Deepening US-China trade spat set to test markets' resilience

Singapore

ESCALATING trade tensions between the US and China are set to test the resilience of regional and global markets, even if investors have yet to press the panic button.

US President Donald Trump on Tuesday made good on his threats and slapped 10 per cent tariffs on US$200 billion of almost all Chinese imports effective Sept 24 - a move expected to hurt Asian businesses plugged into China's global supply chains.

Beijing then announced its retaliatory tariff action against US$60 billion of US goods, timed to take effect on the same day as the US action.

As trade hostilities between the two giant economies worsen, major Asian markets appear so far to be taking it in stride, having priced in the negative developments over many weeks.

But this may not hold, analysts warned, as a fully-played out trade war could seriously dent businesses and economies.

In his Tuesday announcement, Mr Trump said the tariffs on the US$200 billion of China imports will more than double next year unless the parties reach a compromise. He also vowed more tariffs on the remaining US$267 billion of Chinese goods should Beijing retaliate.

Asian markets started Tuesday's trading with knee-jerk weakness but key equity benchmarks in China, Hong Kong and Korea managed to bounce back into positive territory alongside Japan which stayed well in the black throughout the day.

Singapore's key Straits Times Index fell marginally while the indices in India, Taiwan and Malaysia dipped between 0.6 per cent and 1 per cent.

"Technically, China, Hong Kong and Singapore markets are still in a clear downtrend. Fundamentally, markets have priced-in too much pessimism about the outlook. Current valuations for Shanghai Composite, Hang Seng and STI are close to five-year lows," said CMC Markets analyst Margaret Yang.

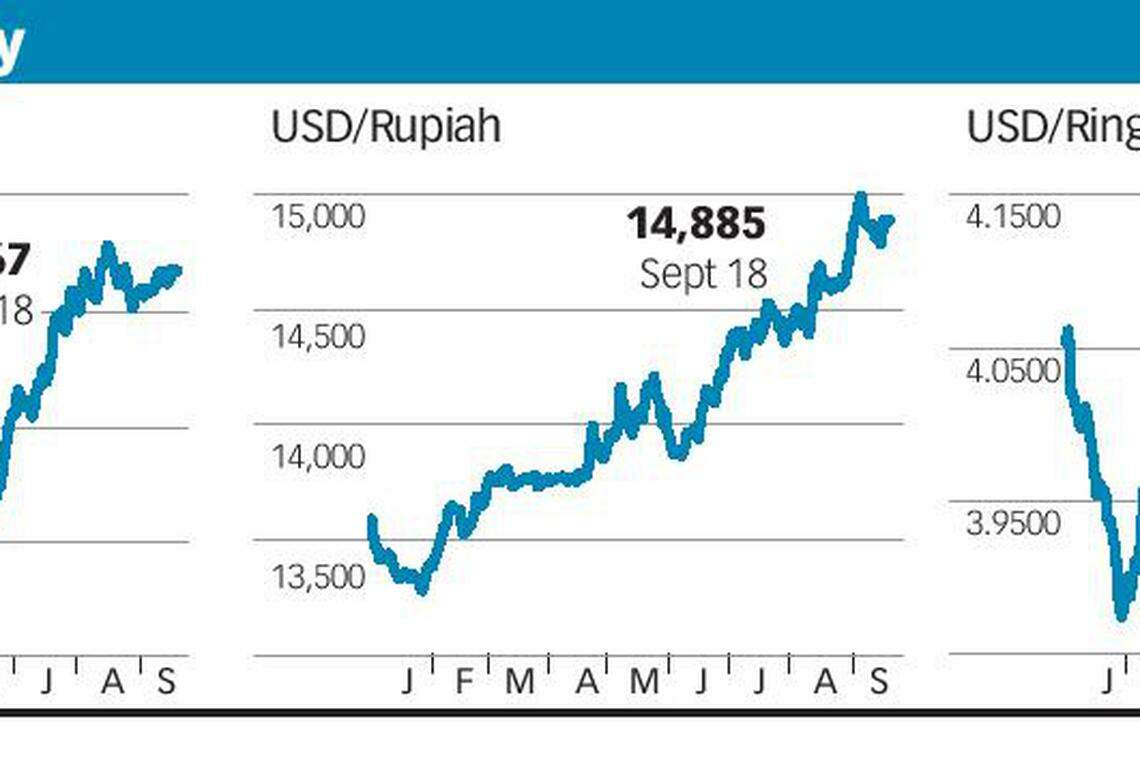

On the currency front, the US dollar saw mild early gains before risk appetite returned to help some regional currencies rebound. The yuan touched 6.8931 against the US dollar before it recovered to around 6.8668, with Beijing keeping a firm grip on the yuan in the aftermath of the latest measures and refusing to let it slide. The Singapore dollar strengthened by 0.197 per cent to 1.3708 as at 6.05 pm on Tuesday.

More volatile emerging market currencies however, suffered a different fate. The Malaysian ringgit weakened by 0.147 per cent to 4.1432 against the greenback and Indonesia's rupiah continued to come under selling pressure, pushing the central bank to intervene on Tuesday morning as the currency weakened by 0.36 per cent to 14,934 against the US dollar.

Maybank FX Research said the rupiah is vulnerable to an emerging market sell-off and tightening monetary conditions, a view widely shared.

"Currencies that belong to markets with weaker external positions will be hit hardest in the aftermath of this decision - another blow for the likes of the Indian rupee, Indonesian rupiah and South African rand," said FXTM's global head of currency strategy and market research, Jameel Ahmad.

In the wake of the latest US actions, analysts forecast China's GDP could suffer a hit of between 0.3 percentage point up to one percentage point. That impact however could be offset by China's fiscal and policy easing.

OCBC Investment Research head Carmen Lee warned that the region could be hit too given its "wide and complex trading relationships with China" across multiple sectors. Closer to home, companies listed on the Singapore Exchange could also feel the heat on various levels, she said.

"Most companies will not be shielded from the effect of higher tariffs on Chinese goods. However, it is difficult to ascertain the direct impact now as the trade war is still on-going and there is still the possibility that China will undertake measures to stimulate the economy," said Ms Lee.

Banking stocks in Singapore have seen some pressure amid the trade storm.

In a report earlier in the month, DBS Group Research said Singapore's banking stocks would be vulnerable to a trade war as it would bruise business sentiments and slow the pace of business loans.

The US Federal Reserve however could moderate the pace of interest rate hikes going forward if the trade war worsened.

In the immediate term, there are wide expectations that another rate hike is in the offing at the upcoming US FOMC (Federal Open Market Committee) meeting on Sept 27.

READ MORE: Retaliatory tariffs put almost all of China exports to US on the line

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

LMIRT Q1 net property income dips 3.1% to S$30 million on higher expenses

Exxon misses on Q1 profit despite big gains in Guyana

US FDA approves Pfizer’s gene therapy for rare bleeding disorder

Chevron's quarterly profit beats estimates

EU toughens rules on Chinese fashion retailer Shein

Keppel prices 70 million euros of floating-rate notes due 2031