Asia needs to put more money where its mouth is

A new report shows that Asia will spend US$8t on food in 10 years, double what it's spending now; while yearly investments will double to US$290b

Singapore

ASIANS will fork out over US$8 trillion on food in a decade - more than double the total spend now - while the annual investments in the food sector will jump over two-fold to US$290 billion by then from US$130 billion now across the region, according to a recent report.

A bulk of Asia's cumulative investments of US$800 billion above current levels needed over the next 10 years will be used to cater for the rising demand of healthier and more sustainable food while 30 per cent will be ploughed into increasing food quantity to feed its growing population, according to the Asia Food Challenge Report by PwC, Rabobank and Temasek Holdings.

This in turn will unlock market growth of 7 per cent a year with development and adoption of new technologies in Asia's agrifood sector plus the enormous disruption potential providing investors big commercial opportunities.

"Investment in the Asian agrifood sector is not just an imperative, but also a great opportunity... collective action is required to unlock this," said the 62-page report, which was released on Wednesday in conjunction with a three-day Asia-Pacific Agri-food Innovation week held in Singapore.

Asian cities, namely Bangalore, Beijing, Hong Kong, Mumbai, Shanghai, Shenzhen, Singapore and Tokyo have the potential to become global agrifood powerhouses that drive development, funding and collaboration across the food and agricultural sector. While much of the innovation and investment will be predominantly driven by the private sector, government will also have a crucial role in developing a suitable ecosystem for growth.

Some notable Asian successes in this space include China's Alibaba and Tencent, which are driving growth in the e-commerce, food delivery and other consumer-facing platforms, and the likes of Swiggy in India and Gojek in Indonesia.

The food delivery market is worth over US$100 billion and is rapidly expanding, the report noted, adding however that other areas such as farms, processing and distributions need a step change in investment.

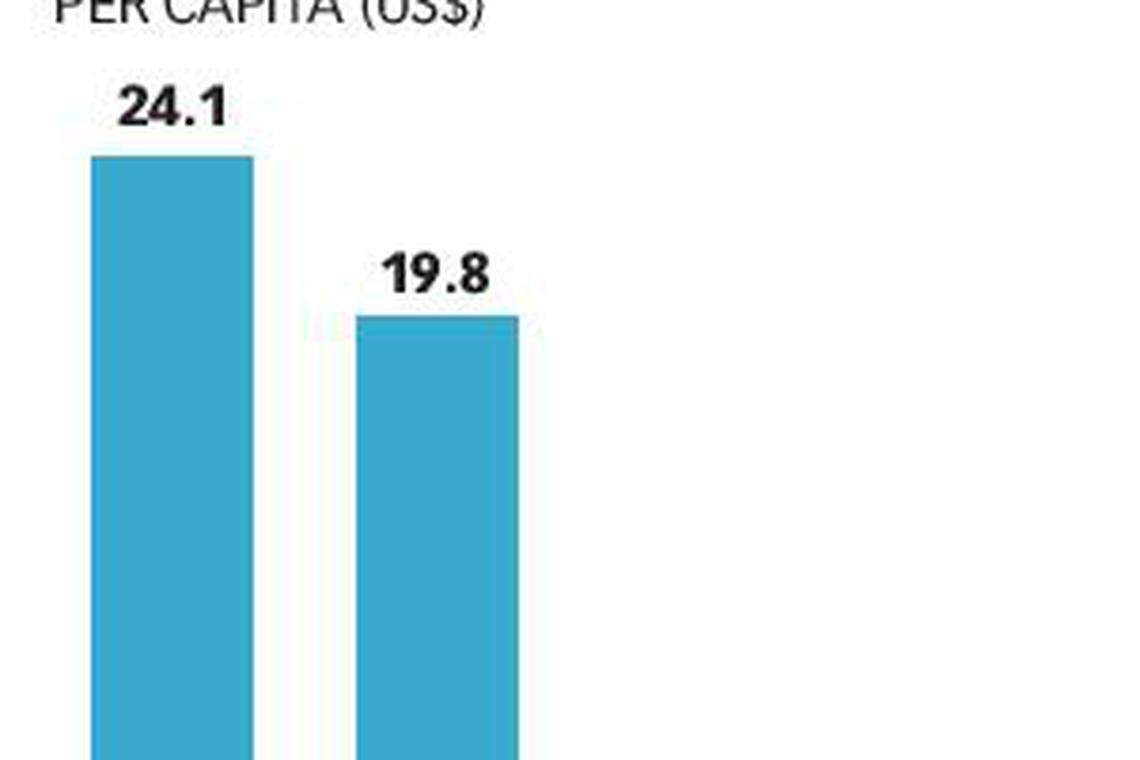

Even so, mergers & acquisition investments in Asia's agrifood tech businesses lag behind other regions. This is even more stark when compared with the population and overall food requirement here.

By 2030, Asia's population will be 250 million larger. With only one fifth of the world's agricultural land, the region will be home to half of the global population.

"The agrifood industry is struggling to keep up. Current trends show that growing populations and urbanisation have led to high wastage and poor quality as supply chains are stretched and broken," it said. Climate change that is impacting land, yields and output are adding to the stress.

At the same time, Asia is relying on imports from the Americas, Europe and Africa.

Against such a backdrop, agrifood businesses that focus on greater technology, more research & development, innovation and intellectual property, and have links with other high-tech sectors such as telecommunications and e-commerce will command higher valuations than their more traditional counterparts. "These are key factors that are helping to drive strong growth trajectories and higher profitability. This presents a significant value creation opportunity for knowledgeable investors," it added.

There have been a few notable investments in recent years in North America and Europe. US-based Merck and Co's US$3.7 billion acquisition of Antelliq, a French provider of digital livestock monitoring products, this year is a "powerful example". London-based BC Partners and its co-investors reportedly scored an estimated US$1.3 billion total capital gain - an over 30 per cent internal rate of return over a holding period of six years - following their exit with the Antelliq sale.

"Such examples show the potential prize on offer for investors who can knowledgeably navigate this rapidly developing space," the report added.

READ MORE: Temasek to stay the course in allocating more funds to the US

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

International

South Korea’s public finances no longer a credit rating ‘strength’: Fitch

UK consumer confidence improves as inflation and taxes fall

Inflation in Japan’s capital falls below BOJ target, slows for second month

China firms are investing abroad at fastest pace in eight years

Sri Lanka’s economy expected to grow 3% in 2024, central bank says

Yellen says US can bring inflation down without hurting jobs