🏠 Should I apply for a BTO before I graduate?

Find out more and sign up for Thrive at bt.sg/thrive

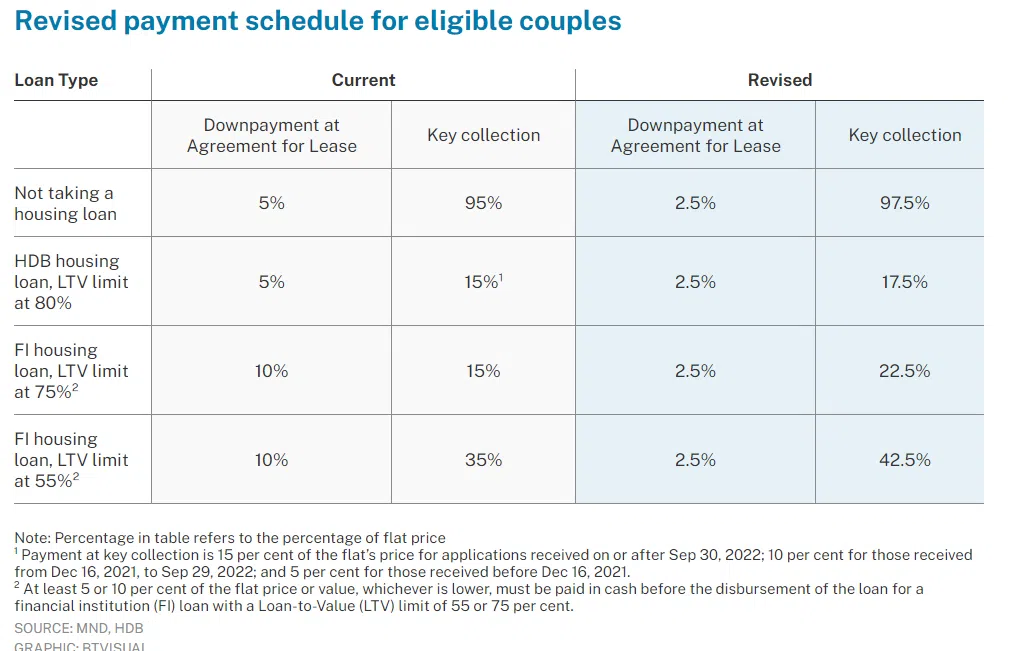

⬇️ Lowered down payment

From June, young couples who are schooling or in NS will fork out less for the initial down payment for their BTO flats.

They will only need to pay an initial down payment equal to 2.5 per cent of the flat’s purchase price, down from the current 5 per cent under HDB’s Staggered Downpayment Scheme.

This applies regardless of whether they take a housing loan from HDB or a bank.

To be eligible, a couple must both either:

Be full-time students, full-time national servicemen (NSF) or…

Have completed their full-time studies or national service within the last 12 months before applying for their HDB flat eligibility (HFE) letter

So, for a couple taking the maximum HDB loan, the full 20 per cent down payment will be split into an initial 2.5 per cent sum – paid upon signing the lease agreement – and the remaining 17.5 per cent, to be paid when collecting the keys to the flat.

📛 Unintended consequences?

Simply put, the main reason young couples apply for a BTO while they’re still in school is the wait time.

After booking a flat, couples have to wait about three to four years for their flats to be completed. Sure, this has come down since the days of Covid-related delays, but couples often also have to factor in the number of attempts it will take to get a low enough queue number to be able to book a flat they want.

What the reduced initial down payment means is that a schooling couple buying a S$500,000 flat will only need to fork out a more manageable S$12,500 down payment after booking a flat.

If planned correctly, they should already be working and able to afford the rest of the down payment by the time their keys are ready for collection.

Through this policy change, the government wants to make it easier for young couples to settle down and start their families earlier. However, as many have pointed out on online forums, it may also have some unintended consequences.

1. Could this encourage couples who are not ready for marriage to apply for a BTO?

What I have observed from the people around me is that break-ups often happen when couples enter a new phase of their lives. How many times have you heard of school flames who split up after one of them heads off to serve NS and the other enters university?

As the top comment on a Reddit thread discussing the BTO change puts it: “Relationships are prone to change at that stage of your life, when you are experiencing huge changes like getting a new job and doing NS. Those teenage years should be the time where people go out, discover themselves and experience different things instead of deciding whether to buy a BTO.”

On its own, marriage is a big commitment that shouldn’t be taken lightly. Add BTOs into the picture, and things can also become extremely costly if one’s relationship goes south.

If a couple breaks up after signing their lease agreement, which typically happens within nine months of booking a flat, they will forfeit their initial down payment in addition to the legal fees paid. They’ll also be restricted for one year from applying for a new flat or a resale flat using the CPF housing grant.

2. Is it financially prudent for students to commit themselves to financing a home when they’ve yet to secure stable employment?

Despite the reduced initial down payment amount, couples still need to cough up the remaining down payment when they collect their keys.

This could pose a challenge for couples who haven’t been working long enough to accumulate sufficient CPF savings and may have to top up the remainder with cash.

Using the same example of a couple buying a S$500,000 flat, they’ll have to fork out S$87,500 to pay off the rest of their down payment. If they’re collecting their keys exactly one year after they start working, that means each of them will have to set aside S$3,646 of their salary (in CPF or cash) every month.

And that’s provided they’re able to find jobs that pay them enough to qualify for the maximum loan for the flat.

🤷 So, should you?

As a side note, we’ve mostly been talking about couples in which both parties have not been in full-time employment for 12 months.

If, say, you’re still schooling, but your partner has been working for 12 months or more, take note that the HDB loan you are eligible for will be determined solely based on your partner’s income, as you won’t be able to get a reassessment on your loan amount. This has been the case since the new HFE letter was rolled out, leaving many confused flat applicants in a bind.

Returning to the recent staggered down payment changes, my take is that this will be beneficial for recent graduates who have been working for less than 12 months. Having found a job, they’ll be able to better gauge what flats they can afford based on their current salary.

As for those who are still in school or serving NS, they should be very aware of the risks of committing to such a big purchase before finding a job.

In my view, young couples shouldn’t feel pressured to apply for a BTO just because the initial upfront cost has been lowered.

If you don’t feel ready, it’s not a bad idea to wait a little longer.

TL;DR

Eligible young couples who book a BTO flat will only need to pay a reduced 2.5 per cent down payment

Those eligible include couples who are schooling or serving full-time national service

The reduced initial down payment benefits couples who are ready to settle down but are financially strapped

Still, the change shouldn’t put pressure on those who are not ready to settle down to apply for a BTO, given that it’s a huge commitment

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

Companies & Markets

Singapore shares open in the red on Tuesday; STI down 0.3%

Huawei’s pivotal role in the US-China tech war, from 5G to chips

CDL Hospitality Trusts reports 6.8% higher Q1 net property income of S$34.9 million

Starhill Global Reit posts 0.9% lower Q3 net property income of S$37.7 million

Binance and CZ�’s fortunes are set to grow, jail or no jail

Stocks to watch: Wilmar, MLT, FEHT, CDLHT, Starhill Global Reit, IReit Global