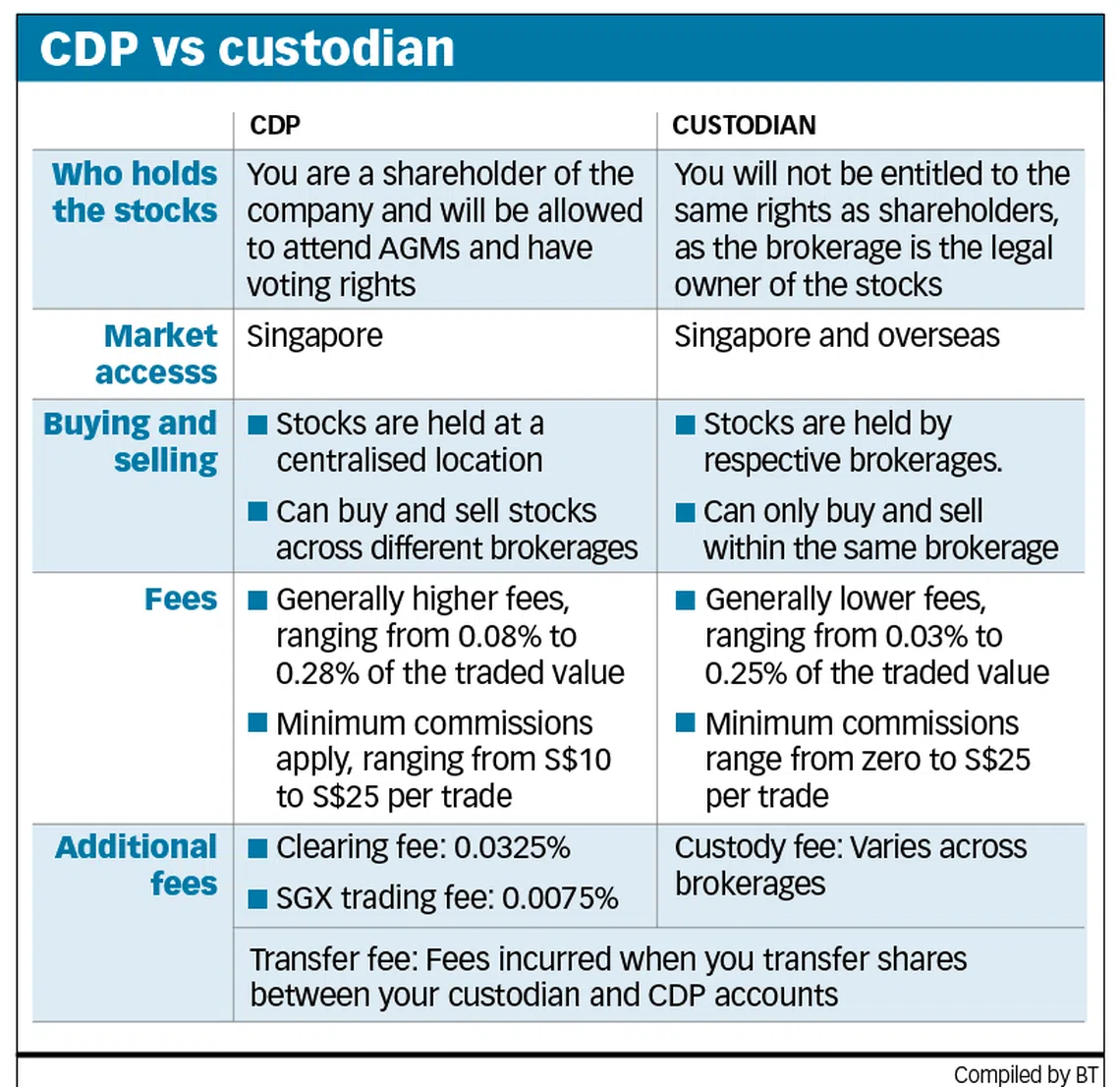

A CDP account and a trading account give you access to Singapore stocks. But if you are keen on investing in markets outside Singapore, you will need a custodian account.

What is a custodian account?

It is operated by the respective brokerage you sign up with. Stocks that you have purchased will not be held under your name. They are instead under the custody of the brokerage you are using. You can also use custodian accounts to buy and hold Singapore stocks.

There are at least 15 brokerages offering custodian accounts in Singapore for overseas trading, and even more when you take robo-advisors into consideration.

CDP vs custodian account

Making a choice

Here are some useful things to think about to narrow down your choices.

- Fees and commissions

Additional fees and commissions can eat into your investment returns. Have a clear idea of how much you are willing to pay and the type of investment you are focusing on.

For instance, are you an active trader or a passive investor? If you trade in large blocks but less frequently, you may prefer paying more in upfront commission versus paying lower commission but regularly paying a custody fee on your holdings.

- User interface

Find a platform that is user-friendly to you. You would want to be able to navigate the platform with ease, and access what you need without having to turn to Google or call a hotline.

- Type of products you can access

Whether it is stocks, bonds, ETFs (exchange-traded funds) or options, ensure that the platform you have chosen supports the type of investment product you are planning to trade. Some platforms also have access to more markets than others.

- Charting features and other tools

Tools such as stock screeners might come in handy when you want to compare different stocks or indices, or if you are looking for investing ideas to diversify your portfolio.

For instance, they can help if you want better income options, or want to add exposure to a specific geographical region.

For the more advanced investors, charting features also allow you to plot other indicators such as volume and simple moving averages.

- Additional offerings

Does the provider offer research reports, articles or even Webinars that are useful to you?

- Test the platform

As it is free to sign up for a brokerage account, it is worth taking the time to test out a few to find one you like best.

- Invest & Grow is a weekly 10-part series that aims to help new investors get started on their investment journey.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.