The return of commercial mortgage-backed securities in Singapore?

A window of opportunity may be opening for Reits and asset owners to tap new funding sources amid rising interest rates

COMMERCIAL mortgage-backed securities (CMBS) are an efficient securitised vehicle widely used by financial institutions in the United States to improve liquidity and recycle capital by selling mortgages in secondary mortgage markets.

CMBS securitisers include US investment banks such as Wells Fargo, JP Morgan and Goldman Sachs. They purchase commercial mortgage loans from US banks secured by offices, hotels, shopping centres, factories, warehouses and multifamily apartments. They then pool together the acquired commercial mortgage loans, package them into portfolios, and issue securities backed by the mortgage loan assets.

Multiple-tranche pay-through securities, usually in the form of bonds, are issued, distributed and sold via exchanges on Wall Street to local and global investors. This includes those in Singapore and Asia, who could then gain access to commercial loan markets in the US via investing in CMBS.

CMBS are a real estate financial innovation that is relatively new to this part of the world. They were introduced to Singapore the same year that the first real estate investment trust (Reit) was listed on the Singapore Exchange, in 2002. The Global Financial Crisis (GFC) in 2007 widened credit spreads and significantly increased the costs of issuing CMBS. New CMBS issuance activities have ceased since 2011, and Singapore’s Reits have reverted to traditional bank loans and the unsecured bond markets to meet their capital needs.

How will the changing credit ratings and interest rate environment impact commercial real estate lending? According to a Bloomberg report in February 2023, CMBS issuance in the US has fallen as bond buyers turn wary after a string of defaults in the office and retail sector. Quality of collateral has become key, and trophy properties favoured. The report notes, however, that according to Bloomberg index data, the US CMBS index has slightly outperformed the broader investment-grade bond market and is up 1.14 per cent so far this year, compared to the latter’s 0.85 per cent gain.

What will push Reits and other real estate players to revisit CMBS? Will the market for CMBS revive in Singapore?

Supply-driven CMBS in Singapore

CMBS debuted in Singapore in 2002, when then-CapitaMall Trust (now renamed as CapitaLand Integrated Commercial Trust, or CICT, after the merger with CapitaLand Commercial Trust in 2020) issued the first rated CMBS notes of S$200 million. In 2003, CapitaRetail Singapore (CRS), an unlisted real estate fund, issued multi-tranche CMBS (Classes A, B, C, D and E) to raise S$560 million, with the A and B tranches denominated in the euro currency and distributed outside Singapore.

Unlike the American CMBS model, which is motivated by banks’ capital recycling needs, Singapore’s CMBS issuance was mainly driven by Reits’ and other asset owners’ motivations to diversify and tap new funding sources outside Singapore. There were 31 CMBS with a total bond value of S$5.91 billion issued by Singapore’s Reits before the CMBS market collapsed in 2007.

The US CMBS involves the wholesale off-balance-sheet transfer of mortgage assets from securitisers’ books to a special purpose vehicle (SPV). In early CMBS transactions, the Reit or asset owners transfer their commercial real estate assets to an SPV (issuer), which assigns the security interests in properties and related lease and asset management agreements to a trustee acting on behalf of beneficiaries, including bondholders and other creditors.

Issuers (related to the Reits) usually retained residual equity interests in properties, which, in CRS’ case, was through subscribing to the lower tranche (Class E) bonds.

Proceeds from the sales of senior bonds are used to refinance existing mortgage loans. In the early batches of Singapore’s CMBS, most senior tranches were issued in euros and distributed in the European capital markets. Few Singaporean institutional investors had access to the Singapore dollar-denominated junior tranches.

Cash flows derived from the commercial properties are used to pay coupons to CMBS investors following a waterfall structure, starting from the A tranche down to the lowest tranche. The principals will be redeemed at maturity through a bullet loan payment. The Class E bondholders in the CRS case (issuers), or the mortgage borrowers, could trigger the sale of all properties and fully redeem the bonds before maturity.

The issuer uses cross-currency and interest-rate swaps to mitigate risks of mismatches between cash flows generated from mortgage loans secured by commercial properties (usually in fixed rates and in Singapore dollars) and cash flow obligations paid to bondholders (usually in euros and floating rates).

One unique feature is that Singapore’s CMBS can involve multiple commercial mortgage loans by a single borrower (issuer). Issuers could use the CMBS structure to obtain a secure line of credit at fixed interest rates and hedge against potential interest rate volatility.

What will drive the revival of CMBS in Singapore?

