Rental market for private homes maintains buoyancy

The Covid-19 vaccination programmes and gradual resumption of air travel globally may lend further support to Singapore's private residential leasing market.

SINGAPORE'S private residential leasing market remains on track for recovery as the global economic outlook improves and vaccination roll-outs gather pace worldwide.

More foreigners and Singaporeans are expected to return to the city-state from abroad as Singapore syncs its border reopening with the population's higher inoculation coverage.

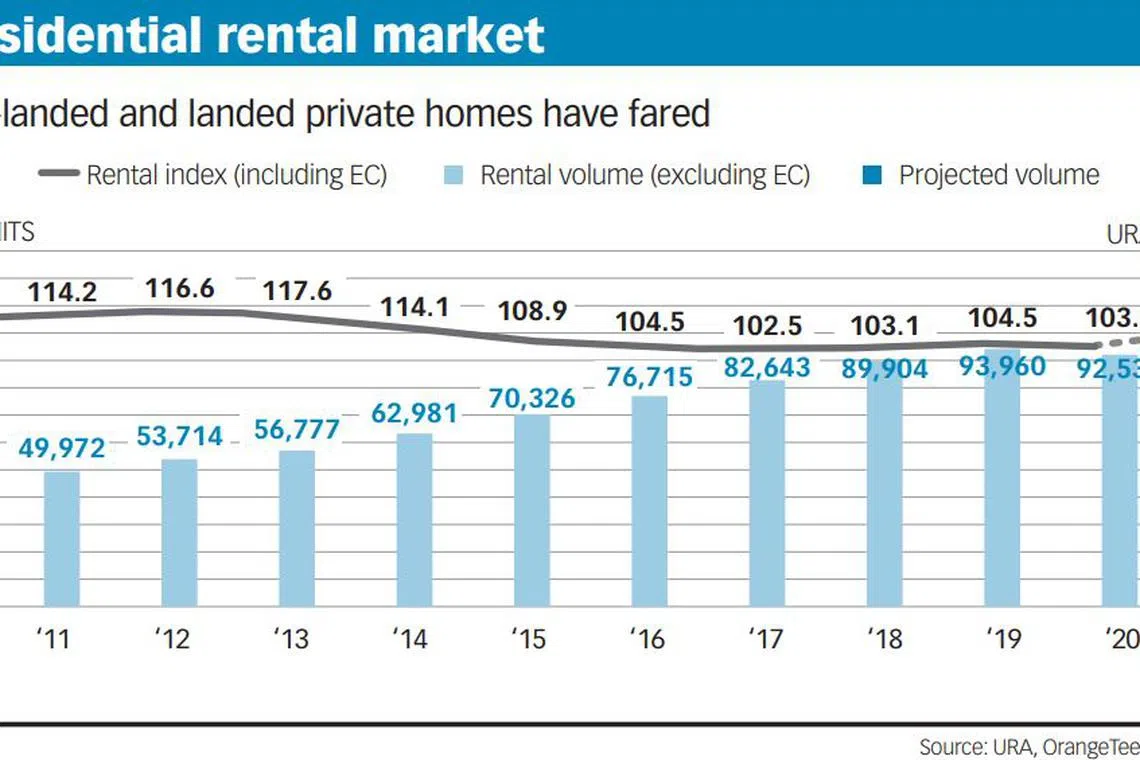

Leasing demand for private housing has bounced back to pre-pandemic levels. According to data from the Urban Redevelopment Authority (URA), 47,515 leasing transactions for landed and non-landed private homes - excluding executive condominiums (ECs) - were recorded in the first half of this year, surpassing the 41,714 units in H1 2020 and 46,232 in H1 2019. The rental volume in H1 2021 was almost on par with the 47,728 transactions in the second half of 2019.

Occupancy rates for private residential properties, excluding ECs, also remained high throughout the Covid-19 pandemic, hovering above 90 per cent from Q1 2020 to Q2 2021, URA statistics showed.

WHAT'S PROPPING UP DEMAND

The pandemic closed borders and triggered travel restrictions around the world. The first six months of 2020 saw the start of a domino effect of an economic slowdown and rising foreign unemployment, with some foreigners retrenched amid the weakened economic climate. Consequently, rental demand for private homes and the growth of rental rates were temporarily stalled.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

In H2 2020, demand rebounded sharply with rental volumes rising more than 20 per cent to 50,823 units, from 41,714 in H1 2020. Many Singaporeans came back from abroad as the lure of a dream expatriate life faded with the pandemic fallout.

A steady stream of permanent residents, students and long-term pass holders returned, helping to prop up demand in the city fringe and suburban areas. Many of these tenants were looking for accommodation near workplaces or international schools. Leasing demand in the vicinity of industrial parks and commercial buildings was firm.

Some Singaporean students that were previously based overseas continued their studies here via remote learning and online courses, after their schools urged international students to return to their home countries. As the number of virus cases climbed, some parents also felt more at ease having their children back home, where advanced healthcare and educational systems would be easily accessible.

Many foreign expats residing in Singapore renewed their leases. Some were expecting to live here for a while as their regional work assignments were placed on hold given the extensive global lockdowns. Others were reluctant to scout for alternate housing during the pandemic.

Tenants opted for shorter leases in general because they intended to move if cheaper accommodation became available; this resulted in more transactions recorded over time.

FRESH DEMAND

While the virus outbreak brought about unprecedented economic challenges, it also triggered a change in housing needs that sparked the emergence of new tenant groups.

Investors may leverage the fresh opportunities that came with the new rental demand for private homes.

