Homes within integrated developments retain their popularity

Despite some threats, such residential properties will continue to appeal to both owner-occupiers and investors in the years ahead.

HOMEBUYERS and investors have shown keen interest in integrated developments amid the current property bull market. Most recently, about 86 per cent of the 487 units at Pasir Ris 8, which is next to the Pasir Ris MRT station, was sold in the first week of the project's launch in July.

What exactly is an integrated or mixed-use development? It is most commonly used to describe a development with residential and commercial components, linked to an MRT station. Sometimes, it may also be connected to a bus interchange. The residential component is usually built on top of the mall.

The concept bears similarities to that of an integrated transport hub (ITH), although the latter does not necessarily include a residential component. The authorities define an ITH as a fully air-conditioned bus interchange that is seamlessly linked to an MRT station and adjoining commercial developments.

The Covid-19 pandemic led to the rapid adoption of the work-from-home practices among white-collar workers. There were also several rounds of restrictions, such as the circuit breaker last year and the two heightened-alert phases this year.

Individuals who live near a shopping centre are able to meet their dining and retail needs easily, especially when such pandemic-related restrictions are in place.

Furthermore, residential properties near MRT stations have always been popular with buyers due to the ease of connectivity.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Demand for homes within integrated developments therefore increased over the past year, as they enable residents to access both retail premises and an MRT station.

That being said, one may argue that individuals working from home most of the time will no longer need public transport to commute to the office daily. The draw of an MRT station in their home-purchase decisions may thus diminish in such cases.

CHANGING PREFERENCES

Looking at the red-hot demand for the recently launched Pasir Ris 8, it is easy to forget that the apartment units in integrated developments have not always been this popular.

When some of the earlier integrated developments were introduced more than 15 years ago, some homebuyers in fact preferred condominiums without the attached malls.

Those buyers favoured more or larger recreational facilities - such as tennis courts, jogging tracks, swimming pools and function rooms - which were usually found in larger condominium developments. Some also felt that condominiums provide more privacy as they are not situated on top of busy malls.

Nonetheless, homebuyers' preferences do change over time, especially given the impact of the pandemic.

PRICE PREMIUM

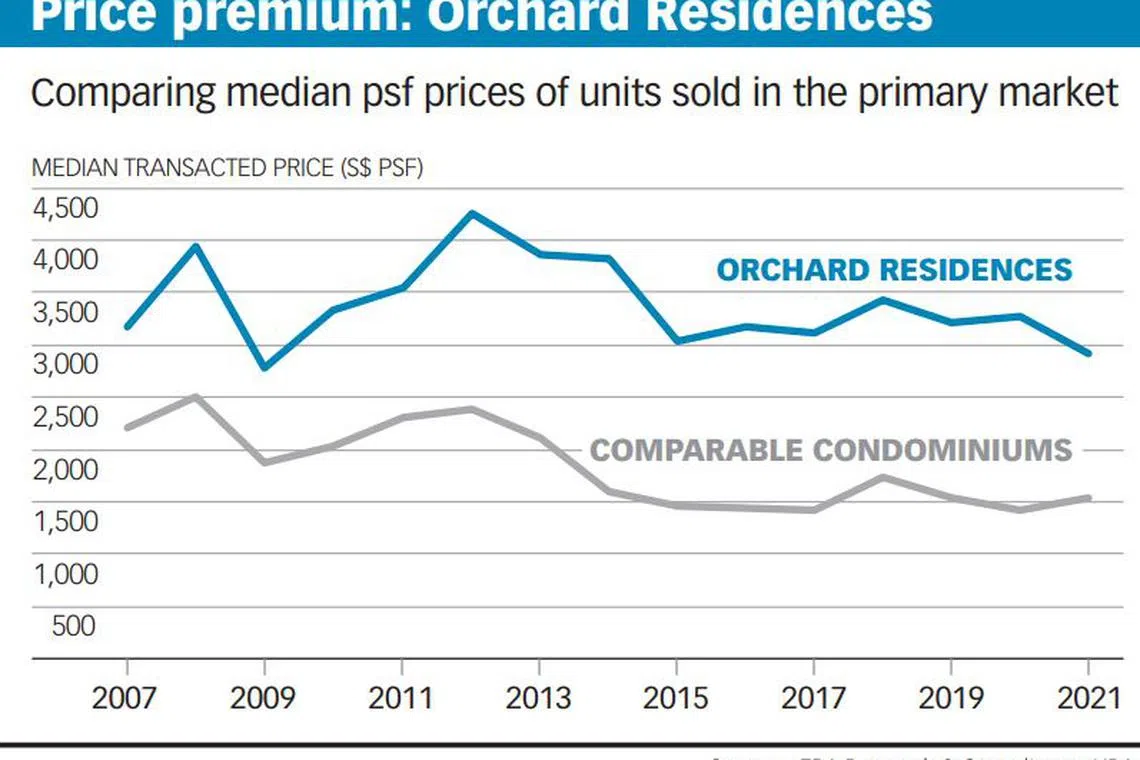

The prices of apartments in integrated developments are usually higher than those of nearby comparable condominiums with the same land tenure and similar age. In our study, the condominiums that were compared to the apartments in integrated developments, are not linked to any mall or MRT station.

Some integrated developments can command price premiums ranging from 4 to 30 per cent, against comparable condominiums nearby. However, there are also a few with only a small or no price premium.

Wider premiums were observed in cases where there had been a dearth of new private residential launches for a number of years in that area before the integrated development's apartments came to the market. This is because the lack of fresh supply of private housing would lead to pent-up demand in the locality, on which the developer of the integrated development could then capitalise.

In addition, the apartments in an integrated development would enjoy a bigger price premium if they are launched in the midst of a bullish market that is fuelled by buoyant demand and ample liquidity.

An example would be The Orchard Residences, situated atop the Ion Orchard mall, with 56 storeys housing 175 luxury apartments. As one of the earlier integrated developments, launched in 2007, it was also the only integrated development and the tallest building along Orchard Road.

The Orchard Residences thus commanded one of the highest price premiums among integrated developments. In the 12-month period after the project's launch, its median transacted price of S$3,064 psf was 25 per cent above the median price of nearby comparable 99-year leasehold condominiums transacted in the primary market.

The median price of the 99-year leasehold Orchard Residences was even higher than the overall median transacted prices of new freehold condominiums in the Cairnhill area.

THREATS TO INTEGRATED DEVELOPMENTS

Still, the bigger threat to apartments in integrated developments are not other condominiums, but technological innovations embraced by consumers, such as in online shopping and ride-hailing services.

E-commerce has already proven to be a serious contender in the retail space. As online shopping becomes more prevalent and orders get delivered more quickly, that will erode the attraction of living above a mall.

Similarly, with the improving public transport network and the emergence of more vehicular options such as buses, LRT, taxi and ride-hailing services, the advantage that residential properties next to MRT stations have over those located farther away will likely shrink.

In addition, retail malls near MRT stations typically see high footfall. This can be both a boon and a bane during a pandemic, as crowded places will have a higher risk of a Covid-19 cluster forming. If a mall is affected, that could cause some inconvenience to the residents living in the apartments above it.

In conclusion, homes that are part of integrated developments have maintained their popularity. As the cost of car ownership remains on an uptrend and the MRT network cements itself as a fundamental part of Singapore's transportation system, such residential properties will continue to appeal to both owner-occupiers and investors in the years ahead.

- The writer is head of research and consultancy at ERA Realty Network.

READ MORE:

- Private residential hotspots: A housing renaissance emerges

- Househunt August 2021: Projects currently on the market

- New or resale homes? Unravelling the property investment conundrum

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.