Headwinds create bumpy Q2 ride for SIA

Singapore

SINGAPORE Airlines (SIA) found itself battling turbulence in its second quarter amid headwinds in the form of a sluggish economy, while excess capacity from its rivals put continued pressure on loads and yields.

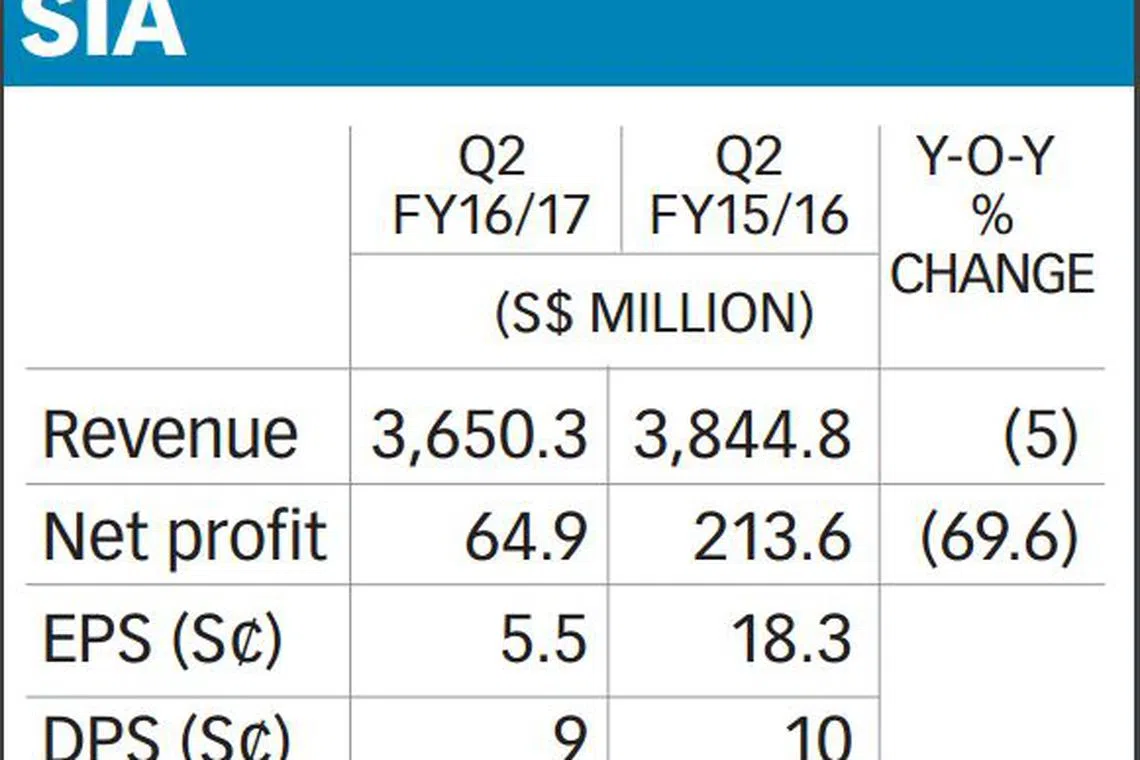

This caused the airline's profit for Q2FY16/17 to plunge nearly 70 per cent year on year to S$64.9 million from a year ago.

Other factors weighing down the bottom line included lower dividends from long-term investments, a S$21 million impairment from two of Scoot's Boeing 777-200 aircraft and poorer results from associated companies, with contributions down S$18 million. The SIA group booked only S$3.5 million in dividends from long-term investments during the quarter, down sharply from S$91.1 million a year ago.

Revenue slid five per cent to S$3.65 billion, while earnings per share for the quarter fell to 5.5 Singapore cents, down from 18.3 cents a year ago.

The national carrier said in its financial results, which were released after the market closed on Thursday: "The passenger airline business continues to be impacted by geopolitical uncertainty and weak global economic conditions. Furthermore, excess capacity and aggressive pricing continue to persist in the market, exerting pressure on loads and yields."

Navigate Asia in

a new global order

Get the insights delivered to your inbox.

Rival airlines such as the cash-rich Gulf carriers have been pumping capacity into the market, especially on the European routes, which is causing competition to intensify.

For the quarter, a sharp drop in fuel costs helped bring expenditure down by S$174 million, but was still unable to offset the slump in revenue; this translated to a 15 per cent dive in operating profit to S$109.1 million.

Fuel costs totalled S$946.4 million during the quarter, down from S$1.21 billion a year ago.

The company is declaring an interim dividend of nine Singapore cents a share, payable on Nov 24; this is slightly lower than the 10 Singapore cents paid out a year ago.

For the six-month period, net profit rose from S$304.8 million to S$321.5 million; revenue slumped from S$7.58 billion to S$7.3 billion.

Most key units reported weaker operating results amid a tepid global economy.

Yields at the parent airline eased from 10.4 cents per passenger-km (pkm) to 10 cents/pkm. But budget carriers Scoot and Tiger Airways bucked the trend, thanks to a bigger network and lower operating expenditure.

The parent airline's operating profit slid from S$98 million to S$79 million.

SilkAir's operating profit was S$4 million lower at S$17 million. Regional wing SilkAir's yields also suffered, easing from 13.3 cents/pkm to 12.4 cents/pkm.

Overcapacity in the market caused SIA Cargo to bleed more red ink as operating losses widened from S$3 million to S$11 million. SIA Engineering's operating profit slipped from S$27 million to S$25 million.

Medium/long-haul budget carrier Scoot was in the black with an operating profit of S$5 million, a turnaround from a loss of S$2 million previously. Short-haul budget airline Tiger clocked a profit of S$3 million vis-a-vis a loss of S$10 million a year ago.

The results appeared to catch some analysts offguard; they had been banking on cheaper fuel to save the day. Macquarie Research had forecasted a 49 per cent jump in operating profit to S$192 million and a four per cent decline in revenue. Macquarie analyst Azita Nazrene wrote in a report dated Nov 2: "We expect its parent airline's operating profit to double to S$191 million from S$98 million in Q216."

Maybank Kim Eng's Mohshin Aziz had projected a Q2FY17 core net profit of S$193 million. "Long-haul traffic is under stress due to overcapacity and competitive pressures," he said in a report on Monday, cutting his target price to S$9.70. "Load factors have plummeted, especially to Europe and the Americas."

For the second half of the financial year, the group has hedged 29.3 per cent of its jet fuel requirement in Singapore Jet Kerosene (MOPS) and three per cent in Brent at weighted average prices of US$68 and US$63 per barrel respectively.

SIA said: "Fuel prices remain volatile, given the uncertainty over how the proposed cut in OPEC oil production would be implemented."

The group said it will continue to bank on its portfolio of airlines to cater to demand in different travel markets, while keeping a close eye on costs.

Cash and cash equivalents totalled S$3.28 billion at the end of the quarter, falling from S$4.6 billion a year ago.

Shares in SIA dipped two cents in trading on Thursday to close at S$10.11.

Copyright SPH Media. All rights reserved.