Domestic demand has helped fill the gap left by the decline in leasing transactions from foreigners. As offices were shut during the pandemic and work-from-home arrangements became a norm, many Singaporeans - especially professionals - have started rethinking their living arrangements. Now acutely aware of the need for bigger living spaces, many have set up dedicated workspaces at home and segregated areas for personal solitude.

A growing number of young adults were also renting apartments temporarily to enjoy more space, independence and privacy. Some lived on their own or with a few friends, thus raising demand for small apartments in the city fringe and prime locations.

There were many former or current HDB homeowners renting apartments as well, especially those who sold their flats at the end of the five-year minimum occupation period. To capitalise on the price appreciation of HDB resale flats, many owners offloaded their flats quickly, even before they had secured another home. Others rented temporarily due to construction delays at their next homes.

Meanwhile, the rental market is increasingly attracting families with school-going children. Singaporean parents tend to go to great lengths to enrol their children in popular primary schools; some even rent homes in the vicinity.

There has been a greater emphasis on distance-based priority - given to those who live closer to the preferred school - as balloting has been observed in almost all phases of the Primary One registration exercise these two years.

The intensive balloting and the need to stay near popular schools have inevitably driven rental demand higher, especially from families that cannot afford to buy new homes in the relevant areas.

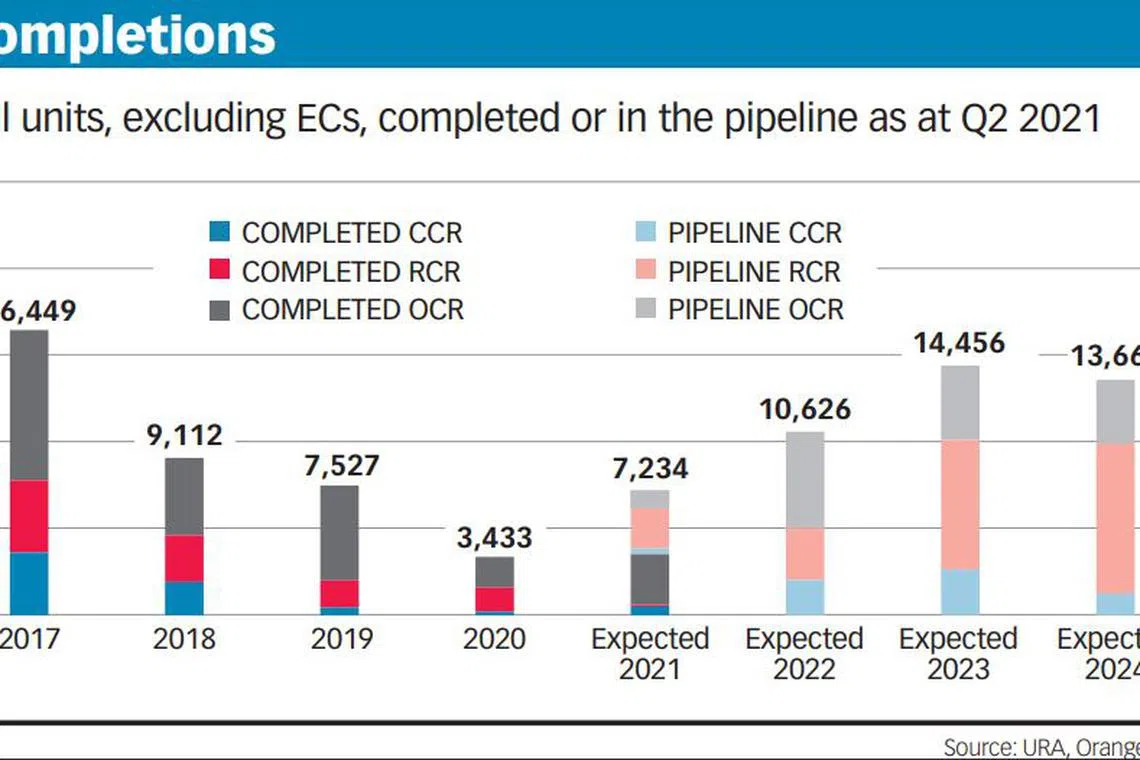

RENTS RISE AS STOCK DECLINES

Construction delays have hampered the supply of new homes, with the pace of completions slowing down significantly. Limited stock and low supply in the pipeline drove rental prices higher in many locations. According to quarterly data from URA, overall rents of all private residential properties rose 2.9 per cent in the second quarter of 2021, steeper than the 2.2 per cent increase in the first quarter of 2021.

Further, the available housing stock for rental has been declining, as many landlords have sold their condominium units with resale prices recovering, in part to unlock their assets' investment values. Affected tenants have had to vacate and look for new accommodation.

Homes sold with tenancy were similarly affected as the new landlords may not renew leases upon expiry.

Consequently, rental demand and rents rose in many locations.

POTENTIAL DEMAND BOOST

The Covid-19 vaccination programmes and gradual resumption of air travel globally may lend further support to Singapore's private residential leasing market. The Republic will progressively restore cross-border travel as domestic vaccination rates continue to rise.

Further, employment prospects in Singapore are brightening as more firms plan to expand headcounts.

An increase in inbound travellers and foreign employment here will likely boost rental demand for private homes. We estimate between 85,000 and 95,000 rental transactions may be inked this year.

As new project completions are likely to remain limited, rents may grow 5 to 8 per cent for 2021.

- Christine Sun is senior vice-president and Timothy Eng is research analyst at OrangeTee & Tie Research and Analytics.

READ MORE:

- New or resale homes? Unravelling the property investment conundrum

- Dwindling options for EC buyers in H2 2021, 2022

- Homes within integrated developments retain their popularity

- The enduring charm of landed homes

- Private residential hotspots: A housing renaissance emerges

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.