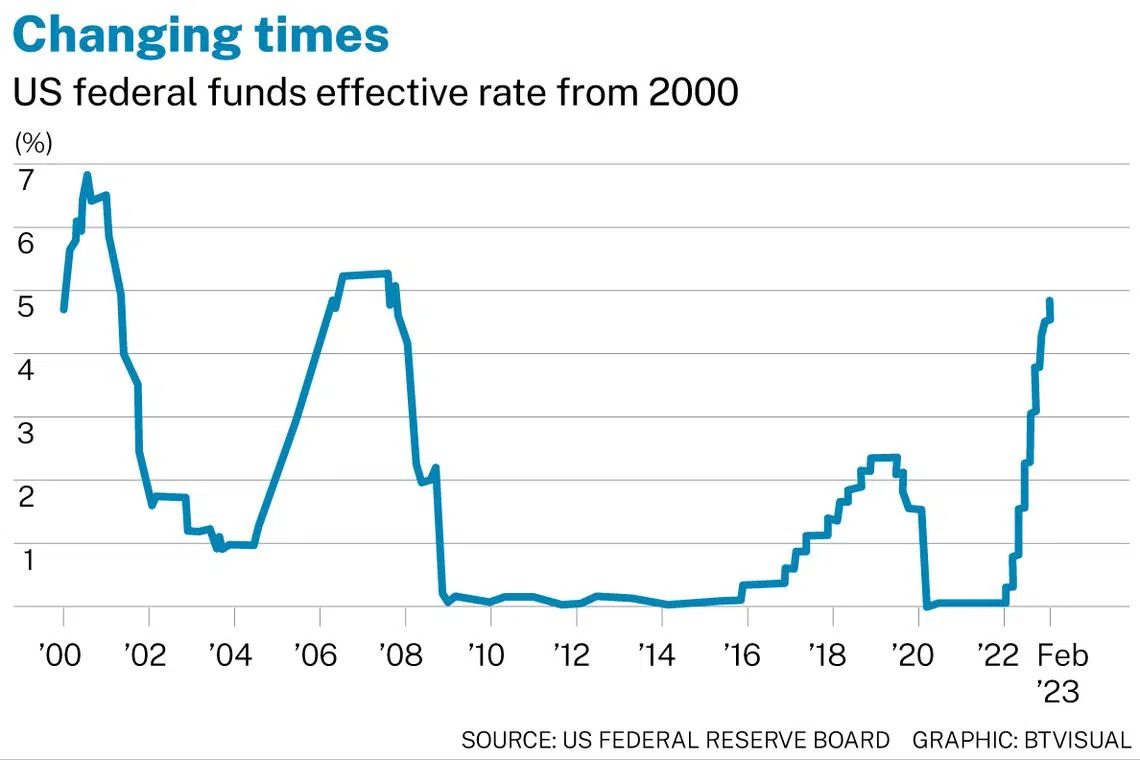

The CMBS cycle is highly dependent on borrowing costs, which are closely pegged to the Federal Reserve Board’s (Fed) effective interest rate in the US. Sora, or the Singapore Overnight Rate Average, is the benchmark rate Singapore’s banks use to set their Singapore-dollar loans, including commercial mortgages.

The Sora rate has a high correlation with the Fed rate, which stayed at the near-zero range for an extended period between October 2008 and March 2022. The Fed rate started to spike sharply after March 2022, nearly hitting the pre-GFC level at 4.83 per cent in April 2023. However, the Fed rate-raising cycle may not have ended, given that US annual inflation is still relatively high at above 6 per cent in February 2023.

Higher interest rates are expected to increase cap rates and adversely affect real estate value. Reits are less willing to refinance existing mortgages amid potential risks of having their real estate asset values adjusted downward. If higher debt yields (interest rates) persist, some Reits may start deleveraging through the divestment of commercial real estate.

The rising interest rates will increase borrowing costs, but alone it will not be enough to drive more CMBS activities by Reits and asset owners. Three other factors must coexist to push Reits and other real estate players to embrace CMBS as a feasible alternative financing option again.

First, liquidity tightening in the traditional debt market causes banks to reduce loans to commercial real estate markets. Second, investment demand for fixed-income securities, including CMBS, could reduce the interest rate wedge between the public market (bond) rates and the private market (debt), making CMBS financing costs more competitive. Third, when the credit ratings between real estate assets and the issuing Reits are widened, separating asset risks via CMBS issuance could also improve the appeal of securitisation and reduce funding costs.

CMBS are an innovative financial instrument that helps loosen capital-raising constraints and creates liquidity to support new investments and growth. They also allow Reits and other real estate players to pool together green-labelled commercial real estate and issue sustainability-linked CMBS to meet the growing demand of investors with impact investing themes.

Colin Chen is managing director and head of structured debt solutions, treasury and markets, at DBS Bank. Sing Tien Foo is the Provost’s Chair Professor at the Department of Real Estate, Business School, National University of Singapore. The views here are the authors’ own and do not represent the views of their companies and affiliates.

Decoding Asia newsletter: your guide to navigating Asia in a new global order. Sign up here to get Decoding Asia newsletter. Delivered to your inbox. Free.

Copyright SPH Media. All rights reserved.