CapitaLand receives Singapore's first SORA-based loan from OCBC

OCBC Bank and CapitaLand have inked Singapore's inaugural loan facility agreement referencing the Singapore Overnight Rate Average (SORA), for a S$150 million three-year corporate loan.

This is a milestone in the industry's transition towards adopting SORA as the new interest rate benchmark for the Singapore dollar cash and derivatives markets, the lender and the real estate giant said in a joint statement on Tuesday morning.

The S$150 million SORA-pegged loan is part of a S$300 million sustainability-linked loan from OCBC Bank to CapitaLand. Proceeds from the facility will be used for general corporate purposes.

Its interest rate, referencing SORA, has two components: a compounded average of daily SORA rates calculated in arrears plus an applicable margin.

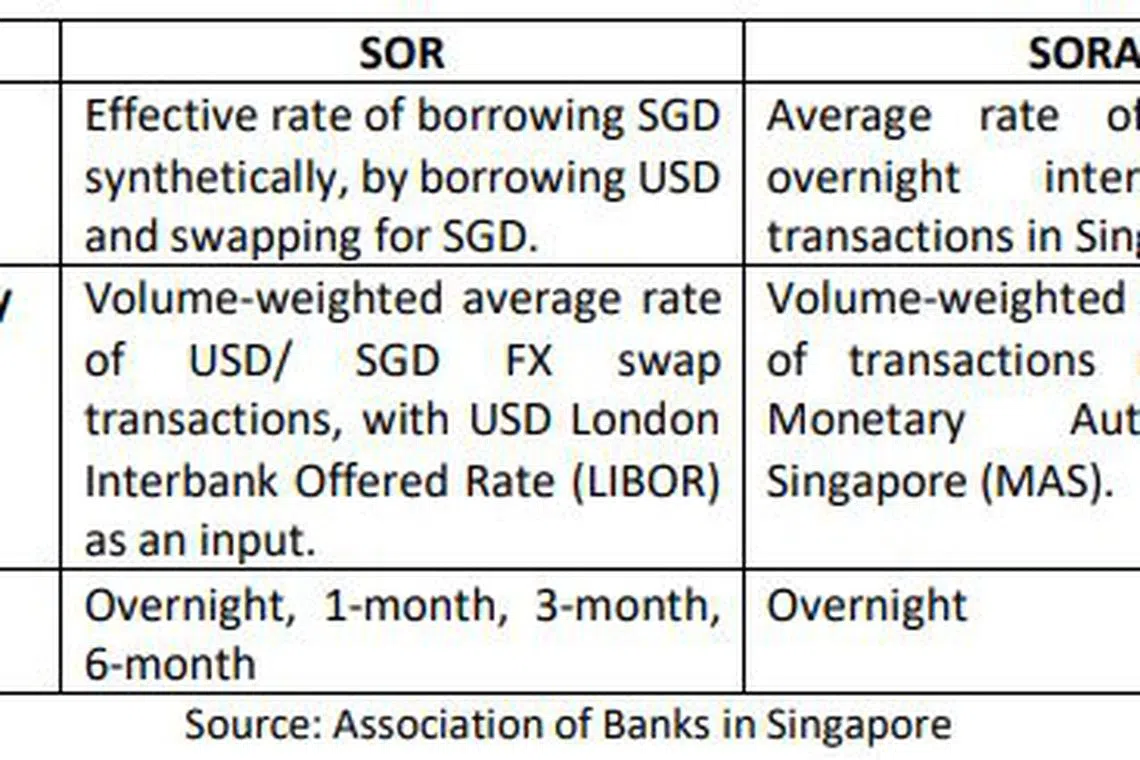

Singapore is transitioning from the use of the Singdollar Swap Offer Rate (SOR) to SORA, as the scandal-tainted London Interbank Offered Rate (Libor) will be phased out by end-2021. Libor's demise will affect SOR, as the latter uses the US-dollar Libor in its computation.

SORA is the average rate of unsecured overnight interbank Singdollar transactions brokered in Singapore.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

It is a backward-looking overnight rate, as opposed to the forward-looking reference rates commonly used for loans in Singapore, such as the SOR where the interest rate is determined at the start of the interest period.

To determine the interest rate of a SORA-based loan facility, the daily SORA rates are compounded in arrears, and the interest rate is determined by the end of the relevant interest period.

Globally, several major jurisdictions have identified overnight rates as the alternative benchmarks to Libor in their respective currencies, and the industry is trending towards the use of backward-looking, compounded-in-arrears rates.

In August 2019, the Association of Banks in Singapore and the Singapore Foreign Exchange Market Committee identified SORA as the most suitable interest rate benchmark to replace the SOR.

Elaine Lam, head of global corporate banking at OCBC Bank, on Tuesday said the latest deal with CapitaLand will "provide guidance for the development of SORA-pegged loans, pave the way for greater market acceptance and help such loans gain traction in the market".

The landmark SORA-pegged loan, being a sustainability-linked loan, also "deeply resonates with" the bank's and CapitaLand's shared commitment to advancing green finance in Singapore, she added.

CapitaLand group chief financial officer Andrew Lim noted that the property behemoth's pioneer adoption of the SORA-based loan enables CapitaLand to contribute to how SORA will be understood, structured and priced, in the process of laying the groundwork for mainstream adoption in the future.

"With the support of a like-minded partner in OCBC, we are able to dovetail this important innovation in Singapore's financial ecosystem with our commitment to our environmental, social and governance efforts," Mr Lim said.

The SORA-based loan is also CapitaLand's sixth sustainability-linked loan. In total, CapitaLand and its real estate investment trusts have raised over S$2.72 billion in less than two years through sustainable financing.

Last November, OCBC Bank and Standard Chartered completed Singapore's first overnight indexed swap derivatives transaction using SORA as the interest rate benchmark.

OCBC was also a party to the first Singdollar interest rate swap referencing SORA, cleared by LCH, in May this year. In the same month, DBS Bank priced the Republic's maiden notes referencing SORA.

Shares of OCBC Bank finished Monday at S$8.94, down S$0.30 or 3.3 per cent, while CapitaLand lost S$0.04 or 1.3 per cent to close at S$2.96.

Key differences between SOR and SORA:

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.