Redefining retail

The push towards F&B and more co-working spaces will likely continue, although the F&B landscape could also see more extensions of the business model via online deliveries and self pick-ups.

LONG before the Covid-19 pandemic, the retail industry has been beset with challenges ranging from manpower shortages, competition from e-commerce, to a plateau in retail dynamism. Today, the industry has been further shaken by safety measures and border restrictions.

With Singapore in its preparatory stages of transitioning to an endemic phase, there are pockets of incremental growth for malls.

Understanding retail trends, consumer preferences and discerning the retail trade mix's evolution will be instrumental in shaping future shopping centres.

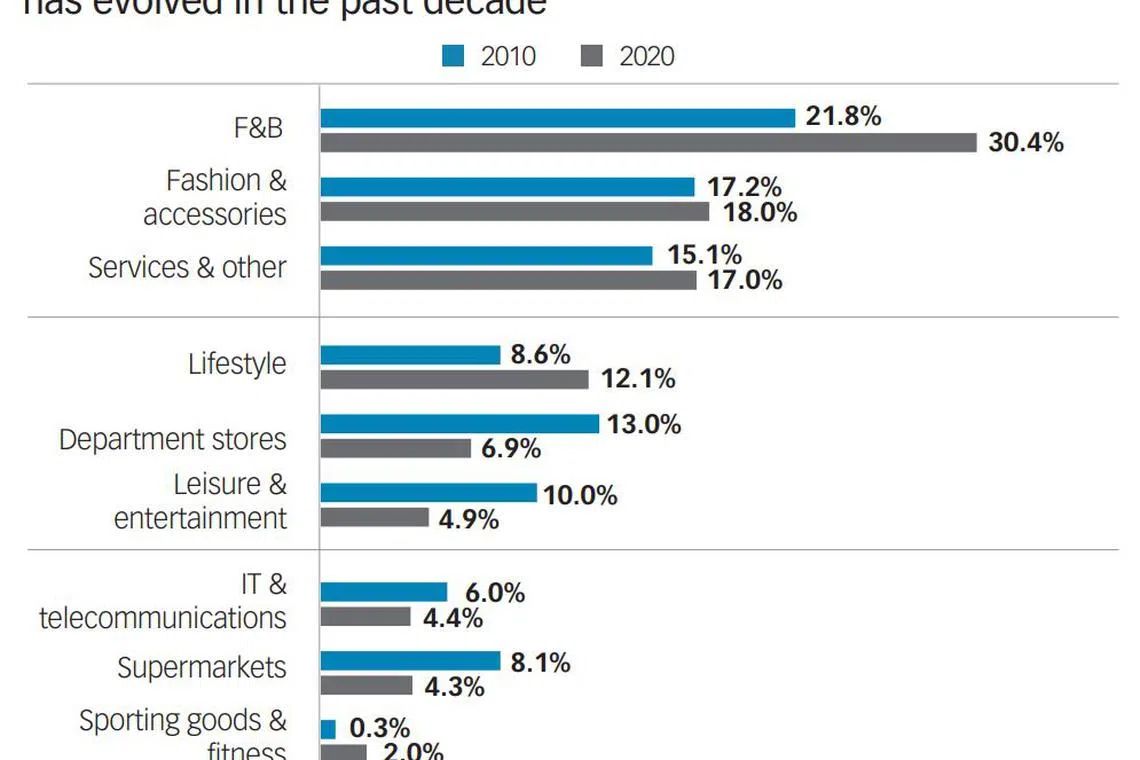

Examining data from eight major Singapore-listed commercial real estate investment trusts (Reits), we analyse how the trade mix of malls in Singapore has changed over the last decade. We also share our thoughts on the retail mall of tomorrow.

CATEGORIES IN DEMAND

Placemaking efforts, coupled with the rise of social media, have gained traction as malls offer avenues for socialisation.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

The most distinct trend is the higher proportion of food and beverage (F&B) tenants, up eight percentage points in concentration. International brands are entering the F&B scene: Shake Shack has opened six outlets and Haidilao has set up 14 outlets, for instance.

The focus on wellness and an active lifestyle has also led to demand for fitness wear and products. Sports and fitness retailers' concentration has grown by two percentage points. Decathlon last year opened a 3,200 square metre (sq m) retail space at The Centrepoint, with immersive and activity-based zones.

