Inside the Philippines’ stacked agenda to steer Asean’s trillion-dollar economy

Trade and Industry Department Undersecretary Allan Gepty speaks to BT on Manila’s priorities as chair of the bloc

[SINGAPORE] The Philippines is steering Asean towards a new era of economic integration anchored by two early wins: a digital economy pact and a free-trade deal with Canada, which take centre stage amid a stacked economic line-up.

The country’s Department of Trade and Industry undersecretary, Allan Gepty, told The Business Times in an exclusive interview that negotiations for the bloc’s landmark Digital Economy Framework Agreement (Defa) are targeted for completion in the first quarter of 2026, which would pave the way for its signing in November.

Defa originated as a key strategy in the bloc’s post-pandemic recovery in a road map adopted in 2021, with the aim of driving inclusive digital transformation across the diverse region. Negotiations officially began in September 2023, and substantially concluded last October.

As the world’s first regionwide, legally binding digital economy arrangement, Defa will serve as a blueprint for harmonising digital trade rules and regulations; it will also create a regulatory framework for paperless trading, e-commerce, cybersecurity and digital payments, and facilitate cross-border information and data flows.

Asean is already one of the world’s fastest-growing digital markets, with a digital economy projected to treble to nearly US$1 trillion by 2030. This value could double with a high-quality Defa.

While trade-in-goods tariffs within the bloc are already near zero, intra-Asean trade stagnated at around a fifth of total trade, not least because intra-regional standards for cross-border data flows, e-invoicing and digital customs systems have not yet been harmonised, said analysts from the Economist Intelligence Unit (EIU).

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Another early win for the Philippines, which officially took over the Asean chairmanship from Malaysia on Jan 1, will be the inking of the Asean-Canada free trade agreement (FTA) – the bloc’s first with a North American country.

The conclusion of the treaty has been a “moving target” since talks officially launched in 2021, said Gepty, but he added that there was now a strong call both within the bloc and externally to finalise the pact. Push factors include US tariffs, threats to the world’s rules-based trading system, and growing global geopolitical tensions.

Asean as a group is Canada’s fourth-largest trading partner, but the country remains heavily reliant on the US. Some three-quarters of its merchandise exports – or a quarter of its gross domestic product – heads south of its border to the US.

EIU analysts expect the Philippines to push hard for the completion of the Defa and the Asean-Canada FTA, which would become the country’s signature achievements. The Defa will present “the (President Ferdinand Marcos Jr) government an opportunity to make the agreement its signature Asean chairmanship project”, they said.

Aside from these landmark signings, the Philippines’ ambitious to-do list touches on strategic goods, semiconductors, critical minerals, artificial intelligence (AI), regional payments connectivity, intellectual property valuation and even space science.

Its economic docket centres on five strategic thrusts, said Gepty.

They are strengthening trade and investment linkages; accelerating digital transformation; integrating the development agenda of micro, small and medium-sized enterprises; leveraging the creative economy; and advancing sustainable, inclusive economies.

The resulting acronym, “SAIL-A”, could be interpreted as “Sail, Asean”, coinciding with the Philippines’ chairmanship logo, which depicts a pre-colonial wooden balangay, the country’s national boat, riding a wave that symbolises the waters binding the bloc’s 11 member states, said Gepty.

Trade, investment harmonisation

The Philippines is looking at several key deliverables for Asean, chief among them a leaders’ declaration on strategic trade management. This aims to regulate strategic “dual-use” goods – such as those with both commercial applications and potential usefulness in nuclear, chemical and biological weapons.

“In pursuing our economic agenda, we have to be mindful of the aspect of security,” said Gepty. “We have to regulate the manufacturing, export, import and distribution of dual-use goods so that they do not fall into the wrong hands.”

Not all 11 members of the bloc have existing laws that regulate the movement of such goods, and there remains work to be done for the rest of the countries to fully adopt their own reforms, he noted.

Another priority is the creation of an Asean semiconductor road map. By mapping out the specific strengths of each member state along the chipmaking supply chain, the region can better direct local and foreign investor dollars. Only then can it look at developing strategies to woo semiconductor investments into Asean, said Gepty.

Since breaking into the semiconductor scene in the 1970s with back-end processes such as assembly, testing and packaging, the region now accounts for nearly 30 per cent of global semiconductor exports in 2024.

The Philippines is also seeking to advance Asean’s critical mineral strategy. Currently, “critical minerals” lack a universal definition; countries today compile their own registries of these essential raw materials, which broadly include key minerals such as nickel, cobalt, copper, lithium and rare earth elements.

Indonesia is the world’s largest nickel producer, accounting for at least half of global output; Malaysia is the first country outside China with significant rare earth processing capabilities; the Philippines ranks among the world’s largest producers of copper and cobalt.

A regional registry would help the region capitalise on its massive reserves. Having a common understanding as to what counts as a critical mineral is key for promotion and investment purposes, said Gepty.

Another noteworthy deliverable Manila is eyeing is a leaders’ declaration on the cross-border movement of digital workers. This could take shape in the form of a special task force mandated to develop and implement a talent pass or work plan, said Gepty, adding that it is a “vital component” in the promotion and implementation of Defa.

Digital transformation, payments

Beyond Defa, two other key priorities under the digital transformation tranche involve AI – a topic on which Marcos centred his speech at the launch of the Philippines’ chairmanship in November – and payment connectivity.

