En bloc deals, better economy bolster Singapore tax coffers

For year ended March 31, stamp duty jumps 50% to S$4.9b; total income tax still forms bulk of tax collected

Singapore

THE en bloc phenomenon in 2017 yielded windfalls of billions not just to home owners but also to the taxman.

Bolstered by a 50 per cent jump in stamp duty collection and higher corporate tax collection on an improved economy, the Inland Revenue Authority of Singapore (IRAS) collected S$50.2 billion in tax revenue for the financial year ended Mar 31, 2018, over S$3 billion more than a year ago.

During the period, stamp duty jumped 49.6 per cent to S$4.9 billion as crowds thronged property launches and homeowners cashed out of collective sales. The party ended in July this year when the government tightened cooling measures to pre-empt potential runaway prices.

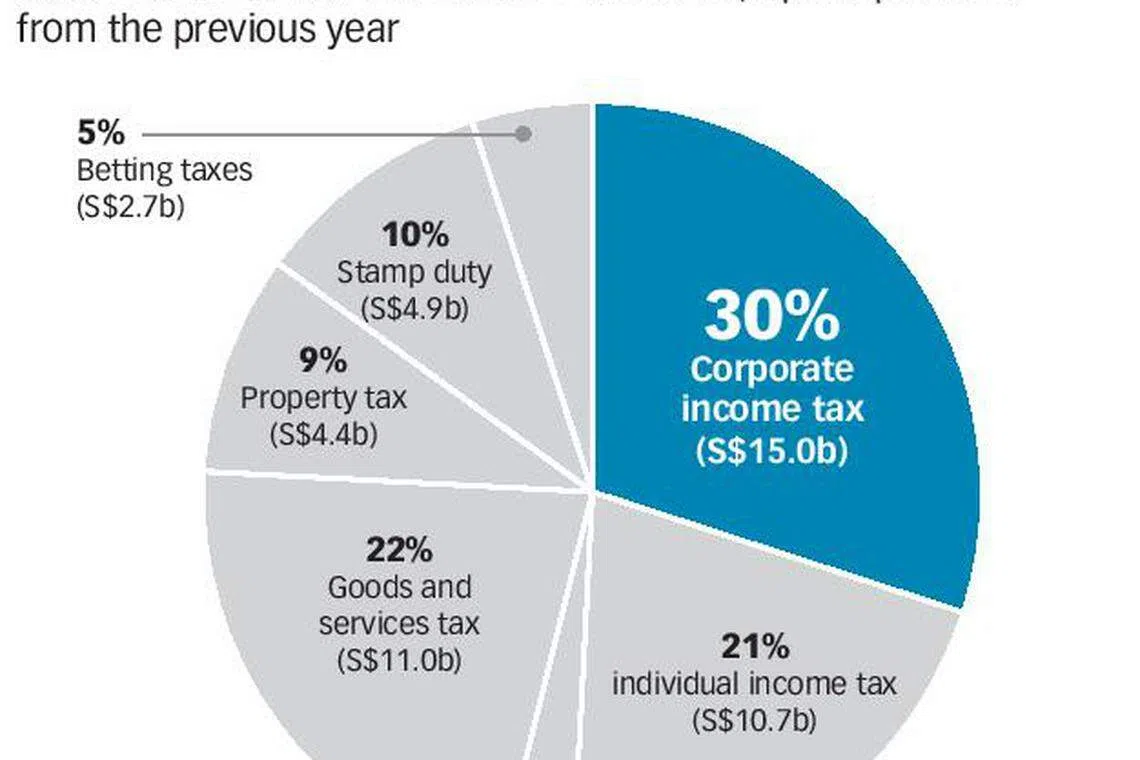

Stamp duty accounted for about 10 per cent of IRAS' total tax collections, behind corporate income tax, which swelled from S$13.6 billion to S$15 billion to account for 30 per cent of total tax revenue.

Income tax - comprising corporate income tax, individual income tax (S$10.7 billion, up from S$10.5 billion) and withholding tax - accounted for S$27.2 billion of tax revenue, 6.3 per cent higher than the S$25.6 billion collected the year before.

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

In its latest annual report released on Wednesday, IRAS said the 6.8 per cent increase in total tax revenue was mainly due to higher stamp duty collection as a result of a larger number of property transactions, and higher corporate income tax collection from improved corporate earnings as the economy grew a better-than-expected 3.6 per cent in 2017.

Property tax revenue was consistent with the previous financial year at S$4.4 billion.

The total amount of tax collected by IRAS represents 66.2 per cent of the government's operating revenue and 11.1 per cent of Singapore's gross domestic product.

Besides stamp duty, property tax and income tax, two other major sources of tax revenue are the goods and services tax (GST) and betting taxes. GST collection was S$11 billion in FY2017/18, similar to the previous year. Betting taxes, comprising betting duty, casino tax and private lotteries duty, came up to S$2.7 billion, unchanged from before.

"The cost of tax collection remained low at 0.84 cent for every dollar collected," said IRAS in a media statement.

The annual report also said that most taxpayers were voluntarily compliant. A total of 96.5 per cent of individual taxpayers filed their taxes on time, while 90.1 per cent made payments on time.

For corporate income tax, 82.1 per cent filed on time and 84.9 per cent paid on time.

Ng Wai Choong, commissioner of Inland Revenue, said: "IRAS has quickened the pace of transformation. Taxpayers benefited from more digital initiatives that provided greater convenience, and made filing, payment, and compliance easier.

"Online tools such as a Virtual Assistant and an interactive start-up kit for new companies provide quick answers to taxpayers. We will continue to engage stakeholders to improve tax services."

IRAS audited and investigated 10,726 taxpayers, recovering about S$384 million in taxes and penalties in FY2017/18. The previous corresponding figures were 10,626 taxpayers and recoveries totalling S$332 million.

Mr Ng said in the annual report that IRAS proactively reviews tax policies to ensure that Singapore's tax system remains robust and competitive.

During the financial year, 28 tax policies were reviewed. These include the deductibility of ABSD, interest and penalty payments as well as the timing of such deductions "to provide greater tax certainty to property developers".

Come Jan 1, 2020, GST on digital services will take effect.

"We are currently in the process of designing the GST measures in consultation with various stakeholders. 850 businesses and associations have so far been consulted," said Mr Ng.

Copyright SPH Media. All rights reserved.