Malaysian ringgit rout eases up

But slow rebound signals it won't recoup losses by the end of the year

Singapore

THE beaten-down Malaysian ringgit may well have been on its way to cap this year just exactly as it did 2015 with the undesirable stamp of being Asean's worst performing currency. But a swift and surprise move by its central bank to stem the currency's sharp fall that has led to some stability may yet spare the highly volatile currency that skittish chop - or not.

Thanks also to higher oil prices, the much-oversold ringgit has climbed in recent days and stood at 4.4290 against the UD dollar at 2.58pm on Thursday - quite a recovery from the 4.45/US$ level it plumbed to earlier this month. Against the Singapore dollar, the ringgit was at 3.123.

"It does appear that the recent round of punishment for the ringgit has come to a pause, but this is the same for most of the global currencies with the dollar rally taking a break," said Jameel Ahmad of FXTM.

Maybank Singapore expects the MYR to strengthen by year-end to 4.25-4.30 and by end 2017, to 4.10-4.15 against the UD dollar.

This is on the back of expectations that the US dollar could soften slightly by the end of the year and also "devoid of any further domestic concerns" out of Malaysia, said Saktiandi Supaat, head of FX research at Maybank Singapore.

Bank Negara Malaysia's moves to stabilise the ringgit also helped; the central bank has directed exporters to hold more ringgit versus foreign currency - this essentially boosts ringgit demand and would power up Malaysia's falling foreign reserves - and went on the offensive on the non-deliverable forward (NDF) market activities of ringgit in the offshore markets to stem currency speculation.

But not everyone is a fan of the central bank's recent moves or deems the ringgit's recent recovery as sustainable.

"BNM's curb of the USD/MYR NDF market... is likely to suck market's liquidity in the NDF market dry, but would also, ironically, mean lasting pressure on the MYR as funds seek to exit, oil price rebound notwithstanding, " said Macquarie in a recent note.

Macquarie had a 4.40/US$ forecast prior to the US election which it has now revised to 4.50 for end of this year and adds that the pair could rise to 4.80 by mid 2017 - not too far off its record low of 4.88 during the peak of the Asian financial crisis in 1998.

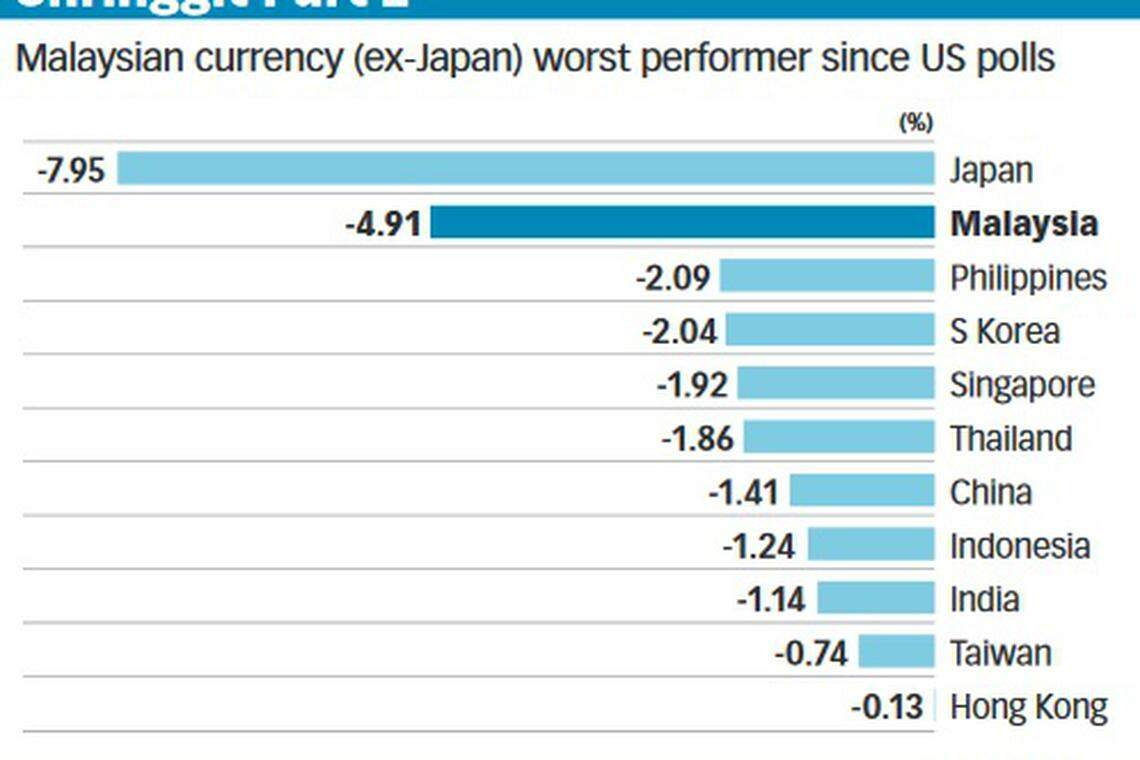

Since the shocking outcome of the US elections on Nov 8 or what is dubbed the "Trump tantrum", investor concerns over President-elect Donald Trump's trade policies, and the possibility of US Federal Reserves raising rates have led to a whiplash of Asean currencies although none as bad as the ringgit which lost 6 per cent last month.

Malaysia (and its currency) is somewhat of an easy assault for portfolio capital outflows given that the country has been a recipient of large FX inflows among Asean economies since the 2008/2009 global financial crisis.

The high level of foreign holdings in Malaysian Government Securities (MGS) - 51.5 per cent as at end-October - makes it vulnerable to a reversal of global capital flows in the region. In addition, there are US$5 billion-US$7 billion worth of foreign funds parked in Malaysia's equities.

"Despite healthy macro fundamentals in Malaysia, with Trump's unpredictability in foreign and trade policy, as well as possible sharper-than expected Fed Funds rate hikes, we believe these factors may put some downside risk to our projection on the Malaysian Ringgit," said Affin Hwang Capital which expects the Malaysian currency to appreciate gradually against the US dollar and trade at RM4.10 by end-2017.

As for end-2016, with three weeks left to its finish, currency experts do not expect the ringgit to regain its lost ground.

For one, as Mr Jameel puts its succintly, the US dollar would need to "fall like a house of cards" for the ringgit to recoup its losses over the past month. That's not going to happen.

The US dollar is however expected to see a period of consolidation during the holiday period through to when Mr Trump takes office on January 20 when the focus could switch to the actual form and impact of Trumponomics on US growth and inflation, said Macquarie.

BT is now on Telegram!

For daily updates on weekdays and specially selected content for the weekend. Subscribe to t.me/BizTimes

International

Philippines denies deal with China over disputed South China Sea shoal

When US diplomats visit China, meal choices are about more than taste buds

China’s first-quarter industrial profits rise at slower pace

Laid-back vibe, stunning beaches, rich cuisine and low cost of living lure more expat retirees to Malaysia

Vietnam tycoon appeals against US$27 billion fraud death sentence

US announces new restrictions on firearm exports