The full details on AI are still being developed, and the region is actively working on establishing regional guidelines for the use of such technologies in medical diagnostics. This is a part of the region’s broader digital health initiatives.

On payment connectivity, the Philippines is pushing for a regulatory harmonisation dashboard that will be made available to the bloc’s nations and interested development partners. Gepty said this tool would provide the framework necessary for member states to align their rules, ensuring seamless cross-border transactions.

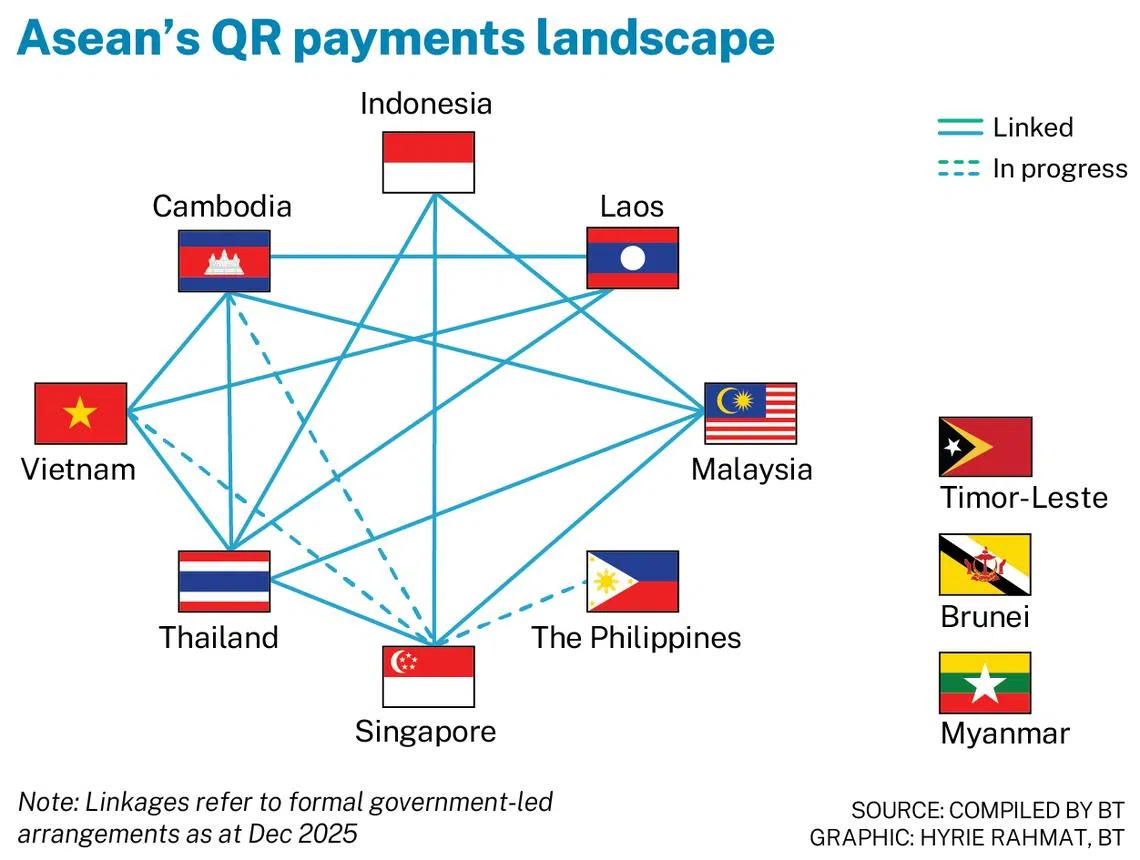

This builds on the 2022 regional payment connectivity initiative, to which several regional central banks pledged their cooperation to enable faster, cheaper, more transparent and inclusive cross-border payments.

This effort has already yielded results, with local currency transactions and linked QR payment systems increasingly becoming the preferred choice for cross-border retail transactions and trade settlement.

The Philippines’ economic agenda during its year-long term might be ambitious, said Gepty.

“But we have to be ambitious because we’re facing a lot of challenges, and we have to be aggressive and cover all areas that would really ensure sustainability and security in the region while ensuring inclusive growth,” he said.

Trouble at home

The Philippines takes on the Asean chairmanship with a bold economic agenda, but its ability to deliver will be tested by domestic headwinds and an overcast growth outlook.

The country’s Q3 GDP growth in 2025 sank to 4 per cent, its weakest expansion since Q1 2021 – weighed down by a corruption scandal, typhoons and tariff turmoils.

Nomura analysts, in their macro outlook report, shaved the house’s GDP forecast for the Philippines to 5.3 per cent for 2026, from 5.6 per cent.

The inadvertent fiscal tightening from the country’s graft scandal is substantial and expected to persist for a while, hurting growth materially in the first half of the year before a recovery in the second as the government implements catch-up spending plans, said the report.

Meanwhile, UOB economists slashed their growth projections for the archipelago to 5 per cent, from an earlier 5.7 per cent for 2026.

But the bank’s analysts noted that the Philippines’ Asean chairmanship is expected to support a gradual recovery next year, alongside a more accommodative monetary policy setting, manageable inflation expectations and increased fiscal spending.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.