More recently, London-based SweatyBetty debuted an Ion Orchard store, its first in Singapore.

CATEGORIES LOSING FLAVOUR

Department stores' footprint has fallen 6.1 percentage points over the last decade.

This can be partly attributed to e-commerce's rise, which puts the viability of cookie-cutter business models in question as customers demand greater novelty in products.

Closures have therefore been inevitable for department stores. Metro shuttered its Centrepoint outlet in 2019, Robinsons let go of space at The Heeren and Raffles City in 2020, and Isetan will close its Parkway Parade store in 2022.

The leisure and entertainment category's proportion in malls has dropped five percentage points, as more consumers see online gaming and streaming services as a substitute for physical entertainment venues.

Nevertheless, we see landlords attempting to inject character into malls by adding unique entertainment tenants.

For example, indoor playground Superpark spans 40,000 square feet (sq ft) at Suntec City, while Fat Cat Arcade at 313@somerset features a 9,500 sq ft gaming hall.

Online platforms are also jumping on the bandwagon of online grocery shopping. Launches have included RedMart Marketplace in 2015, Pandamart in 2019, Amazon Fresh in 2020 and GrabSupermarket in 2021. This led to supermarket tenants' proportion falling 3.8 percentage points.

PRIME VERSUS SUBURBAN

Shopping centres in prime areas capture different customer profiles compared with their suburban counterparts.

The concentration of services in suburban malls grew, whereas the share held steady in prime malls. This can be attributed to rising affluence in the population, with demand growing for beauty, health and tuition and other services to be located nearer to home.

Meanwhile, the proportion of lifestyle retailers fell in suburban malls but rose in prime malls.

Fashion and accessories tenants took up more space in suburban malls but less in prime malls, as the latter allocated a greater proportion to F&B and lifestyle retailers.

THE RETAIL MALL OF TOMORROW

E-commerce continues to gain traction, and the Great Singapore Sale also took an omnichannel approach this year.

Retailers are increasingly marketing their goods online.

Their physical stores may serve mainly as "look and feel" touchpoints and click-and-collect counters for customers.

In terms of digitalisation and innovation, smart retailing can enhance customer engagement and experience.

For example, Decathlon Singapore Lab not only offers a space for the company to test new solutions, but also provides unique tags on certain products for customers to scan for information and reviews.

Livestreaming is also set to be the next big thing, enabling retailers to engage with customers through comments and live replies. This provides more interaction and a personalised experience for viewers on a larger scale.

E-commerce platforms such as Shopee and Lazada have a schedule of livestreams for users to watch and explore.

Meanwhile, independent brands are marketing their products through Instagram Live and Facebook Live.

Co-working operators could also increase their presence in malls, supported by demand for flexible-working spaces in an uncertain economic climate. Spaces by IWG opened a 35,000 sq ft space at One Raffles Place in 2019, and JustCo last year expanded to The Centrepoint, occupying 60,000 sq ft.

Landlords and occupiers should strive to be agile and redesign their business models through innovation and embracing technological solutions.

Already, landlords and occupiers are establishing better symbiotic and sustainable relationships.

The Code of Conduct for Leasing of Retail Premises in Singapore was introduced in June for a more collaborative landlord-tenant ecosystem, to create a more conducive business environment in the retail sector.

The Fair Tenancy Industry Committee, the custodian of the code, will ensure it provides guidance to landlords and tenants of qualifying retail premises so that fair and balanced lease negotiations can be achieved.

The last decade has seen major shifts in retail trends and trade mixes. Looking ahead, we expect further tweaks to future-proof malls.

The push towards F&B and more co-working spaces will likely continue, although the F&B landscape could also see more extensions of the business model via online deliveries and self pick-ups.

The industry will keep innovating with new forms of digital marketing, and it is vital that landlords and tenants join hands to navigate the challenges ahead.

This is an edited excerpt from Edmund Tie Research's upcoming publication on how the retail scene is being redefined.

- Desmond Sim is CEO of Edmund Tie and a member of the Fair Tenancy Industry Committee; Amanda Goh is a research analyst at Edmund Tie.

READ MORE:

- What's behind the resilience of Singapore real estate?

- Retail goes live(stream)

- New norms may emerge in retail sector as sales per square foot of space fall

- F&B outlets may rethink real estate footprint as online sales grow

- Heartland malls in areas with less retail space per capita may recover more quickly

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.